15 Expenses You Should Never Charge on Your Credit Card

A credit card can be a lifesaver on many occasions. It allows you to pay for goods and services when you do not have enough money of your own. You can also use it when you want to make payments without spending the money in your savings or checking account.

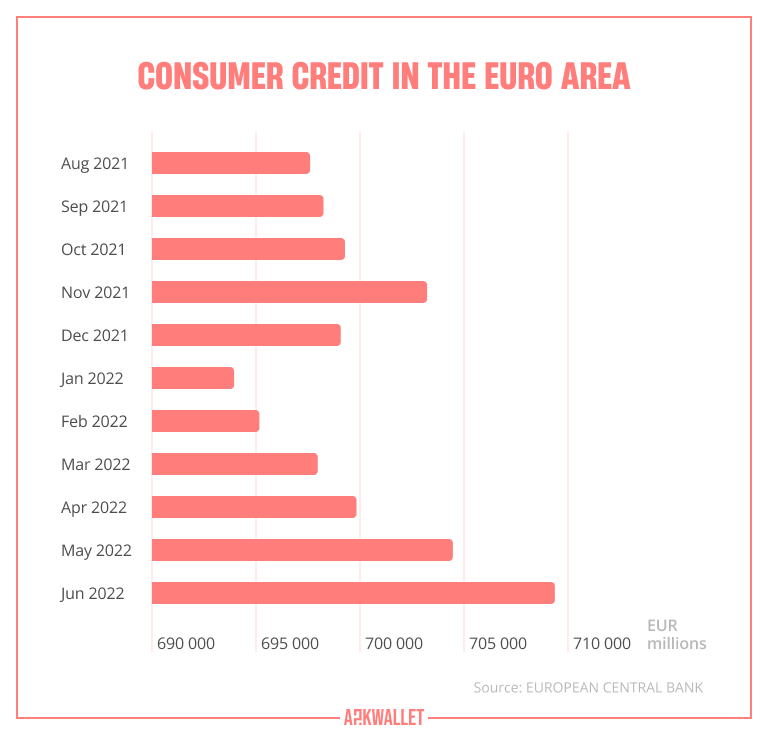

However, a credit card can also be a fast way to run into a huge debt if you do not spend carefully. According to recent publications by The Guardian and Bloomberg, consumer credit card debt is rising in the United Kingdom. The increasing rate of borrowing via credit cards in Britain is now faster than it has been in over 15 years. A similar situation exists in many European countries and the United States. Major factors behind this trend include rising inflation, the high cost of living, and several economic consequences of the tragedy occurring in Ukraine.

Now there are different credit cards in use worldwide. They include those branded by the likes of Visa, Mastercard, UnionPay or American Express for traditional banks and neobanks, credit unions, FinTech companies, eCommerce stores, and many other establishments that issue credit cards.

Generally, card-issuing companies offer credit cards for business or personal expenditures. If your credit card was given to you by your employer for official use, it is a business credit card. But if you obtained it directly from a card issuer to make payments for your own needs, then it is a personal credit card.

Using this straightforward guide, we will show you the expenses you should never charge on your credit card to avoid running into debt.

For Business Credit Card Users

Business credit cards are designed for the benefit of owners of small-to-large-scale enterprises and nonprofit organisations. They come with features and perks that help employees efficiently manage corporate spending, reduce out-of-pocket official purchases, consolidate expenses, and simplify reimbursement. The benefits of a business credit card include easy separation of personal and business finances and access to higher credit limits.

We now begin our list of expenses you should never charge on your credit card with examples specifically for those in possession of business credit cards.

1. Personal expenses

Using your business credit card to pay for personal purchases is not good for your company. It puts you at risk of hurting the company’s credit score and creates an extra hassle for your accountant. It is also most likely a violation of the card issuer agreement, code of conduct, or other related ethical standards within your company. Therefore, ensure you use your business credit card for only payments that qualify as business expenses and are in line with the specifications of your employer.

2. Wages and salaries

Payroll is one of the largest recurring high-cost expenses to manage when growing a business. Therefore, business credit cards should not be used for workers’ wages and salaries. Otherwise, you may be incurring a lot of interest and a huge debt. Instead, when you need a less expensive alternative to financing payroll, try to get a short-term loan for small businesses through a credit union or bank.

