PaySend — can you trust this service for convenience, speed, and low costs or not?

What is PaySend?

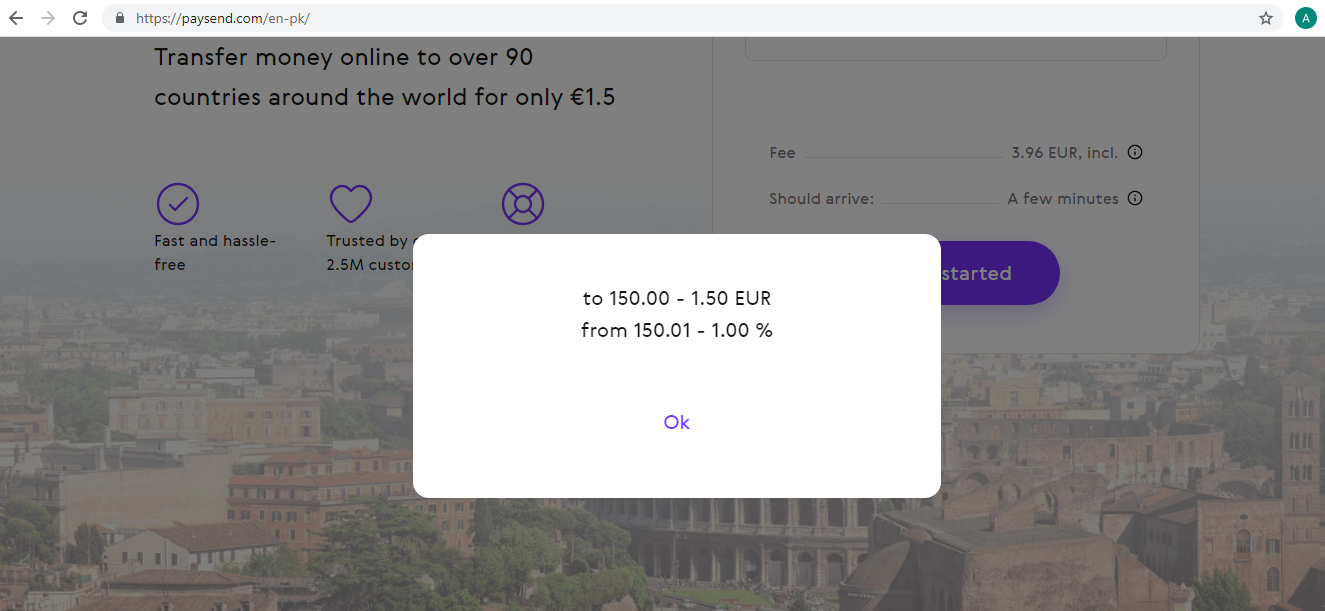

Headquartered in the UK, PaySend operations cover over 90 destinations of the world. PaySend’s online service of cross-border transfers is specially targeted toward users engaged in regular "transfers" of money from card to a card that entails a fixed commission and does not depend on the transfer amount. For instance, if the debiting occurs from the Eurozone, the transfer starts from 1.5 EUR for the transfer up to 150 euros (and 1% of the amount after that), 1 GBP from the UK, 2 USD from the US, and 49 RUB from the Russian Federation etc.

Is PaySend Safe?

For the safety of your account, there is no need to worry. If a payment service is on the market, it is because it fully complies with the regulations and security standards in force, either in the UK or in the country in which it operates. Either way, the security is optimal.

PaySend is an authorized service, regulated by the FCA in the UK, which exclusively deals with international money transfers for individuals and other users. PaySend has also obtained a money service license for its business operations in Canada. Apart from that, PaySend has an international PCI DSS certification. It also supports the secure 3D secure authorization protocol.

In case, if there are problems with the transfer such as a card entered is not supported by the receiving country, the funds will not be debited from the account. In this case, a user may try again using a different card. Additionally, there is an active technical support service to help users with any issues.

How do I use PaySend?

The receiver in the foreign destination is identified by name, address, and account number. The sender only needs to complete the quick registration, verify the transfer request, and submit the payment. Once PaySend validates and processes the international funds transfer request (which usually takes a few minutes), the recipient will be able to access the money. Funds can be sent from almost any corner of the world to a bank account or card, making it possible to send the desired amount to family, friends or a client. In many cases, the funds arrive as quickly as possible.

