Neobanks vs Traditional Banks

Necessity has never stopped being the mother of invention. People have been clamouring for faster, cheaper, easier, and more convenient banking services. These people include freelancers, remote employees, frequent travellers, migrant workers, entrepreneurs, and younger generation depositors and investors. They want to have 24/7 access to their banks, make quick deposits and withdrawals, wire money instantly and make payments to merchants from anywhere. Although traditional banks have tried hard to keep up with the times, they have not always been able to meet all the needs of the most demanding customers. Hence, a new kind of challenger institution called “neobanks” evolved and became globally recognised in 2017. Now, this article adopts a crystal-clear approach to show you the differences between traditional banks and neobanks.

What are Neobanks?

Neobanks are new financial institutions that offer banking products and services to people but exist and operate totally online. In other words, these new generation banks do not have physical branches. They operate through digital platforms and products, such as websites and mobile apps, and charge cheaper fees than traditional banks. The services they offer to their clients include savings accounts, current accounts, payment cards (debit/credit), loans, money transfers, analytics, and so on. Other terms sometimes used to refer to neobanks include virtual banks, internet-only banks, digital-only banks, online-only banks, and challenger banks.

How Do Neobanks Differ from Traditional Banks?

On the one hand, traditional banks operate through all channels and render a much wider range of services than neobanks. They are present in both physical locations and online platforms. Traditional banks provide branches with banking halls and automated teller machines (ATMs) for their customers to deposit, withdraw, and transfer money, as well as discuss any issues with them. They let you use online banking services through web-based, desktop, and mobile applications. Also, some traditional banks can create their own neobanks.

On the other hand, neobanks are using advanced technological tools and artificial intelligence to provide high-quality banking services to their customers using an online-only presence. They are more innovative than traditional banks. With mobile apps, neobanks render a range of specialised banking services to their customers, designedly making banking a simpler and more convenient experience than what traditional banks are offering.

