Why Do Businesses Choose EMIs Over Traditional Banks?

Greek thinker named Heraclitus said, “Change is the only constant in life.” One of the notable trends in the global financial industry is the increasing preference of business clients for electronic money institutions (EMIs) instead of formerly stunning traditional banks. What could be behind this change?

In this article, we will reveal why businesses, especially start-ups and small and medium-sized enterprises, are choosing EMIs over traditional banks. We will also show you the top trending EMIs for all sizes of businesses that want to grow fast.

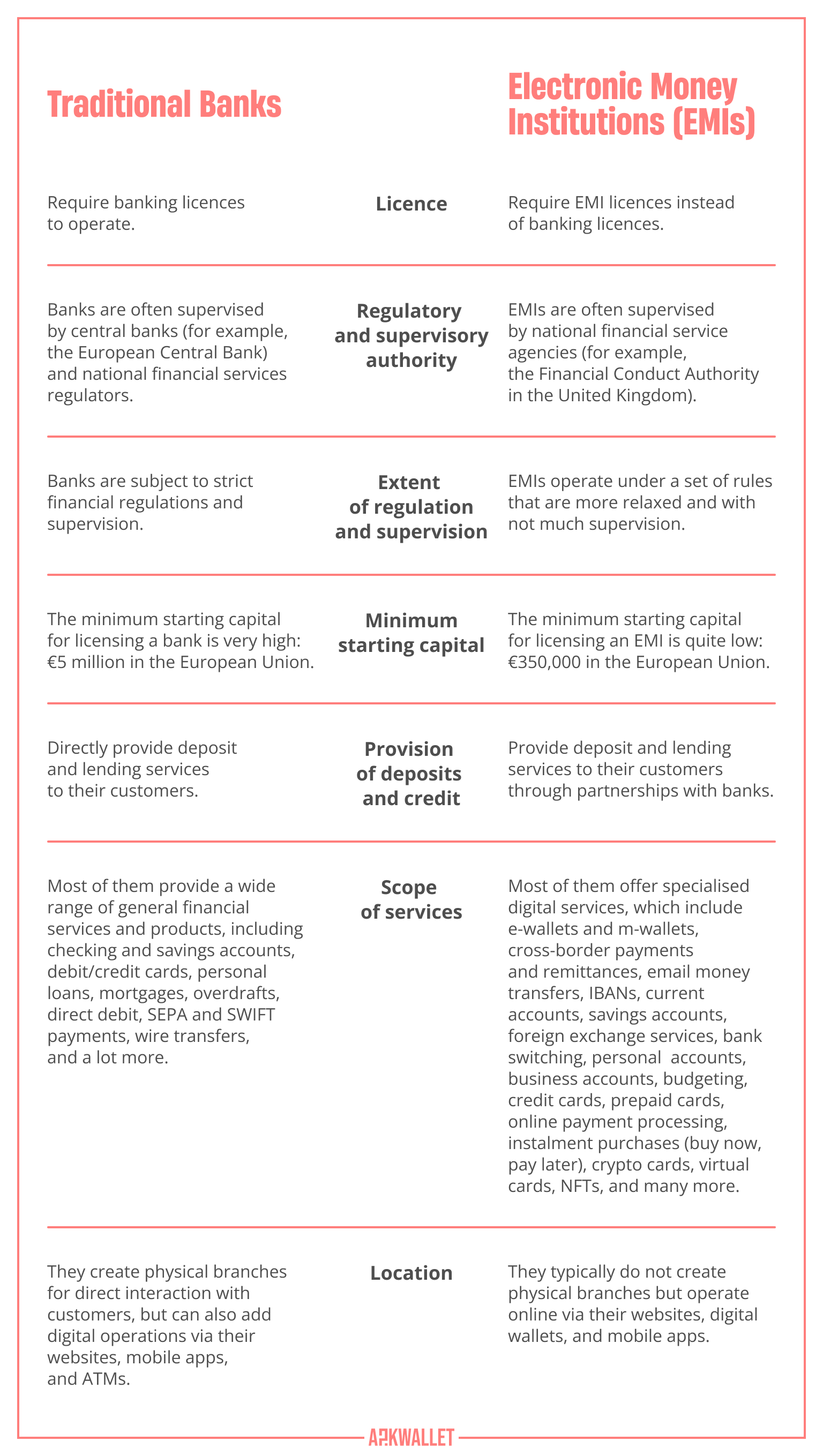

Traditional banks and electronic money institutions are both providers of financial services. They allow individuals and businesses to create accounts and trust them with their funds and financial transactions. However, traditional banks and EMIs do not operate under the same structure.

