Bank Remittance vs Bank Transfer

In the course of making various forms of payments, especially international transactions, you must have heard of bank transfers and remittances. Even though they are used to perform basically the same function, which is to send money to someone within or outside your country of residence, they are not the same. Understanding the differences between these transactions, as well as the complexities of each, is the first step toward making smart money transfer decisions. In this post, we will show you their differences and give more information about using both of them.

What is a Bank Transfer?

A bank transfer is what takes place when money is paid from your account, say, the one you have with a traditional bank, to another person’s account; or when a payment is made from another bank account into yours. In other words, when you want to transfer money online between bank accounts, you use a bank transfer. This may be done either locally or globally. Despite having been in use for so many years, bank transfers are still trending in cross-border payments.

Bank transfers are among the safest methods to send money globally since they involve strict security measures. Traditional bank transfers require an intermediate entity to act as a link between the sender and the receiver. The intermediary, or facilitator, serves as a clearinghouse, assisting in the protection and settlement of financial transfers. An example of a clearinghouse for managing electronic banking transactions is the Automated Clearing House (ACH) in the United States.

How Do Bank Transfers Work?

A bank transfer is a quick process to initiate. Generally, starting a bank transfer does not require providing a lengthy list of information. You should be able to initiate a bank transfer in a few minutes as long as you have the correct information about the destination bank and the account holder. However, before the money can be sent to the recipient in another location, you must pay a sending fee in advance at your local bank.

How to Make a Bank Transfer

Contrary to popular opinion, the first step in making a bank transfer has nothing to do with your bank. It begins with getting the information you need to make the transfer. So, you need to get the recipient’s bank account details and transaction reference code, which could be a SWIFT code for identifying their bank or a Unique Transaction Reference (UTR) number for tracking their payments.

The second step in making a bank transfer is to log in to the online banking platform of your bank. This is necessary to access the digital payment services of your bank and select the option provided for you to send money. Next, you will have to enter the necessary details of the transaction. Finally, request your bank to send to the receiver the amount of money you have indicated on the online platform. But if you do not have access to your bank’s online platform or your bank does not have an internet banking system for customers, go to the bank and make your money transfer in person. This might require standing in line, signing some papers, and waiting some days for the money to be sent to the recipient.

The next step is for your bank to put the money in the clearing phase so that it can be transferred to the recipient’s bank. It is only when the money has been cleared that it will get to the recipient’s bank account. Mind you, as the money moves from one stage to another in the transfer process, it could take between one and five business days or more for the funds to get into the receiver’s account.

What are Remittance Services?

Remittances, or remittance services, make it possible for people to send money to recipients who may or may not have bank accounts. Such transactions can take place over the counter at cash pick-up points, where cash is handed over to the recipient. Besides, you do not necessarily need to have a bank account to use remittance services. You can initiate a transfer using an app on your mobile phone.

How Do Remittance Services Work?

Individuals and businesses can use remittance services to send money to and from China, South Africa, India, the European Union, the United States, the United Kingdom, and most parts of the world. Recently, a large number of remittances have been made to Ukraine to help affected people.

Since they charge competitive fees, offer more specialised products, and have minimal requirements for access to their services, remittances have made it easier and faster for expats, digital nomads, and freelancers to send money to their families and friends back home.

There are many options for using remittance services to wire money abroad. They include neobanks, e-wallets, and other FinTech companies. Popular remittance service providers include Wise, Paysend, WorldRemit, and TransferGo. While these options do not require the use of a clearinghouse and are known to be generally faster than bank transfers, some of them are more prone to fraud and other safety concerns. Nevertheless, you can avoid this risk by using only top-rated money transfer services on AskWallet—they are safe and secure. By the way, it might interest you to learn how individuals and business managers can accept online payment systems safely through this guide.

How to Make a Wire Transfer

Remittance services are not difficult to use. Wire transfers can be made from the sender’s app to the receiver’s app or from the sender’s app to the cash pick-up location nearest to the receiver. The steps below describe the most frequent procedure for sending money abroad using this method:

- The sender visits a remittance centre or logs in to a remittance app on their smartphone.

- The sender completes the remittance form online with their information, as well as the recipient’s personal information such as full name, phone number, and address.

- The transfer amount and fees are computed and paid when the sender makes a transfer request

- The remittance service generates and sends the sender a unique money transfer control code, which he or she will forward to the receiver.

- The receiver goes to the remittance centre to claim the funds upon providing the control code, sender's details, and a valid ID.

