How to Save Money During High Inflation

From Europe to the United States and several other parts of the world, inflation has been at historically high rates since the beginning of 2022. As a result, many people, households, and businesses are experiencing a financially difficult time meeting their needs.

Euronews has it that, in the UK, the inflation rate went as high as 10.1% in July. The inflation level is higher than it has ever been in the last 40 years.

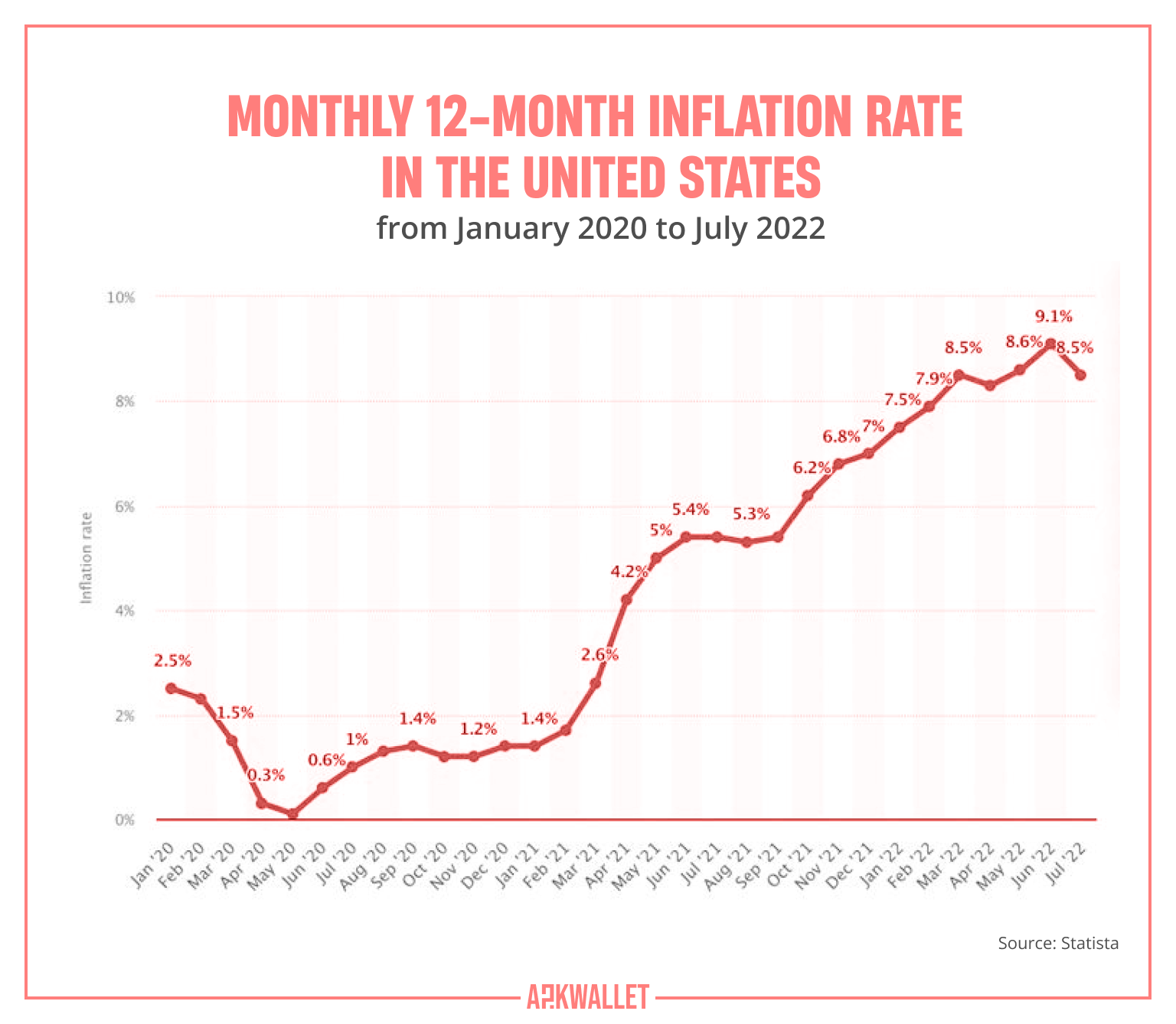

Also, according to Statista's most recent report, prices in the United States grew by 8.5% in July 2022 compared to July 2021. This figure is in line with the 12-month percentage change in the consumer price index (a concept we will explain later in the article).