Below is our illustration of the differences between traditional banks and electronic money institutions.

EMIs Offer Cutting-edge Business Solutions

Electronic money institutions offer advanced solutions to the needs of all kinds of businesses. They distinguish themselves from banks by using advanced technologies and innovative systems that allow them to service clients in ways that are faster, safer, and more convenient.

Digital and remotely operated solutions

Digitalization is key to how FinTech businesses like electronic money institutions operate. It enables them to provide customers worldwide access to their accounts 24/7.

Furthermore, businesses usually get IBAN accounts from EMIs through a simplified and fully remote process. As a result, they conveniently save and invest their funds in multicurrency accounts, managing them from home or abroad.

Fast payment services with multiple options

EMIs are known to be proficient in reducing how long international transfers and local payments take. They use advanced technology and the flexibility of their operational structures to speed up the payment processing time. EMIs provide electronic wallets, digital currencies, and even cryptocurrency, which are fast payment methods for business transactions.

Better compliance standards and funds security

Electronic money institutions offer better compliance standards when it comes to financial services provision and managing online payments safely. They use cutting-edge technological tools and sophisticated internal systems to offer advanced solutions, such as in-depth real-time fraud monitoring and control via the internet. In that way, any suspicious activity in a customer’s account can be easily and quickly detected, flagged, and immediately addressed.

Best EMIs for Anysize Business

Having shown you the advanced solutions that EMIs provide to businesses, it is about time we mentioned some examples you can register an account with to support your business. Below are the best electronic money institutions for start-ups and small and medium-sized enterprises today.

Intergiro

Intergiro is an EMI that offers banking products and services for modern businesses with fast-growth potential. It holds a licence for the issuance of electronic money and is regulated by the Swedish Financial Supervisory Authority.

It is a highly secure and safe service. One of its modern security measures includes saving its customers’ information in secure and encrypted storage spaces. Also, the service gets real-time alerts of suspicious activities on user accounts, enabling quick response and early fraud protection.

Intergiro is ideal for card acquirers, product builders, payment service providers, innovators, FinTech start-ups, and digital businesses of all sizes. You can create a business account with Intergiro to enjoy its wide range of banking-as-a-service offerings through its API (application programming interface).

ConnectPay

ConnectPay is a one-stop shop for the banking needs of all sizes of businesses. It operates under the ConnectPay UAB company, which is registered in Lithuania as an electronic money institution. The service is authorised and regulated by the Central Bank of Lithuania.

You can use its APIs to issue IBANs, collect fees, execute payments, screen transactions, manage all inter-bank queries, perform KYC checks, and send reports to regulatory authorities. Besides, you can tailor its APIs to the model of your business because ConnectPay allows flexible integration.

In terms of security, ConnectPay does not only provide a safe and secure platform for its customers but also gives them security advice. There is a link on its website where it tells them how to conduct themselves safely and securely while using the digital platform or mobile app for online banking. This is necessary because account security is a shared responsibility in reality. A careless user is more likely to expose confidential information than a careful user, no matter the level of security of their banking or payment platforms.

Square

Square is a FinTech company and electronic money institution based in San Francisco, California, United States. However, its services are available to businesses in the United Kingdom, Canada, Australia, and Japan.

Square is your go-to solution provider for quick, secure, and simplified payment acceptance. You can use its APIs and customisable payment forms to receive payments safely. It provides support for in-person and online payments and a free Square POS app that works efficiently with its various hardware options for businesses.