How to Choose Between Bank Transfers and Remittance Services

Here are the factors to consider when you do not know whether to transfer money via an international bank transfer or a remittance service provider:

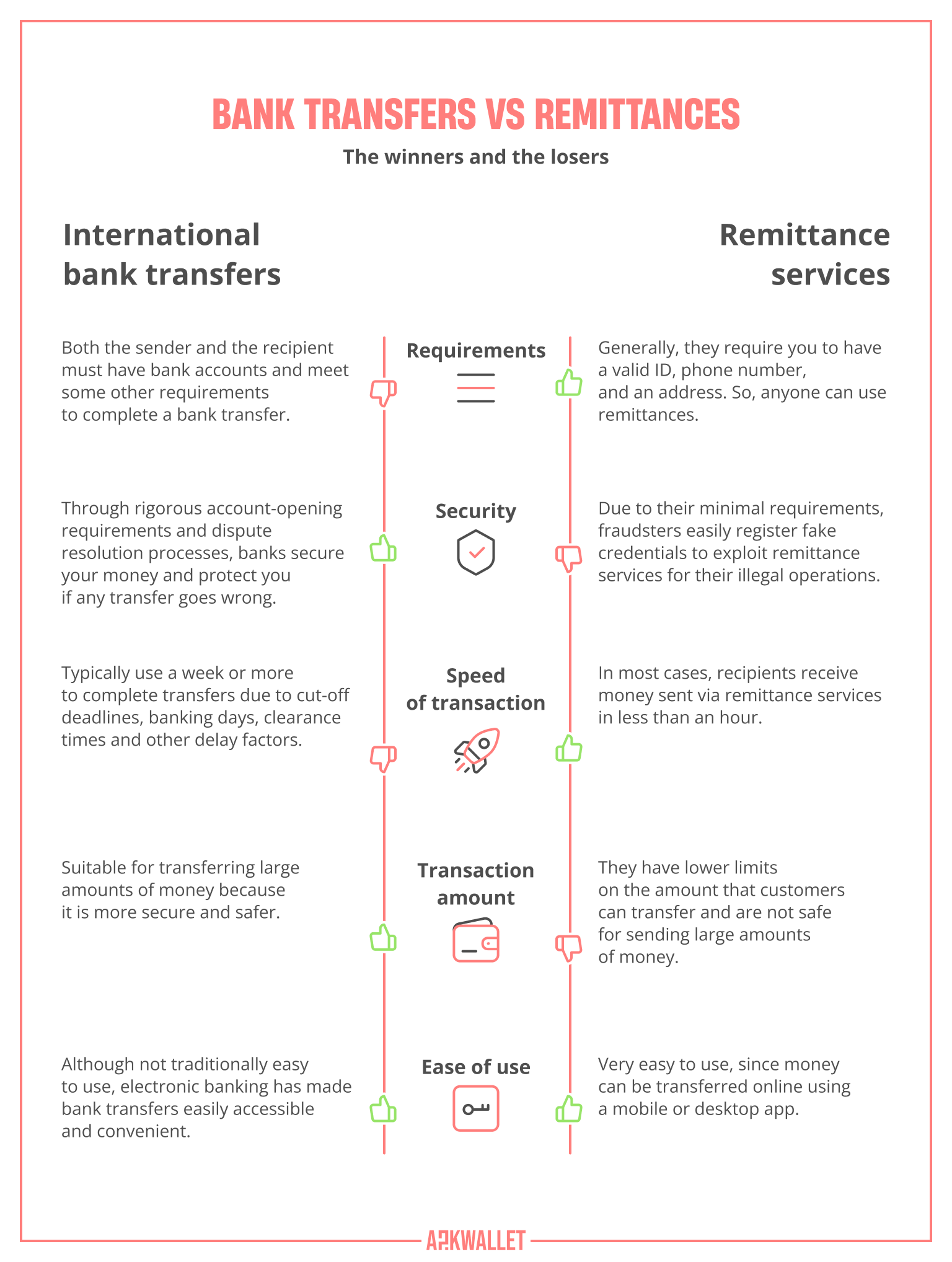

Now, it is hard to say whether either service is better than the other. This is because it depends on the customer's priorities. Therefore, you have to consider and compare the prices, speeds, exchange or currency conversion rates, the amount of money you want to send, and the ease-of-use of the method before making your choice.

The Top-rated Payment Services for Sending Money Abroad

Wise

Wise allows you to transfer money between domestic and international accounts. It lets you spend abroad using your Wise debit card, cash out from ATMs, and keep over 50 currencies in your account.

Wise offers fee-free transfers to its new users. You will get a full fee waiver on the first 500 EUR you send to someone. You also get to save eight times more on average when you make a transfer via Wise than through a bank. While opening an account is free, the fee for sending money is 0.40% of the amount sent. However, this fee varies depending on the receiving country.

Your payments are safe with Wise because its mobile app and website use advanced security tools to safeguard your transactions, and it keeps your money with established financial institutions. Moreover, it is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. Register an account with Wise to send money to 80 countries.

TransferGo

Use TransferGo to pay anyone located anywhere in the world. It is a registered payment service provider, regulated by the FCA. It supports money transfers to more than 160 countries. Your first two transfers on TransferGo will be free of charge, while subsequent payments will attract an exchange cost of between 0.5% and 1.5% of the amount sent and a flat fee of between 0.99 EUR and 2.99 EUR.

Using the mid-market rate, TransferGo charges a small foreign exchange fee. Its prices are among the most affordable on the market. Furthermore, all costs are included in the amount that the recipient gets. Once you have scheduled your payment with TransferGo, you will not have to worry about currency changes. The amount you specify in your order will be sent to the recipient.