3. Lavish entertainment of clients

The cost of entertainment can vary greatly from customer to customer. Some clients frequently want an extra push to do what you require of them. But there are limitations to how far you should go to impress a customer without the approval of management. Offering expensive gifts or services on a business credit card may not be worth it, even though it might seem like a good idea. When you think it is necessary to do such a thing, try to find out whether it is compliant with your company's spending guidelines.

4. Personalised business travel

There appears to be this perception of financial independence once you leave on a work trip. But is charging a luxurious hotel on your business credit card really necessary? Likewise, do you have to stay two more days in a beautiful location for your enjoyment because you are not spending your money? Think about what is morally acceptable and let your professional principles always guide your actions. Every payment you made on your business credit card will show up in the transaction history of your company. Will your manager be pleased to know that you spent corporate funds in that manner?

5. Risky investments and crypto assets

Investing can be a profitable thing to do with your financial resources. Nevertheless, it can be very risky. Out there, you will find numerous investment opportunities and platforms that promise to reward you with high returns when you put your money in them. As tempting as you may find them, it is not safe to use your business credit card for such high-yield opportunities.

Moreover, in reality, there is no guarantee that you will make a huge profit from investing in crypto assets, digital currency, NFT, or stock. Things may go bad and leave you with nothing in return for your investment. Again, will your boss be pleased that you spent corporate funds this way?

6. Unnecessary costly expenses

Card issuers set a high limit on business credit cards to encourage companies to make high-cost purchases. While some costly expenses are impossible to avoid in business, several others are unnecessary. In other words, your business can actually succeed without them. Examples of avoidable high-cost spending that should not be charged on your business credit card include:

- Paying for out-of-town conferences (use online meeting platforms like Zoom, Microsoft Teams, or Whereby instead).

- Employing a new full-time staff to do a few infrequent tasks (such as graphic design or copywriting) that a freelancer or a part-time employee can do at a low cost.

- Buying a larger office space when most of your clients do not regularly come to your workplace.

7. Cash advances

You may get to a point when you are scrambling to raise additional working capital for your business. A cash advance might be your next option as a manager. Based on the amount involved, the frequency at which you obtain it, and the time it takes you to repay the cash advance, your chances of getting the next credit or loan will be lower if you perform poorly.

In fact, it is not a good idea to charge cash advances on your business credit card. This is due to the fact that the APR on cash loans is typically greater than the one charged on your credit card purchase. Additionally, there is no grace period for cash advances, and they are expensive.

8. Legal settlements

Potential investors are usually cautious of a company that uses its business credit card to pay for legal fees. It sends them a signal that the company could be in trouble. Instead, try to use other payment methods that will not make your stakeholders and investors think negatively about your business.

For Personal Credit Card Users

When people talk about credit cards, they usually refer to personal credit cards. These cards allow individuals to borrow funds to meet their regular or daily spending needs and repay them later. They come with features like low credit limits as well as attractive perks for individuals, such as travel benefits and airline rewards.

We now continue our list of expenses you should not charge on a credit card with additional examples that will be especially beneficial to personal credit card users.

9. Health care expenses

You may be persuaded to use your credit card to cover an unexpected medical payment. That is not an issue in and of itself. When you miss a payment deadline and accrue interest, then a problem occurs. That is why we consider it wise for you to start an emergency fund that you can use as a last resort instead of your personal credit card. Besides, you should invest in quality insurance to save money on your health care spending.

10. Rent or mortgage

It is not a good idea to use a credit card to pay your rent or mortgage. Many mortgage lenders will not even let you do it. You may argue that there are third-party services you can use to pay your mortgage with your personal credit card. But you must not forget that such agents frequently impose fees that will raise your monthly expenses. So, why should you incur more costs?

Besides, the interest on your mortgage will still be due even if you do not intend to pay off the whole sum on your credit card each month. Therefore, do not increase the amount of interest that goes toward your credit card balance.

In addition, the amount of credit you have available will also be reduced if you charge a significant amount, such as your rent or mortgage payment, each month. Such action will harm your credit score.

11. School fees

College fees have surpassed the average cost of living in many countries. It might be incredibly handy to use your credit card to pay tuition if you're a needy college student, but you should not because you cannot pay off your balance in time. Instead, think about alternative school finance choices like scholarships, student loans, and grants. You may be eligible for one or more internal and external funding options provided by your school. So, try this alternative.

Besides, some student loans could include a grace period during which you are exempt from making payments while attending school or for a while after you graduate. This option might allow you time to look for employment before you have to start making payments on your student loans, a feature that credit cards do not offer.