This widespread high inflation is not the first in history; it will not be the last. Therefore, this is the best time to learn how to secure your financial freedom sustainably amidst skyrocketing prices.

In this article, we will outline various ways you can protect yourself against the impacts of inflation, irrespective of your country of residence. You will also find the best mobile apps and digital platforms for saving and growing your money at all times.

Meaning of Inflation

Inflation is a term used to describe a situation of a general increase in the prices of goods and services, which leads to a higher cost of living.

During inflation, people experience a decrease in their purchasing power over time. As their capacities to pay for goods and services reduce, their local currencies also lose value in relation to other currencies.

But what causes inflation? In most cases, widespread scarcity (supply shortages) and high demand lead to inflation! In other words, when there are not enough raw materials or other resources to produce goods and services in the quantities that people usually demand, the cost of production will increase as producers will spend more money to obtain them from alternative sources. The situation will further lead to a rise in prices as manufacturers will want to earn more revenue from sales to compensate for their high cost of production.

In some cases, the customers bring about inflation. When buyers begin to earn more money or receive new knowledge of the benefits of certain products they consume, they begin to spend money on them. In such a situation, they would want to secure for themselves as many quantities as possible and would not mind paying a higher price. This behaviour is in line with the principle of demand and supply in economics: supply decreases as demand increases, leading to demand-pull inflation or higher prices.

