Best Payment Methods for Freelancers

A few days ago, you received a message from your client thanking you for doing a great job. They asked for your payment method, and you speedily provided it. To your disappointment, they asked you to give them another option because they do not use that one. You tried to find a quick alternative but to no avail. So, they promised to send your payment later. Until now, you are yet to receive your money. You have come to realise that apart from being skilful, you need more than one payment option for uninterrupted cash inflow as a freelancer. Now, this article is your guide to the best payment methods for freelancing.

Should Freelancers Have Multiple Payment Options?

Yes! Clients enjoy employing the services of flexible freelancers. Providing multiple payment methods is a way to show that you are not rigid. Since you cannot easily tell how a client would want to pay for your service in advance, it is smarter to have three or more popular payment options. And this can help your business to grow by facilitating quick receipt of payments from your clients.

Benefits of Providing Multiple Payment Methods

Here are the major ways in which offering multiple payment options to your clients can be beneficial to your business:

Keep existing clients happy

Your current clients may be satisfied with your services and options for financial settlement. But that does not mean that their preferences will not change with time as they discover new payment methods. Therefore, to keep them happy, you should find out the payment methods that are commonly used and add them to yours – especially those that your clients are likely to find more favourable.

Attract new clients

Your new clients will be pleased to do business with you repeatedly if your services are good. An important aspect of good service is the ease of payment. If your clients do not have to incur any unnecessary costs or undergo undue stress to pay you, they would like to contact you again. The only way to give them this kind of convenience is to show them different ways to pay you.

Improve cash inflow

An effective way to ensure business success as a freelancer is to create a system that can accept money from different channels. By having several methods for receiving payment in cash, electronic money, or cryptocurrency, you can please diverse clients, boost sales, and grow your business faster.

Best Payment Methods for Freelancers

Freelance exchanges like Fiverr, Guru, Freelancer.com, and PeoplePerHour support various payment methods. They use systems like PayPal, Stripe, and Payoneer for payment processing. While you may want to use such marketplaces, you simply cannot use all the options for getting paid there. Therefore, you need to have a mix of the popular payment methods on freelance websites. Now, the following are some of the best options for your freelancing business:

PayPal

PayPal is one of the most used methods for sending and receiving payments over the internet. It is available in 202 countries and allows its users to make payments in 25 currencies. It provides personal and corporate accounts for individuals and businesses. Read an honest review of PayPal on our website.