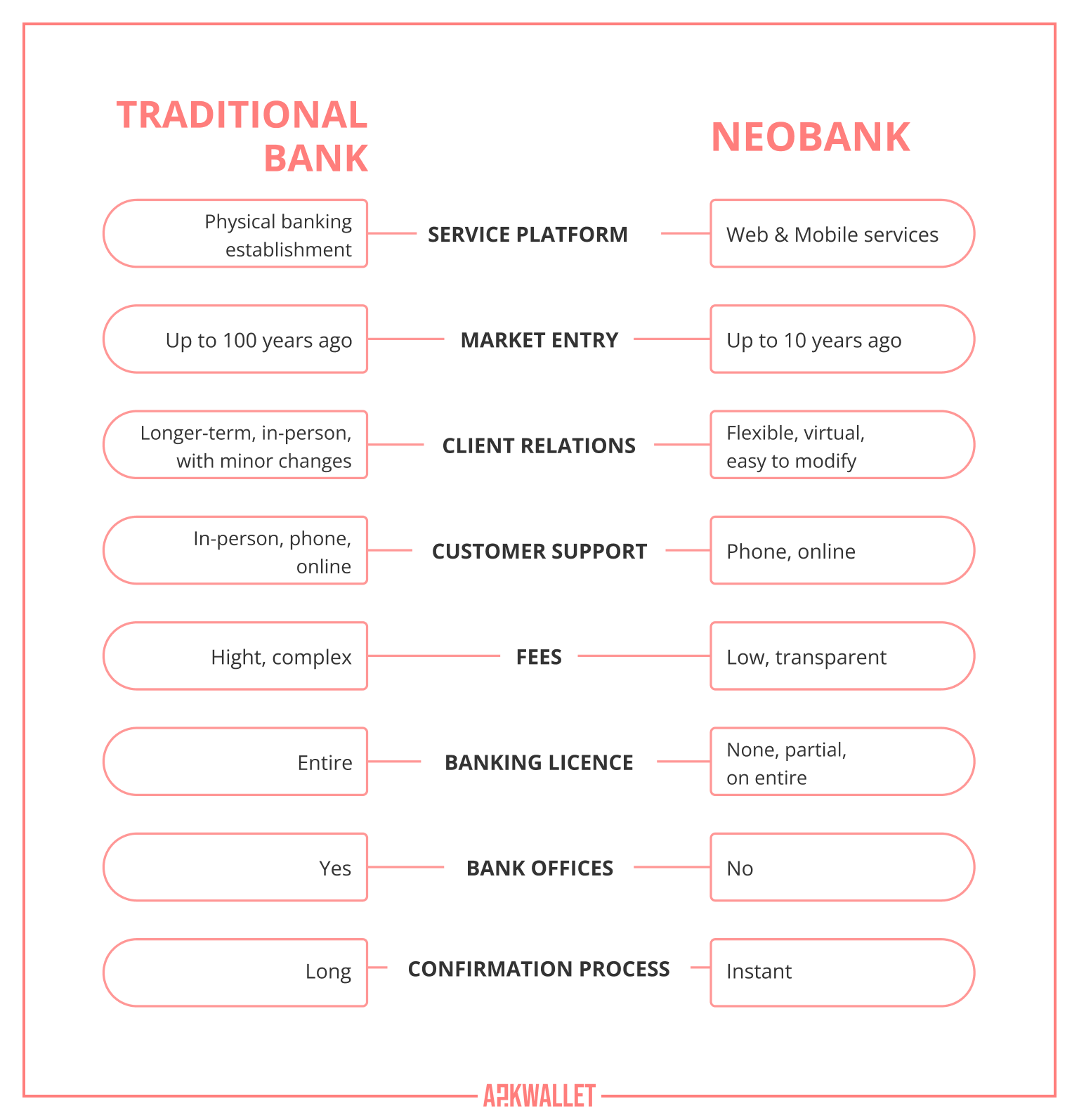

Now here is a visual summary of the key differences between traditional banks and neobanks.

Why Do People Prefer Neobanks?

People choose neobanks over traditional banks for the following reasons:

- Neobanks offer higher interests on savings to encourage their customers to save.

- Since neobanks have lower operating costs because they do not have physical branches, they are able to charge lower fees than their counterparts.

- Neobanks work 24/7 and their services are not limited by bureaucratic structures, geographical location, opening and closing hours, and the like. Thus, with such high accessibility, their customers can travel with their banks coming along.

- Traditional banks are not able to offer personalised services that meet the needs of different customers (niche marketing) like neobanks. Therefore, some people would prefer to receive services from new banks that know how to meet their needs better than to stay with conventional banks that are not operating at such a personalised level.

How are Neobanks Evolving?

Some of the main factors driving the growth of neobanks are the increasing use of smartphones and the internet worldwide, demand for less complexity in the operations of banks, and the rising number of digital nomads. These digital-only banks appeared to challenge traditional banks in various areas of banking services delivery, including fast deposit and withdrawal, secure and instant transfers, better customer engagement, smooth online connectivity, good mobile app user experience, and others. Additionally, the evolution of neobanks is not expected to slow down any time soon. According to the findings of a leading market research and consulting company KBV Research, neobanks are anticipated to expand at approximately 47% compounded annual growth rate (2020-2026).

Best Neobanks in 2022

Is this your first time learning about neobanks? Have you always wanted to bank with one of them but could not find a reliable guide? The following are some of the best, secure, safe, and affordable neobanks according to AskWallet’s users:

Atom Bank

Set up in 2014, this is the first-ever licensed neobank in the United Kingdom. Atom Bank operates under the regulation of the Financial Conduct Authority. This digital-only bank has free IOS and Android apps for mobile devices. This app provides advanced security features including biometrics for signing into your account through voice or face identification. With Atom Bank, you can open a savings account, have access to mortgages, loans, and enjoy a wide range of banking products for individuals and businesses. However, to register an account with Atom Bank, you must be a UK resident, have an existing current account and be ready to pay some fees for: a mortgage valuation, missing a mortgage payment, changing your mortgage terms, and so on.