Measurement of Inflation: CPI vs. RPI

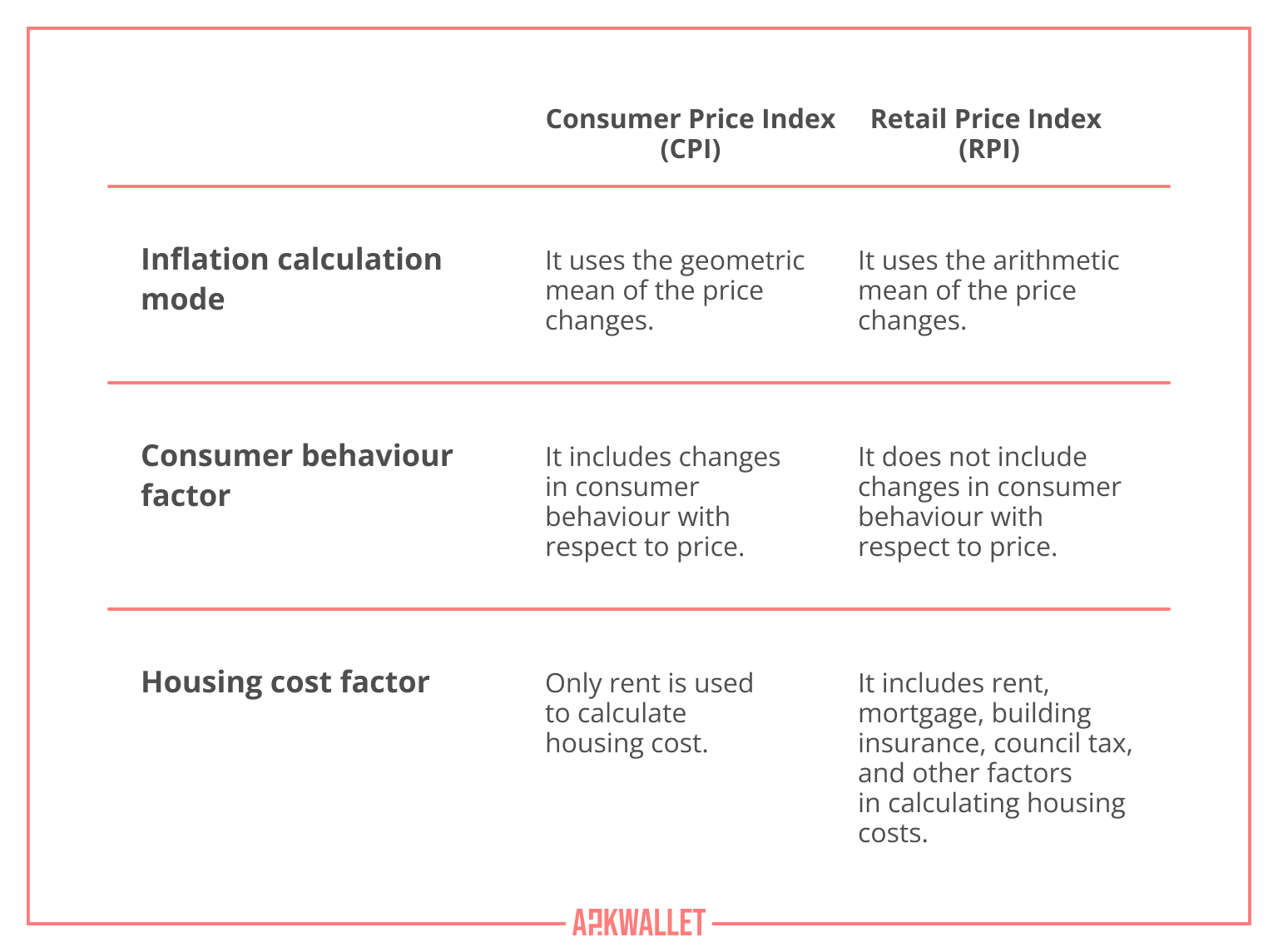

Around the globe, experts measure inflation using the Consumer Price Index (CPI) or the Retail Price Index (RPI). While we do not intend to go into the technical details about computing inflation using any of these tools, we would like to show you the main differences between them.

Here is our simple head-to-head comparison of CPI and RPI.

What Inflation Means for You

It takes knowing how inflation works to make good savings and investment decisions. Otherwise, your €500 in the bank today could become equivalent to €480 in the market in the next three to six months. In that case, you would have lost €20 from your bank deposit or savings account due to a fall in the value of your money, even though it still looks the same digitally. That is what a general situation like inflation means for you.

Facts About Inflation in Europe in 2022

Prices have actually started going up since the COVID-19 pandemic when global supply chains were faced with production problems, travel restrictions, and reduced workforce productivity. To add salt to injury, energy costs have risen rapidly due to several factors, including the shortage of supply following sanctions on Russia.

In its efforts to control inflation in the European Union (EU), the European Central Bank (ECB) has increased interest rates for the first time in 11 years. The move was revealed in a publication by the Voice of America (VOA). The current inflation in the EU is an economically unhealthy development that is running at its highest levels for months since record-keeping for the euro began in 1997.

The ECB announced that there would be a further increase in the interest rate in September if the situation does not improve. “For September, we can consider a bigger increase if the inflation outlook persists or deteriorates. Our future decisions will be data-driven,” said the Vice President of the ECB, Luis de Guindos, during an interview.

Meanwhile, Eurostat, which is the statistical office of the European Union, did not see a decrease in the EU inflation rate any time soon. It reported that, based on flash estimates, inflation will grow from 8.6% in June to 8.9% at the beginning of the second half of the year. The estimates were calculated using the main components of inflation in the euro area, which are energy, food, alcohol, tobacco, non-energy industrial goods, and services.

Statistical findings published by Statista on August 18, 2022, showed that Eurostat underestimated the situation: the EU’s inflation rate increased to 9.8% in July. According to the report, the European countries most hit by inflation were Estonia, Latvia, and Lithuania, which topped the list with rates as high as 23.2%, 21.3%, and 20.9%, respectively. The least affected countries during the month were Finland (8%), France (6.8%), and Malta (6.8%).

How to Reduce Your Expenses During Inflation

When there is a general rise in prices, one of the smartest things to do before thinking of how to increase your income is to reduce your expenses. How can you do that? Below are simple ways to cut down on your spending.

Create a budget and set spending priorities

The first thing to do is to budget for your income, expenses, and savings. In that way, you are planning ahead of your paycheck. It is wise to get some personal budgeting tools if you are not used to putting money aside. Use them to maintain your savings plan.

Furthermore, set a realistic priority of things you intend to spend on each month. For example, you can use the 50:30:20 budgeting rule to allocate 50% of your income to needs such as food and shelter, 30% to wants such as vacations and entertainment, and 20% to pay off credit card debts or personal loans. If you do not have debts, you can deposit the remaining 20% in a high-yield savings account.