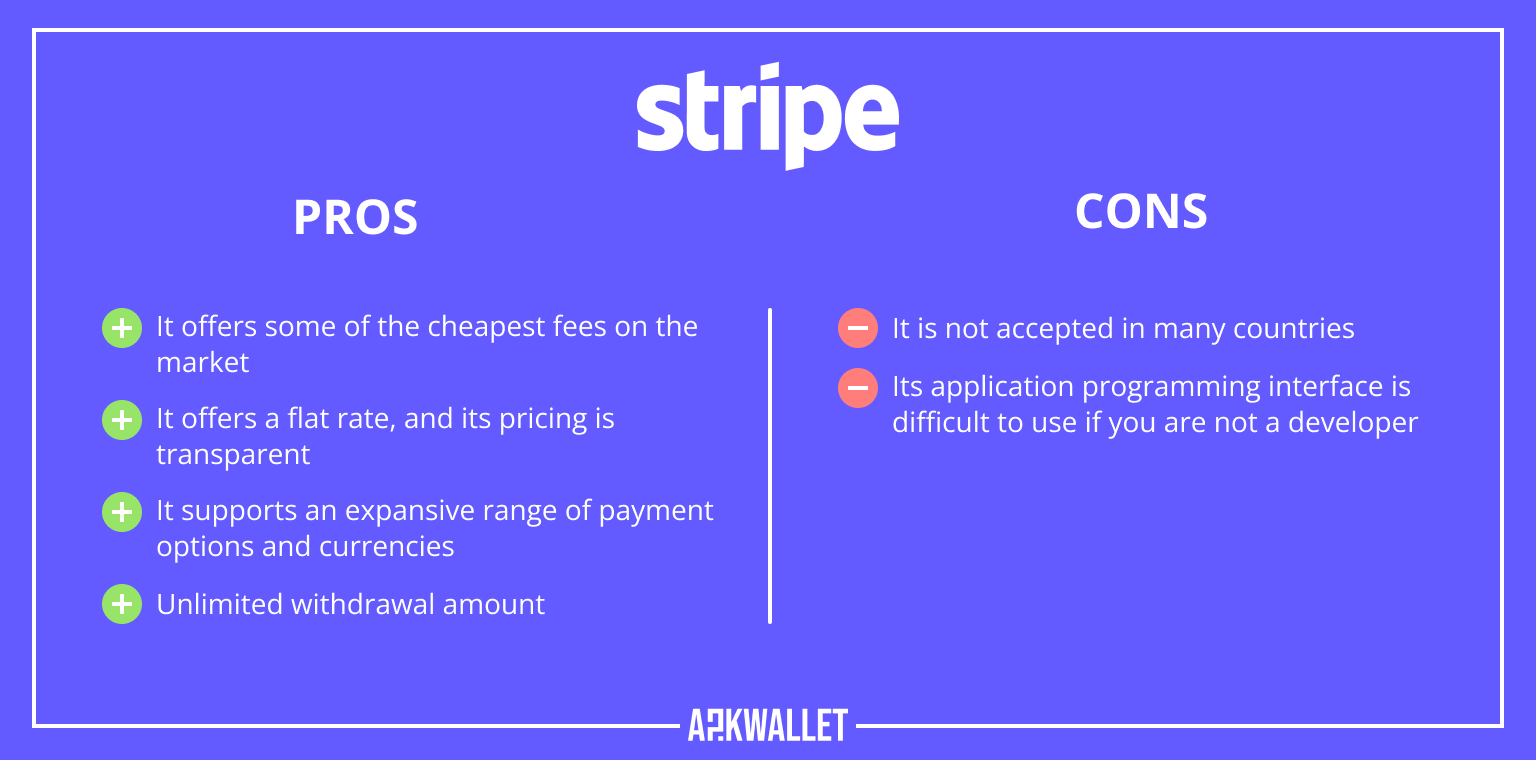

Stripe

Internet businesses rely on Stripe for online payment processing. It can help freelancers to design customised payment platforms with secure tokenization at cheap rates. It supports over 135 currencies and payment methods across more than 35 countries. Most of its users and partner financial institutions are in the United States.