Starling Bank

Starling Bank has a full licence to operate in the United Kingdom. Like Atom Bank, it was founded in 2014. For four consecutive years, Starling Bank has been voted the best neobank in Britain. All you need to register a personal or business account with this bank is your mobile phone. There is a Mastercard card for whichever account you open. Also, it supports having a joint account (for couples) as well as multicurrency accounts – in GBP, USD, and EUR. Pay no monthly fees and enjoy fee-free abroad transaction and ATM usage, as well as 24/7 customer support in the UK when you bank with Starling Bank.

Current

Current is an online-only bank for residents in the United States of America. It was founded in 2015. Users of the app can spend, save, and have control over their money while they enjoy no hidden fees, a 4% annual percentage yield on savings, a free visa debit card, and 24/7 support. However, while its Basic and Teen accounts can be opened for free, you will have to pay US$4.99 to use the Premium account which comes with more benefits.

Bunq

Bunq was created in 2012. Residents in the United Kingdom and other countries in the European Union can create an account with bunq. By doing so, they gain access to more than 25 Euro-denominated IBAN bank accounts, 3 physical cards issued by Mastercard or Maestro, and 5 virtual debit cards from Mastercard. All users of this neobank are allowed to make free withdrawals from any overseas ATM but limited to only 10 withdrawals monthly. They can open personal, joint, or business accounts but will be charged a fee for payments received from banks outside the Single Euro Payments Area (SEPA).

Chime

If you reside in the United States, Chime is a reliable neobank for you. It outrightly considers itself to be a financial technology company rather than a bank. All its mobile banking services, such as its various accounts and credit cards which are obtainable through the app, are provided by its partner traditional banks, including Stride Bank N.A., United States. This neobank was established in 2013. Also, with regards to personal budgeting, the app comes with tools that can automatically help you with savings.

N26

Now, if you are based in Germany, Italy, or any other supported country in Europe, one of the best neobanks for you is N26. This online bank was established in Berlin, Germany, in 2013 to offer personal and business accounts to English-speaking clients, including expats, and serve as a gateway to a new world of convenient banking. It offers free account opening, a Mastercard card, options for savings and loans, fee-free currency conversion during wire transfers, unlimited and free withdrawals, and does not charge any monthly fees. However, there are different limits on the number of ATM withdrawals you can make in a month, and this depends on your account type. While N26 Standard account users have a limit of up to 3 withdrawals, N26 Metal account users have 5 more. Nonetheless, users of the N26 app can receive customer support in any of the following languages: English, Italian, Spanish, French, and of course German.

Can Neobanks Substitute for Traditional Banks?

The short answer to this question is partially. Presently, traditional banks outperform neobanks with respect to the number of banking products and services on offer to the public. Therefore, challenger banks like neobanks cannot be used to utterly replace traditional banks. Besides, even though we are already living in a digital era, not everybody is tech-savvy and capable of operating a virtual bank. To totally substitute traditional banks for neobanks is to exclude some people from the banking population. These people include senior citizens who are yet to embrace modern digital banking technology, residents in rural areas with limited internet connectivity, all who lack digital literacy, and those who prefer to have in-person relationships with their banks.