Smartly reduce your utility consumption

Utilities are very important for wellbeing. They include water, energy (electricity and gas), heat, and proper sanitation or waste disposal. However, you can reduce your consumption of these essential services to save some money during inflation. Besides, it is environmentally friendly. You will be helping to build a greener nation by doing so.

To reduce your utility bills, try to implement the tips in this guide by the United States Department of Energy. For example, you can unplug electrical appliances when you are not using them, avoid preheating your oven, turn lights off during the day and when you are not using them, and switch to LED lightbulbs that are energy efficient.

Shop around for cheaper alternatives

While you might not be able to get alternatives to your utility service providers, you sure can find them for your groceries and other shopping. It is undoubtedly obvious that, aside from energy, supermarket prices have seen some of the highest inflation when it comes to high expenses. Therefore, compare brands while you shop for groceries or household items. In that way, you will discover less expensive alternatives that are also good.

This idea does not work like magic. You may not see the effects right away when you start shopping around and selecting less expensive items. However, you will eventually notice it in your reduced spending and increased savings.

Ways to Increase Your Income During Inflation

In reality, there is a limit to how much of your expenses you can slash down. Hence, you need to think of another way forward. Since inflation reduces your purchasing power by making your money lose value in the market, you should explore ways to increase your income and, possibly, cancel out the effect of the rise in prices. The following are simple tips that can help you grow your income at any time.

Get a side job

Try other ways to earn extra cash while you go about your regular job. No money is small money if you have the time and skills to earn it. You can try options like babysitting, dog-walking, paid online surveys, disc jockey (DJ), graphic design, online sale of your personal property, freelance writing, and so on.

As you go about finding a side gig, make sure you can receive timely payment from your customers or clients in any location. In this regard, you can register an account with one or more of the providers of the best apps for freelancers and digital nomads.

Negotiate for a raise at work

A wage or salary increase is a fantastic chance to earn more money and reduce your debt or boost your savings. It is common for employers to raise the pay of their workers after the successful completion of their probationary periods.

If you think you are qualified for a raise at work or the idea has been on your mind, there is no better time to do so than during inflation. Besides, when the labour market is friendly, rising prices make it easy for employees to ask for a pay raise.

Consider investing

One of the greatest ways to give your funds the chance to increase in accordance with inflation, or perhaps outrun it, is to invest over the medium-to-long term, which is often five years or more. There are several alternatives that might potentially increase the value of your money over the long term. They include your pension plan, stocks and shares, Roth IRA, crypto assets, and other investment platforms.

13 Ways to Protect Yourself from Inflation

Inflation has many negative effects. It not only reduces your purchasing power but also raises the cost of living, lowers the value of your currency, and increases economic inequality. Therefore, you must do your best to protect yourself against it by following our professional tips below.

- Avoid carrying excess cash

If you tend to have more liquid cash on hand than you would require for an emergency fund, you might want to think about investing the extra money. Even if the stock market is now at a low point, over a lengthy period of time, an investment might earn a far better interest rate on the stock market than it would in a savings account.

- Still try to save as much as you can

Create a savings account and deposit three to six months' worth of spending in it. Only use it in case of an emergency. Even if the majority of savings account interest rates are low, any return is still preferable to nothing at all. So, be on the lookout for high-yield online savings accounts, which frequently provide rates that are substantially higher than the industry standard.

- Avoid unnecessary spending

Price increases at the grocery store and the petrol pump are common when inflation is this high. That is not the time to spend on unnecessary fun activities and luxuries. Maintaining control of your expenses and adhering to a budget will allow you to monitor your cash inflow and outflow each month.

- Search for tax efficiencies

Search for tax-efficient investments in your brokerage account to help you fight inflation. Assets that typically lose more of their returns to taxes should be allocated to tax-advantaged accounts, while those that lose fewer of their returns to taxes are better suited for taxable accounts. That is the best way to optimise tax efficiency.

In principle, tax-efficient investing will reduce your tax burden, which means you pay less on what your assets produce, allowing you to retain more of your money. Tax-free accounts like a Roth IRA can be highly advantageous, so open one and contribute the most amount possible.