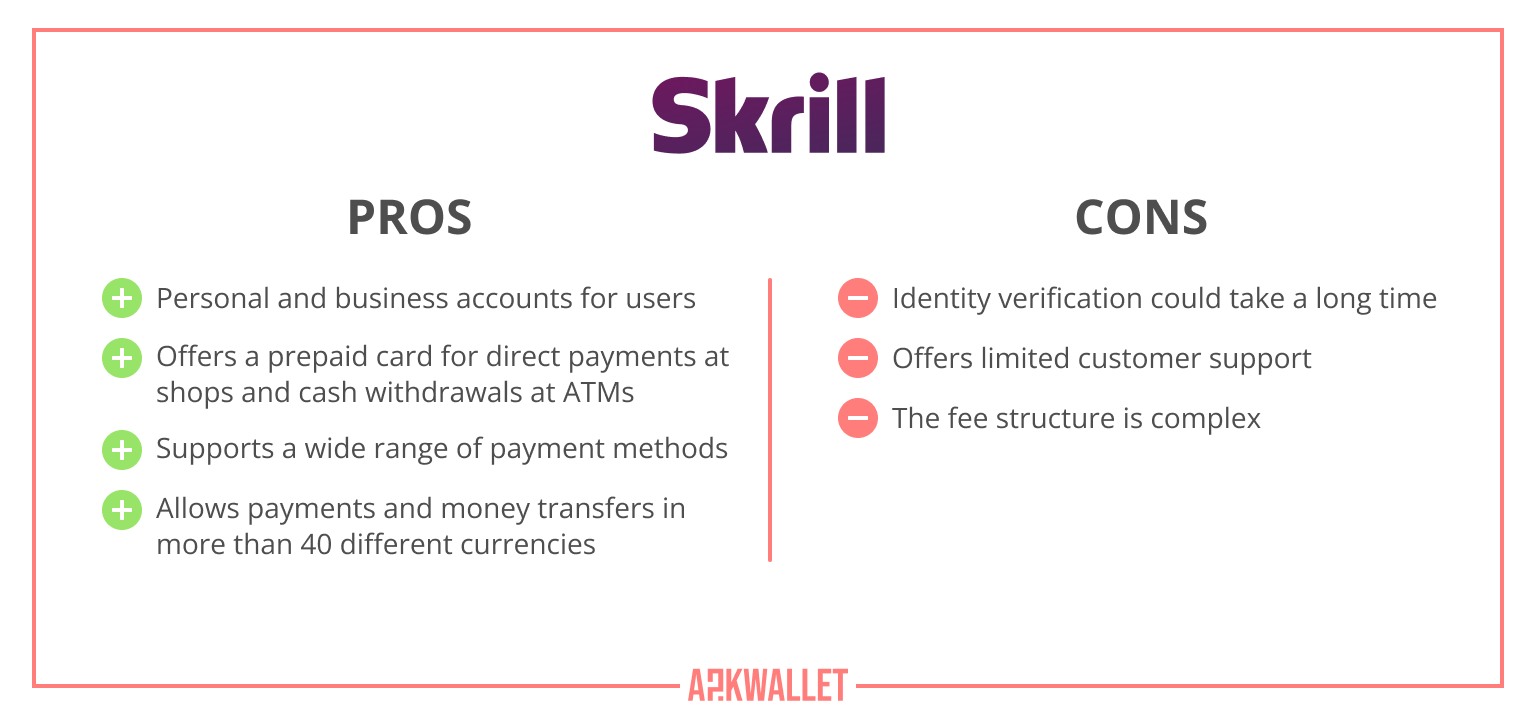

Skrill

Skrill provides a secure and easy system for making payments online and sending money internationally. It is a dependable digital alternative to accounts offered by traditional banks. With this e-wallet and mobile app, freelancers can receive payments for free but pay a fee whenever they withdraw money to their bank accounts.