Challenges Facing Traditional Banks and Neobanks

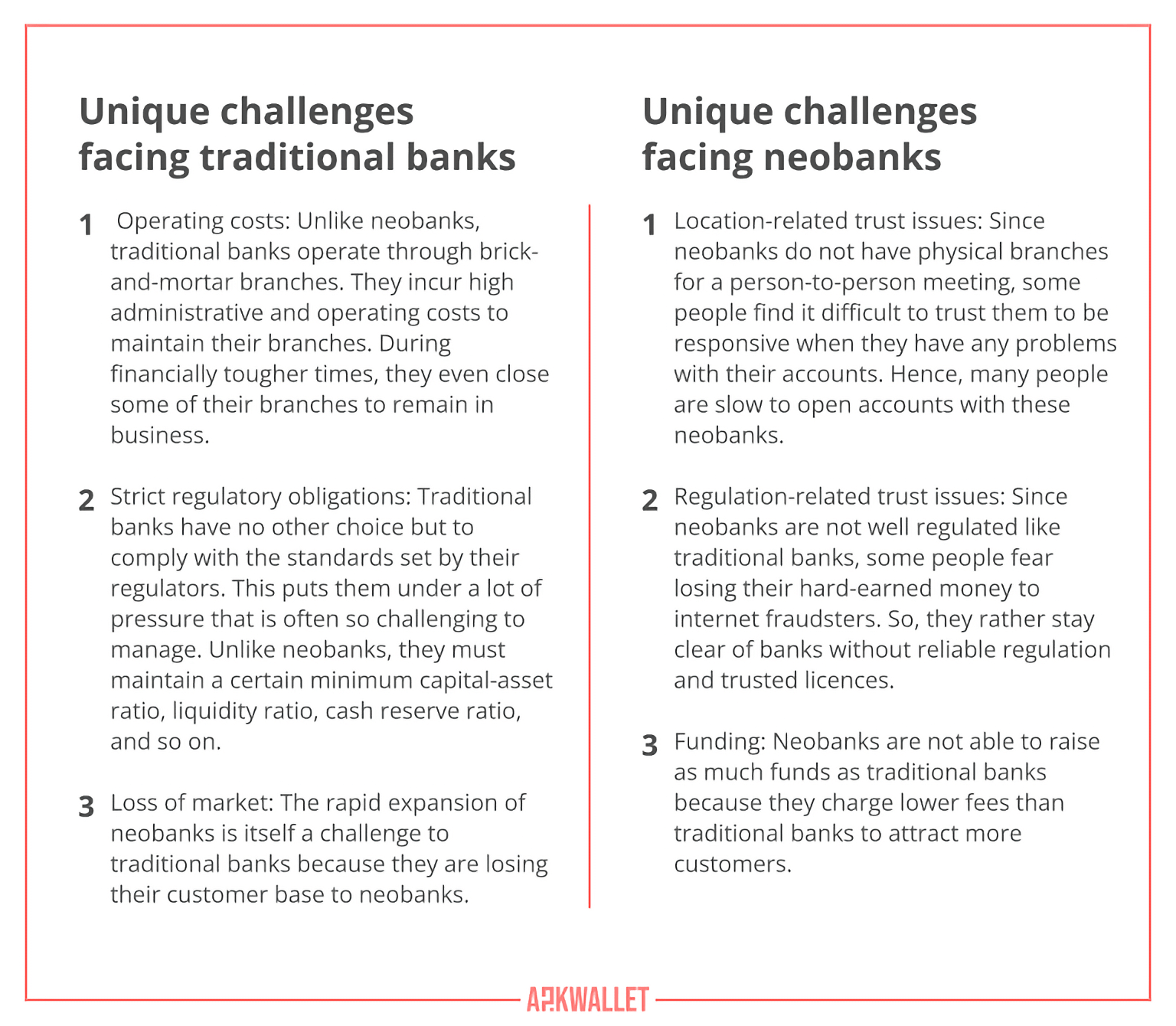

There are numerous problems facing traditional banks and neobanks today – some are faced by either of them while others are shared between them. To give you more insight into their differences, we have juxtaposed their distinctive challenges in the following table:

Conclusion

Now, compared to traditional banks, neobanks are the real deal and the future of banking. They offer highly innovative, cheaper, personalised, and more convenient services to the banking population. Apart from the challenges inhibiting their expansion, neobanks have their pros and cons, which you can find on our website. Nonetheless, as more neobanks gain public trust in their products and services and raise more funds to finance their operations, they will continue to significantly redefine banking and challenge traditional banks. Maybe they will be able to replace traditional banks someday. Until then, it is more profitable to register an account with any of the neobanks listed above. Besides, you can have accounts with traditional and neobanks simultaneously. Please feel free to share with us your opinion of the banks you have already used. We try to make an honest rating, so every opinion and evaluation of our users is important to us.