- Invest in a retirement plan and a brokerage account

The best strategy to fight inflation is investing. You can contribute to the workplace retirement plan offered by your employer and create a brokerage account for additional savings, which you can use to take advantage of compounding. Make sure your investment portfolio is well-diversified by including a range of assets, such as bonds and stocks to reduce your exposure to any one type of asset in the case of a crisis.

- Invest in Treasury Inflation-Protected Securities (TIPS)

Government bonds, known as Treasury Inflation-Protected Securities (TIPS), can shield you against inflation. According to the Consumer Price Index, the principal of a TIPS rises with inflation and falls with deflation. You are paid the original or adjusted principal when a TIPS matures. So, you can include this option in your strategy.

- Consider real estate and commodities

During periods of inflation, one should also consider tangible assets like real estate and commodities, as well as intangible assets like non-fungible tokens (NFTs). Warren Buffet recommends investing in real estate to combat inflation. In fact, by simultaneously raising rental revenue, a property can offset an increase in the rate of inflation.

- Value stocks are worth considering

Investing in commodities that are constantly in demand, such as food and energy, is a wise move. How? These goods are necessities, and businesses that offer them can raise their prices while riding the inflationary wave. You can try it and see how much you can make in return.

- Pay attention to businesses that can easily raise prices without hurting the industry

Warren Buffett has always advocated making investments in companies with minimal capital requirements, especially when inflation is high. You have to look for businesses that may simply raise their costs. It will provide a long-term profit if you can invest in a business that can raise its prices without experiencing any loss of sales.

- Invest in Series I savings bonds

Series I savings bonds can be a better choice if you have additional cash in your savings account. Invest the money in this option instead of allowing it to receive an interest rate far below inflation. The annual interest rate can reach 10% and fluctuates with inflation. However, the timing of your request for the money will determine whether or not this makes sense.

- Direct debit detox

Many people accumulate memberships and subscriptions that they probably do not need. Inflation is the best time to examine them and think about cancelling them or looking for a better bargain. The amount of money you might save after the detoxification of your direct debit might surprise you.

- Try to pay your debts

Governments (through central banks) typically raise interest rates to help regulate the economy as inflation increases. Your regular payments may increase if you have any debt with variable interest rates. Prioritise reviewing your loan agreements to ensure that you are not paying more than the lowest interest possible.

- Get advice from experts

Lastly, and most importantly, seek advice from experts. Besides, it is not always easy to know what is best for you among so many savings and investment options out there. For instance, a sound investing plan should include tax-efficient investment structures and the holding of a mix of assets. You may make the wrong combination without professional assistance or guidance.

Best Apps to Help You Beat Inflation

In addition to the expert guidelines we have provided in regards to overcoming inflation, below are the best high-yield savings and investment apps you can use in all seasons.

bunq

bunq is a neobank that offers different types of accounts to meet the needs of a wide variety of customers. You can open a bunq Easy Money account, which you can use for personal budgeting. It allows you to have up to 25 sub-accounts with which you can save and spend money in 16 currencies. Besides, bunq Easy Money account holders can have multiple European IBANs for SEPA and SEPA Instant transfers.

Atom bank

Atom bank is the first app-based bank in the United Kingdom. You can take advantage of its Instant Saver and Fixed Saver savings accounts, which you can open in a few minutes. The former allows you to have 24/7 access to your money (unlimited withdrawals), while the latter lets you lock your money for a long time and earn attractive interest within six months to five years.

Monzo

Monzo is a neobank that provides several accounts for individuals and businesses. They range from current accounts to joint accounts for couples and personal accounts for kids below the age of 18.

During inflation, you can make money from long-term savings by opening an Individual Savings Account (ISA), which is a tax-free account in the United Kingdom. Monzo offers tax-free savings through its ISAs. You can save up to £20,000 in a Monzo ISA.

Revolut

Revolut is a financial super-app and a neobank. You can use it to invest your money and make good returns. The investment options include cryptocurrencies, stocks, and premium goods like gold. Also, starting an investment in the stock of a large company costs just €1 when you trade via Revolut.

When you open an account with Revolut, you can use the app to never miss the most recent market information, such as changes in the prices of stocks and cryptocurrencies. How? Revolut provides you with real-time notifications to keep you informed of market changes.