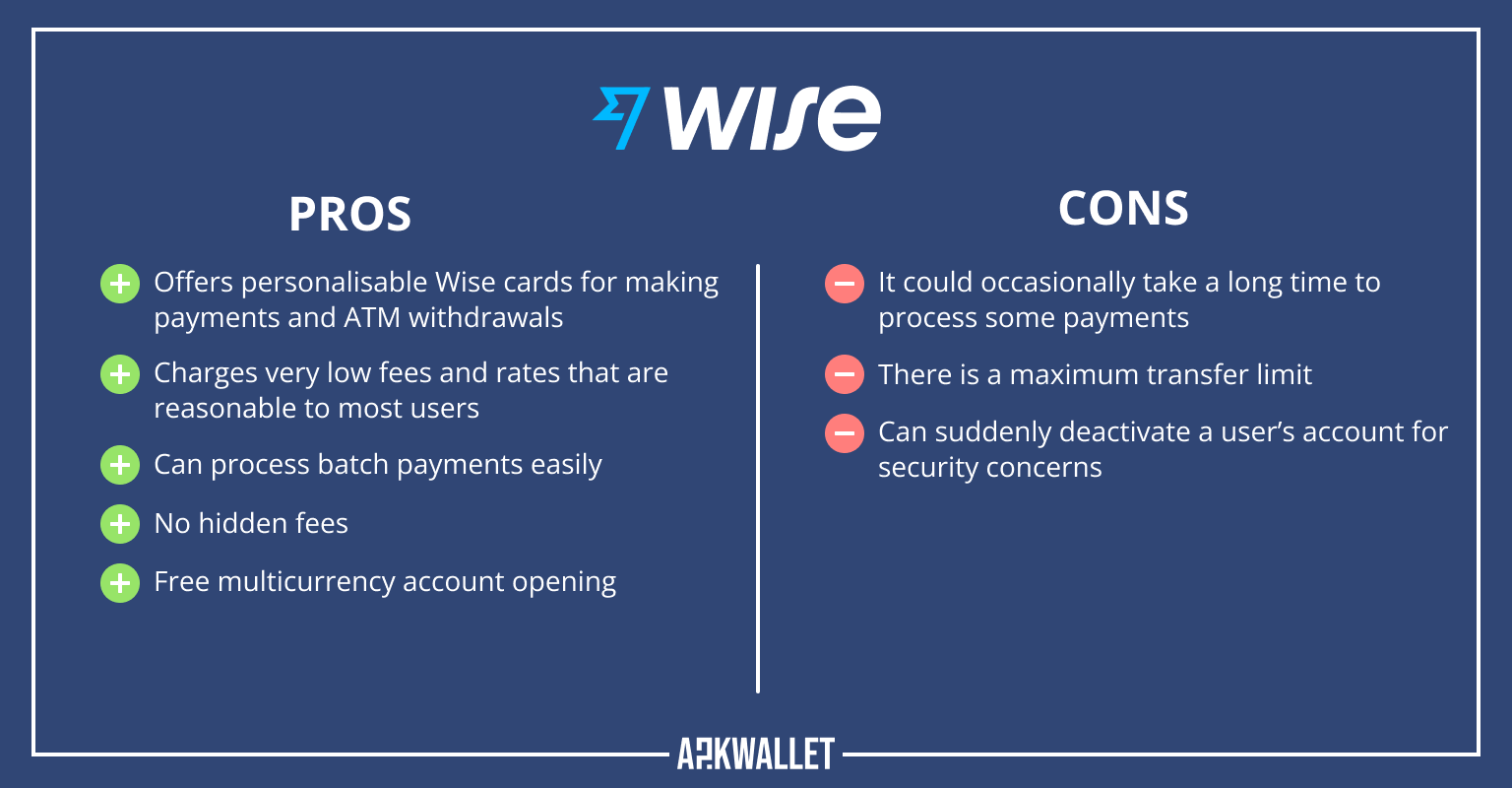

Wise

Wise is one of the safest systems for domestic and international money transfers. It is fast, transparent, cheap, and usable in many countries. Also, it offers the possibility to create a very cheap multicurrency account but charges fees that vary according to your country, currency, and the amount involved in each transaction. For an expert review of this payment method, check our website.

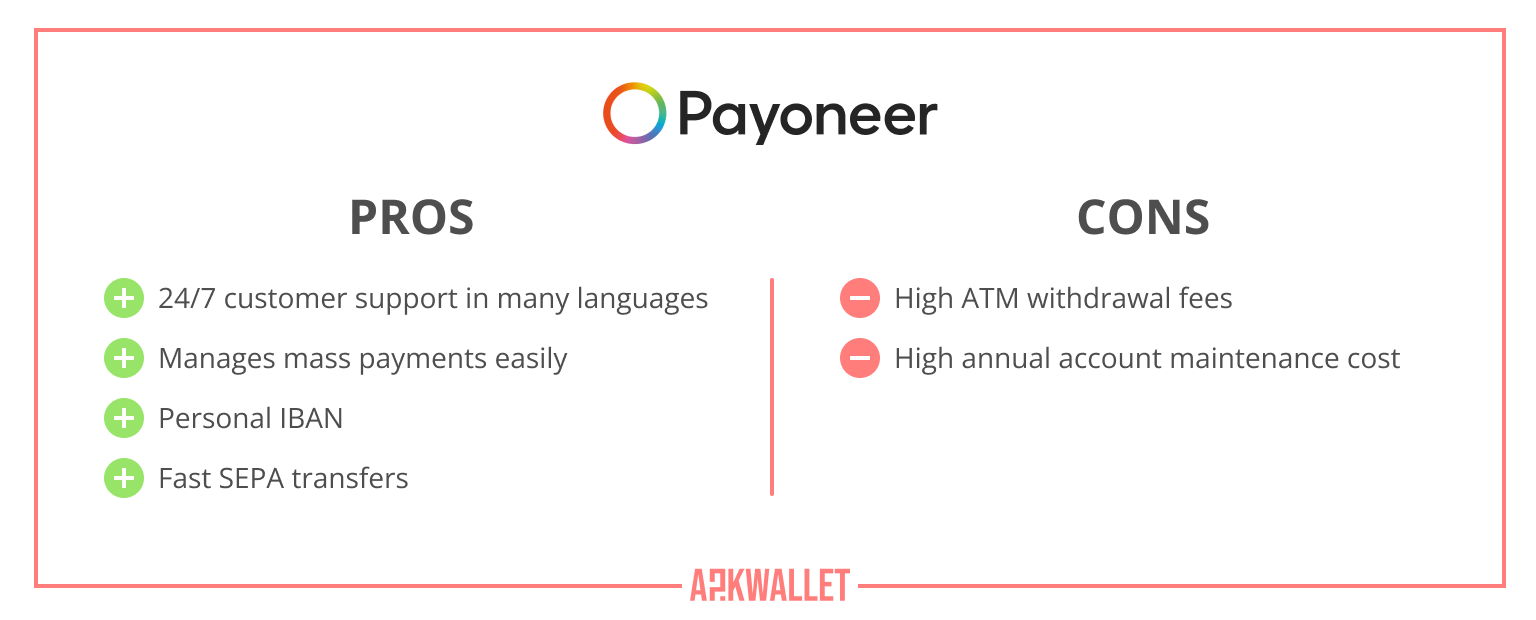

Payoneer

Freelancers can use Payoneer as an alternative to PayPal because it is easier for receiving payments. However, it charges an annual fee of US$29.95 for card usage and maintenance. We have an overview of Payoneer on our website.