You can invite as many people as you wish to open TransferGo accounts and earn cash rewards. Each time someone creates an account with your invite code and transfers 100 EUR between two different currencies in their first six months, you will receive 22 EUR. If you do not have an account with TransferGo, you can create one for free here.

WorldRemit

WorldRemit offers a safe, fast, and low-cost way to send money. It charges the mid-market currency conversion rate and a fixed transfer fee of 2.99 GBP. It is headquartered in the UK and regulated by the FCA.

With the free app from WorldRemit, you can send money to more than 130 countries in minutes, choosing from over 70 currencies. It also has many locations for cash pick-up.

When you create an account with WorldRemit, you can use the code “3FREE” to make your first three transfers for free. Note that there are some terms and conditions attached to this offer. You can find them and other information, such as how to create an account and send money to different locations, on WorldRemit’s website.

Instarem

Through its innovative mobile app and intuitive website, Instarem lets you send money in a transparent, simple, cost-effective, secure, and fast way. It operates in over 55 countries.

To send money via Instarem, you can use a debit card or bank transfer method. While bank transfers can be done free of charge, a fee of 2 EUR, which could change depending on the amount and the receiving country, is charged for transfers made via a debit card.

Xe

Xe is a popular and trusted brand when it comes to international money transfers. It is available for free. Also, Xe does not charge any transfer fees and has no minimum transfer amount.

Xe supports money transfers in more than 60 currencies and more than 170 countries. It also accepts payments via bank transfers and debit/credit cards. Besides, you can use the Xe Currency Converter to access the mid-market exchange rates for all currencies in real time.

Paysend

For a fixed fee of 1.5 EUR, 1 GBP, or 2 USD, you can use Paysend to transfer money from your location to more than 150 countries. Your transfer will be processed to the recipient’s account or bank in seconds. Furthermore, you can open a multi-currency account with Paysend to send, hold, and spend money in up to eight different currencies in one app as you travel around the world. It is a great money transfer service for students, expats, and frequent travellers.

To use Paysend, download its app on Google Play, the App Store, or AppGallery and start sending money easily and quickly. You can use bank cards, bank accounts, or mobile numbers via Paysend Link to make reliable money transfers.

All money transfers via Paysend are PCI DSS certified. Payments made through Paysend are also certified by Mastercard, Visa, and China UnionPay. It is fully regulated by the FCA in the UK.

Mercury

Mercury offers bank-beating exchange rates. You can save up to 5% when you use it to make international money transfers to your family and friends. With a Mercury e-account, it takes a few clicks to move money between more than 160 countries 24/7, while holding up to 40 currencies in one account.

You can earn money forever if you become an affiliate of Mercury. How? Just open a personal or business e-account with Mercury and you will automatically become an affiliate. This affiliate programme is different from others because it does not require a separate sign-up. So, all you need to do is sign up, recommend Mercury to someone and have them automatically added to your network, and watch your balance grow through your commission whenever someone you introduced to Mercury does a transaction. Mercury will pay you 5% of its profit from transactions made by the people in your network; that money is your commission. You can choose to spend it or save it as you please.

Mercury is authorised and regulated by the FCA and the Financial Sector Conduct Authority (FSCA). It is a top-rated financial services provider. It complies with anti-money laundering and counter-terrorist financing standards.

FairFX

FairFX can be your all-in-one payment solution if you register an account with it. You get to pay less to send money in over 100 currencies because it offers some of the best exchange rates and does not charge any hidden fees.

In addition, FairFX lets you pay in any of the 20 major currencies available online for free. These major currencies include the British pound sterling (GBP), euro (EUR), US dollar (USD), Chinese yuan (CNY), Australian dollar (AUD), Canadian dollar (CAD), South African rand (ZAR), Swiss franc (CHF), Danish krone (DKK), Hong Kong dollar (HKD), Indian rupee (INR), and Japanese yen (JPY). You can make fee-free payments at any time. But you must meet the minimum payment requirement of 100 GBP or the equivalent in another currency.

You can get 3.5% cashback with FairFX by using its FairFX Currency Card—a multi-currency card that can be ordered online for free and used in more than 190 countries. You can use it to cash out at ATMs for a low flat fee, which depends on some terms and conditions.

Bank Transfers vs Remittances: The Winners and the Losers

We will now compare bank transfers and remittance services in a head-to-head battle to identify the winners and losers in each competitive area, as well as see where they might have a draw or a tie.

Note: *Cut-off deadlines refer to established times when banks stop processing transactions for the day and postpone any unprocessed payments to the next business day. This could cause delays in money transfers.

Final Word

Neither a bank transfer nor a remittance service can be recommended as the only method to use when sending money home or abroad. Whereas a remittance service is a fast way to deliver money to a family member or friend who lives abroad, transferring a large amount to the same family or friend as savings is best done by bank transfer. Use the information provided in this article to easily make smart money transfer decisions.