Binance

Another way to overcome the effects of inflation is to make money off of cryptocurrency. The crypto economy, which is currently worth about US$2 trillion, is accessible through several FinTech products and exchanges like Binance.

On Binance, you can buy, sell, trade, and hold more than 600 cryptocurrencies. It also allows you to own the Binance Visa crypto card, which you can use to earn up to 8% BNB cashback as often as you charge eligible purchases on it.

In addition, Binance has an NFT Marketplace that connects artists, creators, and crypto enthusiasts so that they can easily trade NFTs. Why should you care about NFTs? Read this post to find out.

Nexo

Nexo offers an online platform where you can grow your crypto wealth and keep it secure. You can also receive up to 2% in crypto rewards for your expenses with the card.

Nexo promises to give you US$25 in Bitcoin (BTC) for every person you invite to join the platform. You will get the money when they register a Nexo account and deposit at least US$100 in assets.

Coinbase

Coinbase is a crypto exchange that allows its registered customers to earn up to US$13 worth of cryptocurrency. Its card allows you to spend cryptocurrency or US dollars without incurring any transaction fees. In that way, you can save some money over time. However, the card is available only to customers in the United States.

Wirex

Take charge of your finances at all times with Wirex. Download the Wirex app to quickly convert between 18 traditional currencies and cryptocurrencies at special OTC and interbank rates. What is more, you do not need to pay any fees when you make fiat-to-fiat transactions via this platform.

FAQ

The best way to survive inflation is to reduce your spending and increase your income by investing in businesses and financial assets. You can also consider using personal savings or budgeting app to manage your cash flow.

During inflation, you can put your money in high-yield savings accounts. and profitable investment opportunities like real estate, cryptocurrency, NFTs, treasury inflation-protected securities (TIPS), stocks, series I savings bonds, mutual funds, and tax-free retirement savings plans.

To fight inflation with your money, reduce how much you spend and increase the amount you save and invest. That’s basically it! You can begin by creating a budget and setting a spending limit, then seeking expert advice on what investment portfolio to consider.

Invest in high-yield instruments during inflation, and you will reap the reward in a few years. You can also trade commodities like gold and NFTs.

Some experts also recommend investing in yourself by learning new skills or getting more qualifications in your profession. By doing so, you would be able to ask for a salary raise or charge a higher fee to cope with the rising prices.

Borrowers and lenders benefit from inflation in different ways. On the one hand, when a borrower owes a large sum of money, a general rise in prices will reduce the value of the debt and allow him or her to pay the lender an amount that is lower than the initial market value.

On the other hand, a lender will benefit from inflation when prices go up because demand for credit and loans will increase. This high demand will cause a rise in interest rates, which will be to the benefit of the creditor.

Other economic actors that benefit from inflation include but are not limited to energy producers and sellers, electric vehicle manufacturers, real estate agents, and food sellers.

Yes, you should buy a house during inflation if you can afford it. Besides, investing in a product that typically retains or increases in value is especially crucial during periods of inflation. Home ownership has traditionally been a powerful inflation hedge since home price appreciation has exceeded inflation in many decades going all the way back to the 1970s.

Generally, debtors gain when inflation comes. If you have a fixed-rate mortgage, you should try to pay it off during inflation. In that way, you will repay at a lesser cost than the pre-inflation rate.

Yes, pay off your debt during inflation if you can. The value of the debt would have been reduced by the rise in prices.

Widely diversified stocks do well during inflation. They include Federal Realty Investment Trust, the Trade Desk, EPAM Systems, Stanley Black and Decker, Altria Group, Sanderson Farms, Tractor Supply, eBay, and Philip Morris.

Inflation can hardly be accurately predicted. The major reason is that there are many factors behind the general rise in prices. Energy prices may begin to fall, but this will not be enough to end the inflation.

The Bottom Line

Based on the present reality, it is now more crucial than ever to ensure that your money and financial assets, including savings and investments, are not being consumed by rising prices due to spikes in inflation.

The present economic crisis will not last forever. But while it remains, you must figure out how to increase your income and make profitable investments. Hence, on our part, we have shown you the best ways to succeed financially during and after inflation. We expect you to make meaningful use of this knowledge. Best of luck!