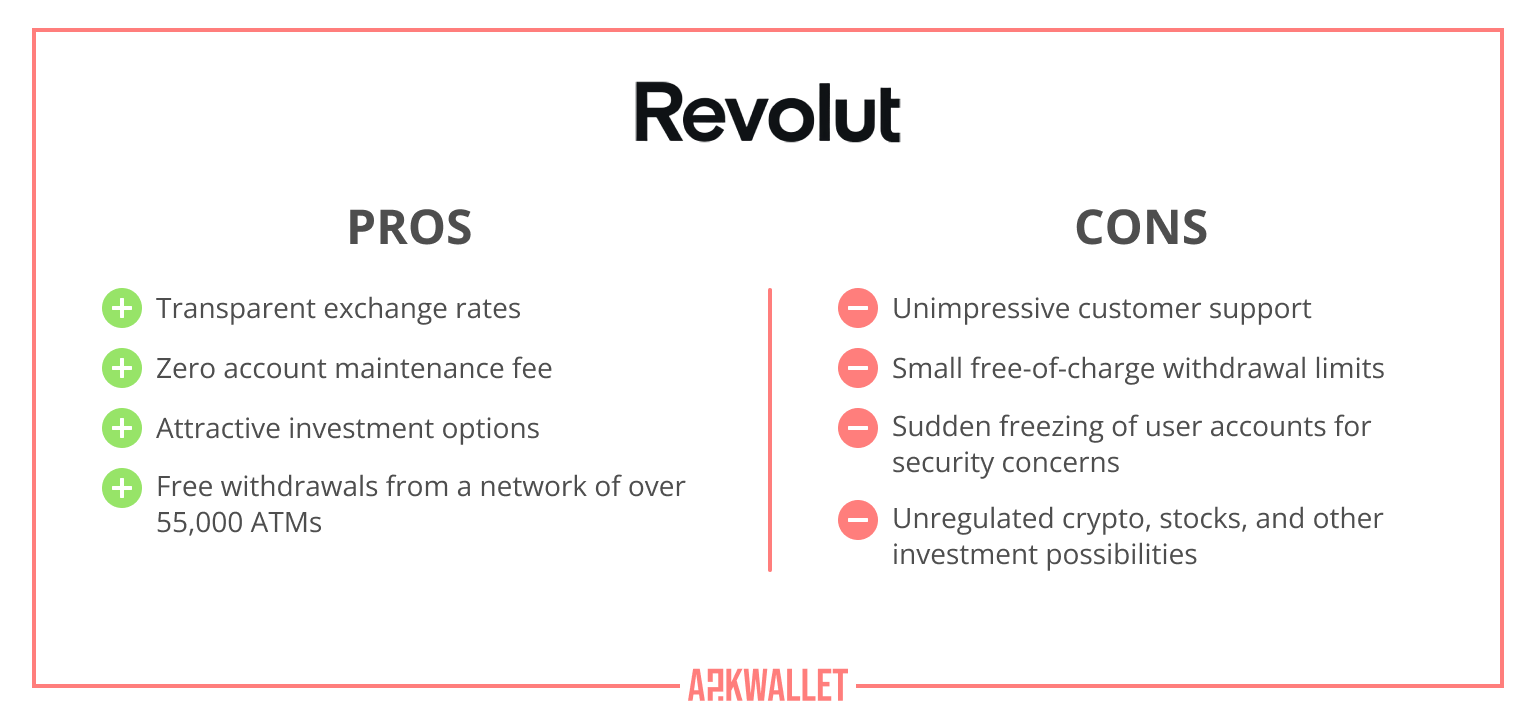

Revolut

Another popular method for international payments is Revolut. It has rich and impressive features for payments management, money transfers, card freezing, crypto trading, and lots more. Any freelancer can use it as an alternative to traditional banks as it provides an account number, a sort code, and access to credit via its website and app.