In certain situations, the terms of crediting may impact the speed due to the peculiarities of the recipient's bank. Many banks have their specific rules, and the accrual can be delayed up to 2-3 business days. Many reputable providers such as China Union Pay, MasterCard etc., have partnered with PaySend to offer secure, transparent, and credible transaction processing.

PaySend services are less costly because it cooperates directly with international payment systems like Visa, MasterCard, and local card schemes, and do not use third-party processing centres for transfers. It allows you to serve banks around the world using these cards. Thus, the service does not pay a "commission" to intermediaries, and, accordingly, no fee is taken from the users. Money is transferred between partner banks.

A significant advantage of the PaySend service is that when sending money abroad, an additional commission is not included in the exchange rate in the form of a commercial exchange rate. Conversion takes place at the exchange rate set by VISA and MasterCard systems. PaySend is connected to several currency exchanges, and therefore the required currency pairs are exchanged at the real rate at the time of transfer. Also, the transaction will be completed swiftly (in most cases). So, it appears as a low-cost and low-stress funds transfer provider. However, there are certain money transfer limits, and I suggest visiting PaySend’s money transfer page and talking to the support team if you are transferring a large sum.

PaySend transfer methods

These types of transfers are available to users:

To a card

Funds are sent from one bank card to another. The service is available for any destination where PaySend operates. After receiving the funds, users can make withdrawals via ATMs or spend the money to shop. This service is offered via the PaySend global transfer service.

To an account

Money can be sent from the sender’s credit card to the receiver’s account at a banking institution. The service is available for P2P and B2B payments.

PaySend Link

It is a unique feature that allows you to quickly request funds from a mobile phone number. You can send any person a request in the form of an SMS message with a link to request for transfer. The person who received your request can follow the link and send you a transfer after registering with the service.

PaySend accounts

Apart from the Global Transfer service, Paysend users can access these products:

PaySend global account

It is a convenient way to store, send, or spend your funds. While users can make transfers to friends and family (using the same account) in over 80 countries instantly and at interbank rates, they can also store money in different currencies. You will also save up on extra charges when exchanging currencies at interbank rates. You can also spend in any currency you want to use in any country without paying an additional fee, as PaySend does not charge anything. This account comes with a virtual card that allows switching between different currencies of your account. It is also useful for withdrawing money from ATMs globally or making online purchases.

PaySend global payments

Paysend has extended its services to include SMEs and merchants with over forty payment methods. After a simple integration and quick onboarding process, businesses can start accepting payments. This account also provides many supplementary services such as loyalty programs, tax reporting, accounting etc.

PaySend global bank solution

This platform is targeted towards both businesses and individual users to help with daily banking needs such as currency exchange, SEPA and SWIFt transfers etc.

Pros

- The recipient gets an instant receipt of funds

- Responsive customer service

- Fixed low commission

- Best exchange rate in most cases with no exchange rate margin

- Secure payments as PaySend is FCA regulated. The payments are also certified by major payment networks

Cons

- Not available in the US

- Limitations on using a bank account for funds transfer

- Difficult to reverse mistaken transfer. This is a minor downside of instant funds transfer making it difficult to get your money back without the assistance of the person on the receiving end

Conclusion

You might be asking the question, should I give it a go. PaySend could be a service of your choice as it offers some benefits as a funds transfer card-to-card service. In my opinion, PaySend is an alternative. I will not label it as a replacement for existing services. Yes, it is user-friendly, quick, convenient, and secure for your card-to-card transfer needs. If you are a resident of a country where accessible bank transfer is available, there are more functions to this service along with a low-cost fee. PaySend is worth a try, but as always, I highly recommend doing additional research to see if it fits your needs and contact their customer support to clear any confusion.

FAQ

Yes, Paysend allows card-to-card transactions. Instead of adding your bank details, you can simply enter your and the recipient card details, and transfer money. A PaySend credit card to a debit card transfer is usually completed within minutes, and costs very less.

Yes, users are required to provide their IDs and other supporting docs to confirm their identities. You can refer to the PaySend verification process which clearly explains all requirements.

If you are sending funds from a credit card to a savings or current account, you should be aware of the fees involved. You can get in touch with them via Paysend customer service email- [email protected] to know more.

The PaySend money transfer service is now available to the US customers from September 2020.

If the recipient’s bank has not processed the transfer, then the payment can be canceled on PaySend. A successfully concluded transaction is considered final and can’t be reversed.