Furthermore, Square offers “buy now pay later” instalment loan services via its partnership with First Electronic Bank, which is a US-based chartered industrial bank and Member of the Federal Deposit Insurance Corporation (FDIC). Through this collaboration, Square makes it possible for you to allow your customers to pay in instalments while you get the full payment from another FinTech company called Clearpay.

DECTA

DECTA is a global payments processing service provider. It provides merchants, banks, FinTech companies, payment service providers, and different kinds of businesses with the tools they need to participate successfully in the world of cashless payments.

DECTA is registered in the United Kingdom as an electronic money institution. It is authorised by the FCA. The company is a Principal Member of Visa and Mastercard. It issues a variety of cards to support different businesses with their digital payment acceptance technologies and white-label cards.

The company is able to deliver a wide range of financial and technologically driven services through its partnerships with other FinTech giants and multinational corporations. DECTA’s partners include Apple, UnionPay, Deloitte, Visa, Mastercard, PayPal, Alipay, QIWI, and Google.

Payeer

Payeer is an electronic wallet for buying, selling, exchanging, and holding fiat money and digital currencies (cryptocurrencies). It is regulated by the Ministry of Economy and Communications of Estonia under the name Payeer OU.

Payeer works with crypto-friendly banks, crypto service providers, and merchants worldwide to provide payment services for business needs. It lets you send payments via API to e-wallets, bank cards, and cryptocurrency platforms using your Payeer account.

Concerning security, Payeer takes anti-money laundering (AML) and data protection very seriously. The company has a firm policy under which it maintains a high standard of AML compliance, high-risk monitoring, fraud prevention measures, and customer identification (KYC).

Statrys

Statrys is an electronic money institution that is fully licensed and regulated by the Customs and Excise Authority in Hong Kong and the FCA in the UK. It provides accounts that fit the needs of different businesses, helping them with easy multi-currency accounts, fast payments, and competitive FX rates.

The services of Statrys are ideal for businesses that are into consulting, IT and telecommunication, international trade, e-commerce, marketing, and food and beverage production. Besides, it enables them to issue Mastercard virtual and physical cards to their team members and customers so that they can make and receive payments in-store and online.

Statrys provides unique Euro IBAN account numbers so that businesses can easily manage payments with suppliers and clients across the EU. Their customers also receive real-person support via phone, email, WhatsApp, and WeChat.

Mercuryo

Mercuryo helps you simplify all business payments. It is an Estonian-based EMI that provides a multi-currency wallet that can be used to easily purchase, sell, exchange, and manage crypto. It supports 33 fiat currencies and 13 cryptocurrencies.

Another benefit of creating an account with Mercuryo is that the company can help you take care of fraud tracking, chargebacks, PCI compliance, blockchain monitoring, data storage, verification processes (KYC checks), and licences.

Mercuryo’s simple API and Banking-as-a-Service can be used for a smooth integration that requires minimal coding. Besides, the entire process will take just a few days, and your online payment platform will be up and running.

Cybersecurity and the Choice of EMIs Over Traditional Banks

Some experts argue that the main reason businesses prefer EMIs to traditional banks is cybersecurity. Many companies perceive the FinTech products of EMIs, such as e-wallets and mobile apps, to be safer against internet fraud than the online platforms of traditional banks.

We will now look at the common ways cybercriminals attack the digital banking systems of traditional banks.

Common attacks on digital banking platforms

Fraudsters frequently use the following techniques to break into customers’ online accounts and steal their money:

Phishing

Phishing describes deceptive actions that appear to be communications from authorised parties. An intentionally deceptive message aims to persuade the reader to take hasty actions, such as clicking on a questionable link or disclosing private details. Criminals can use this information to steal sensitive data from user accounts online, make electronic transactions, and embezzle their funds.

Unencrypted data

Hackers love unencrypted sensitive financial data because it is a gold mine. Data encryption makes sure that attackers won't be able to decrypt stolen or compromised information. Thus, encrypted data provides an additional layer of protection and considerably lowers the likelihood that it will lure cybercriminals.