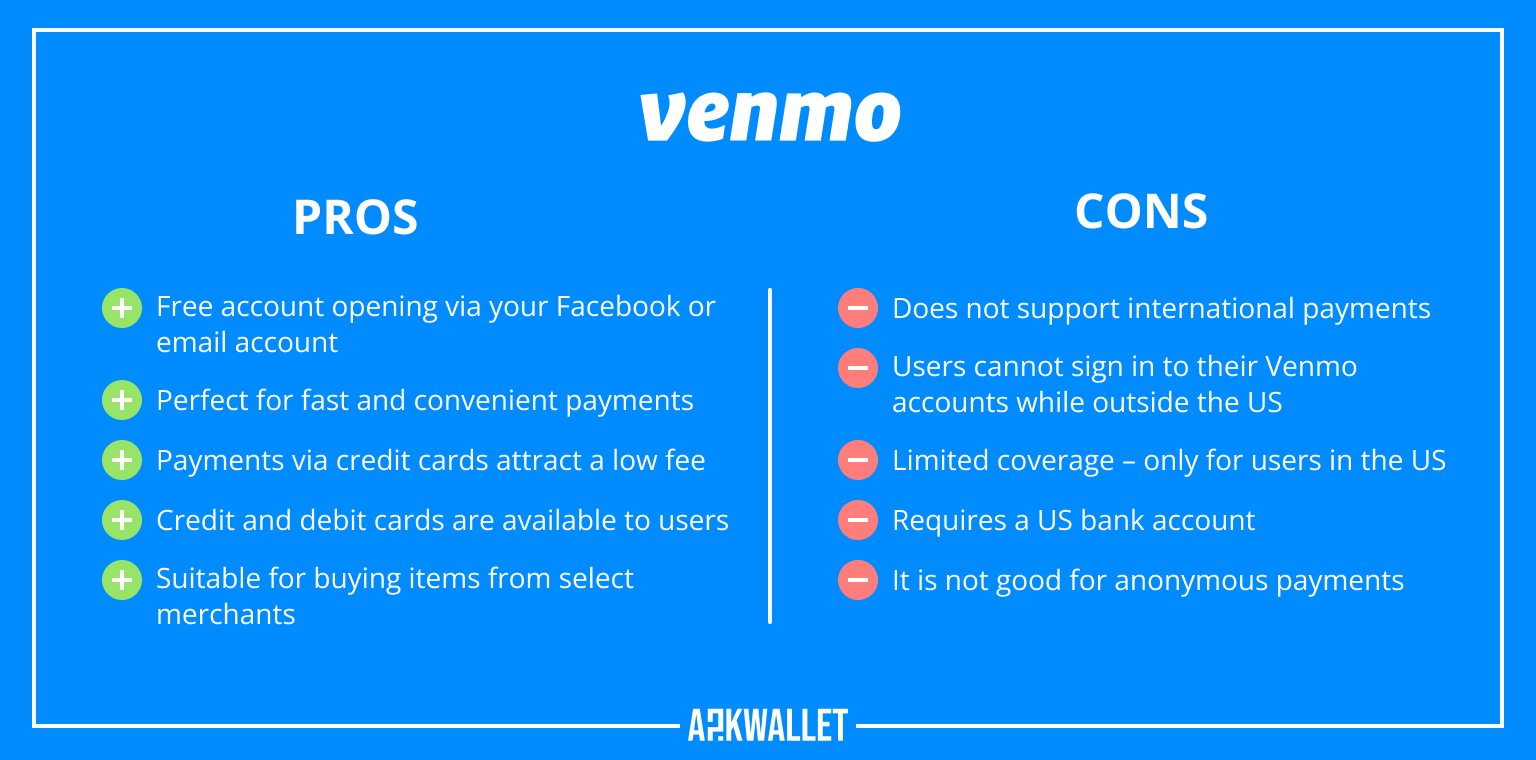

Venmo

Initially, Venmo was only used for online payments. Today, it is an electronic wallet and a payment gateway for freelancers and entrepreneurs to process payments and manage mobile money transfers within the United States. Its peer-to-peer platform makes it easy for its users to make fast and secure payments. Using the app, anyone can search for other users by name and send them money. That sounds good, right? Now, between Venmo and PayPal, which do you think is right for you? Find out on our website.

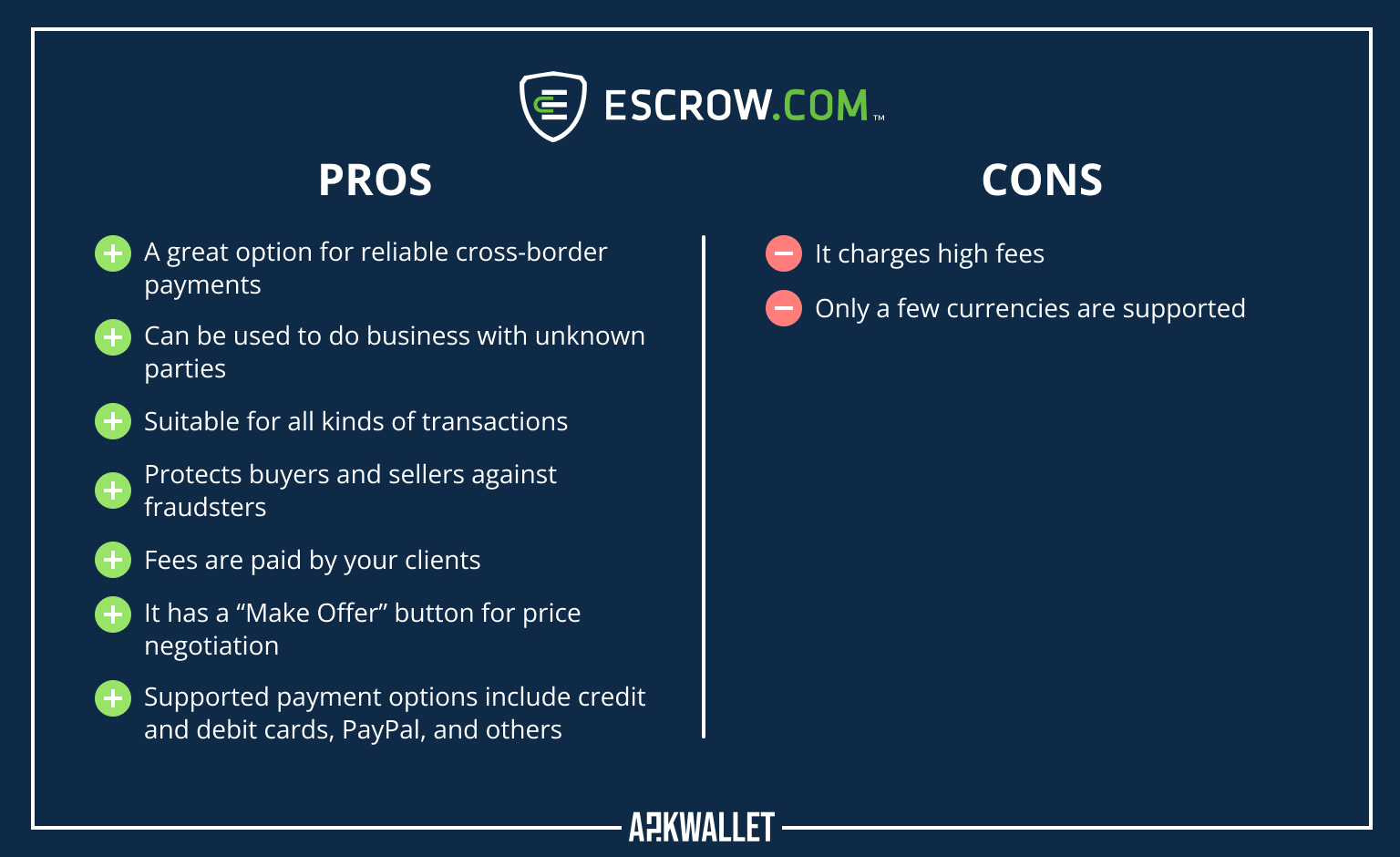

Escrow.com

Escrow.com is a unique online platform that you can use to avoid delays in getting paid. How does it work? It follows five simple steps. Firstly, you and the client will agree to the terms of the transaction. Secondly, the client will send your payment to Escrow.com for safekeeping. Thirdly, you will deliver the requested product or service to the buyer. Fourthly, the buyer will confirm/approve the delivery of the product or service on the platform. Lastly, Escrow.com will release the client’s payment to you. This online payment system is available in many countrieswith limited currency options.