Malware

One of the simplest techniques fraudsters employ to get access to customers' data is to install malware on workplace equipment. They send messages or other attachments containing hazardous software to those who have poor security expertise. Instead of stealing consumer data in this situation, the attackers want to limit access and demand a ransom to get it back.

Spoofing

One of the most recent kinds of cyber risks is spoofing. In this technique, the original website of the bank is reproduced by cyber criminals in a way that is functionally identical. They steal users' login credentials when the ignorant customers of the bank try to sign into the fake website using their correct username and password. Therefore, it is important to take note of the correct address of your bank’s website to avoid using a copied version.

Insecure third-party services

Some banks and financial institutions use third-party services to provide their customers with a better experience. Customers of the original bank may incur significant losses if their third-party service providers use weak security systems.

Is Bank Money Safer Than E-Money?

E-money, or electronic money, refers to value digitally stored on a device connected to the internet for later use as a medium of exchange. It can be accessed using a physical or virtual card, a digital wallet, a mobile app, or a web-based platform. EMIs typically deal with e-money.

On the other hand, bank money is deposit balances with a traditional bank. It can be withdrawn in the form of cash (banknotes or coins), or electronically transferred from one account to another.

The safeguarding of customers’ money has also been a focus for traditional banks and their regulatory agencies. For instance, to ensure that customers will not lose their money in the event that a bank fails for any reason, which includes cyberattacks, the European Union recently passed laws requiring each member to establish at least one Deposit Protection Scheme (DPS) on a national basis. This does not, however, ensure that all sensitive data is fully protected.

In order to ensure the safety and availability of their customers' money, EMIs that accept e-money deposits typically operate with a policy of holding their clients' money in separate accounts at central banks or other secure deposit-money financial institutions. Therefore, there is extremely little chance that money will be taken from the bank accounts without the consent of the owners.

Additionally, electronic money institutions provide their clients with the best fusion of cutting-edge security and payment processing technologies. They collaborate with the top industry players in the cybersecurity niche as they continually look for new approaches to fortify the security of their digital and mobile platforms.

FAQ

FinTech companies and electronic money institutions are better than traditional banks because the former make it possible to meet complex financial needs in simpler and more secure ways. Besides, FinTechs offer less expensive solutions than traditional banks.

Digital banks offer a variety of innovative services that traditional banks do not, which include 24/7 banking and money transfer services, more attractive interest rates on savings accounts, lower fees on checking accounts, and customised products that meet personal and business needs in better ways.

Digital banks, or neobanks, are different from traditional financial institutions in many ways. We will mention two notable differences.

Firstly, neobanks do not have physical branches as they operate online round the clock, unlike traditional banks that have opening and closing hours that limit your access to them.

Secondly, digital banks, or neobanks, are cheaper and more cost-effective than traditional banks. The latter cover their administrative and operational costs of having physical branches by charging higher fees, while neobanks can manage lower costs and charge cheaper fees to increase the convenience of their clients.

Whether FinTechs will replace traditional banks is a debate that has lasted a long time. Some experts say it will; some others say it will not.

In our opinion, FinTech and traditional banks need to continue working together to deliver better products and services to consumers. For example, while FinTechs and EMIs can gain from keeping their customers’ funds in separate accounts with traditional banks that have licences and existing infrastructure to manage deposits, traditional banks can gain from the technological expertise and innovative products of their counterparts in the industry.

Banking with EMIs is the way forward!

Traditional banks are slow in adopting new technologies for the provision of safer and more secure financial products and services. They still rely on bureaucratic procedures in service delivery. Besides, the use of physical branches makes it difficult for them to be flexible enough to deliver 24/7 services, which most EMIs are good at doing.

On the other hand, electronic money institutions are more agile and technology-focused than traditional banks. They provide a multi-layered approach to preventing cyberattacks through advanced security compliance, customer safety education, staff training, the installation of automatic fraud detection systems, and several other methods.

Therefore, the core solutions to the needs of businesses with a fast-growth mindset can be found in electronic money institutions. It should not be surprising that more businesses are choosing EMIs over conventional banks