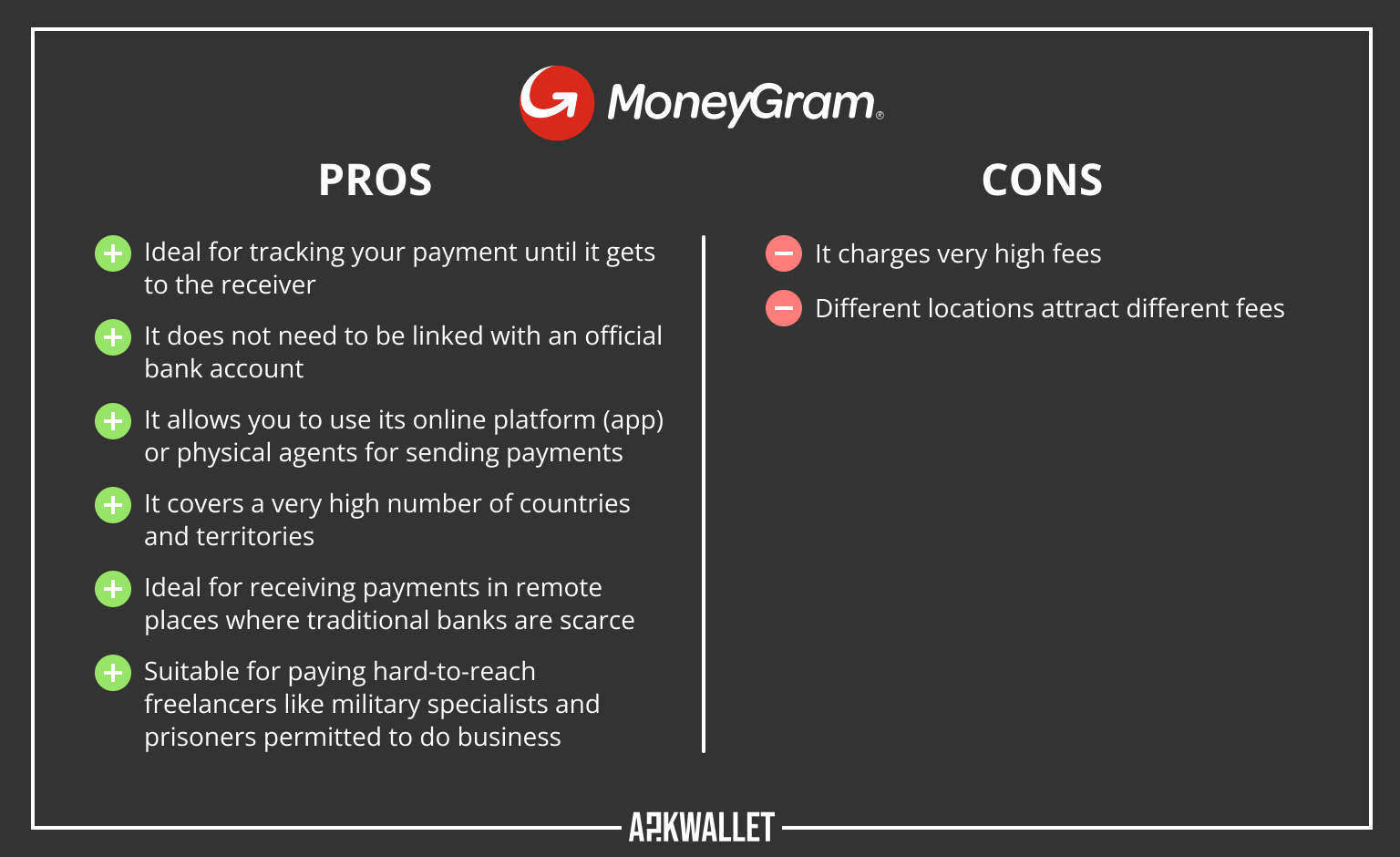

Moneygram

One of the most reliable money transfer companies in the world today is Moneygram. It can process domestic and international payments to bank accounts, mobile wallets, and cash pick-up points at impressive speed. It operates in more than 200 countries and territories, has about 350,000 agents, works with over 400 banks across the globe, and supports over 45 currencies.

What to Consider When Choosing Methods for Getting Paid

Client convenience

Good business practice is to always put your customers first. Therefore, you must not choose any payment method that will cause avoidable physical, mental, or financial stress to your clients. Their convenience should be your utmost priority.

Brand popularity

Go for widespread payment methods. If it is not a popular option, it is most likely not worth having. So, do some research and identify the most used brands, digital wallets, and other payment options among freelancers and entrepreneurs in your line of business.

Fee

Do not put your clients under financial stress by letting them pay high fees for using your preferred payment method. Offer them cheap systems. If possible, provide them with free-to-use ones.

Security

Choose secure payment channels. Neither you nor your clients should have any fears about the safety and security of the payment options you have for your business.

Support

Unforeseen issues may arise while using your payment methods. So, you should only choose options that provide fast customer support.

Conclusion

Using multiple payment methods can help you enjoy your freelancing business. You can expect timely payments. Besides, your clients will be happy that they can pay you conveniently. Having learnt the best options for receiving secure and fast payments as a freelancer, take advantage of them today and grow your business.