12. Cryptocurrency

Personal credit cards are being used more frequently to purchase cryptocurrency on exchanges like eToro and Coinmama. But this is not a safe way to invest in cryptocurrency because the market is unstable and unpredictable. Besides, you are still liable for paying back what you borrowed plus interest even if your investment loses value. In that case, you will be experiencing a net loss, which may lower your credit score.

Nevertheless, applying for a personal crypto credit card that gives rewards might be a wise thing to do before investing in cryptocurrency. It will allow you to receive cash back on purchases as well as other perks that may be used to increase your portfolio's cryptocurrency holdings.

13. Gambling

Gambling is an activity that can be profitable but also very risky and unpredictable, like investing in cryptocurrency. The risks involved in this venture include potential financial loss from gaming and developing an emotional challenge known as “problem gambling,” which is an uncontrollable urge to spend all your money betting.

In its efforts to control problem gambling in Britain, on 14 January 2020, the UK Gambling Commission announced a ban on the acceptance of credit cards by gambling businesses. The restriction took effect on 14 April 2020. Meanwhile, some European Union countries are looking into banning gamblers from betting with credit cards. They may announce their resolutions at any time.

Therefore, do not use your credit card to gamble at online casinos and other iGaming websites. There is no assurance that you will win and get enough money to pay back the debt. You will also have to pay interest and risk having a good credit score.

14. Tax payments

Taxes can be paid using a personal credit card, but you should not do so. Payments made with a credit card are not free, in contrast to bank account transfers. You will end up paying a fee that is deducted from your tax refund. This cost might range from 1.87% to 3.93% depending on the payment processor you use. Nonetheless, if using your credit card is the only option you have, go ahead because it is preferable to owing the revenue service or tax authorities in your country. Still, you should double-check the card’s APR and have a realistic and reliable plan for repayment.

15. Wire transfers and money orders

Do not use your credit card to wire money. It is a very expensive thing to do. Why? They are frequently seen as cash advances (or money orders) by your credit card issuer. Hence, credit card wire transfers attract additional fees. You may be required to pay an extra fixed sum or a percentage of the cash advance. Therefore, it is not a good idea to charge money orders or wire transfers on your credit card.

Best Neobank for Most Credit Card Expenses

Having shown all that you should not use your credit card to pay for, are there no alternative solutions for you? Of course, there are! Below are the best neobanks that can allow you to get the most benefits from your credit cards and other cardless credit offerings.

Revolut

Revolut is a neobank that offers a fee-free credit card that you can use to earn rewards on your expenses locally and internationally. Even currency exchange is free of charge. You will also earn 1% cashback on all cashless purchases for 3 months.

Guess what? As long as you fully repay your balance at the end of each month, Revolut will allow you to enjoy a grace period of up to 62 days. That means you will not have to pay any interest on purchases until your grace period is over. There is a lot more to gain from using Revolut.

Monzo

Monzo is a neobank that provides a BNPL alternative to credit cards through its Monzo Flex borrowing offering. You can use this product online and in-store to pay for anything over 3 interest-free instalments, including what you bought about 2 weeks ago. It comes with a Mastercard card. However, only people not less than 18 years old can use Monzo Flex. Find out more about a Monzo account on our website.

Monese

Are you struggling to have a good credit score? Did you know that you can build your credit score without even having a credit card? Yes, you can! All you need is a London-based neobank called Monese.

With Monese’s Credit Builder, you do not need to apply for a personal or business credit card to improve your credit history. Create an account with Monese today to access and enjoy this offer. It is available to all UK registered Monese account holders aged 18 to 75. This product costs £7.95 per monthly.

N26

N26 is a German neobank. Through its N26 Credit offering, you can get an instant loan of up to €25,000 to finance any project through a loan plan that ranges from 6 to 84 months. The interest rate begins at 1.99% per annum.

The application process will take only a few minutes, and you will not need to do any paperwork to obtain it – everything will be done via the N26 mobile app or website.

Starling Bank

Starling Bank is a UK-based neobank that has won multiple awards in the industry. When you create an account with Starling Bank, you can get overdrafts and loans for personal or business purposes. Its personal lending offerings include a personal overdraft, an overdraft cost calculator, and an overdraft eligibility tool.

Business managers can register an account with Starling Bank to get a custom business overdraft, fair and flexible business loans, and a reliable business loan calculator.

Starling Bank offers interest rates that range from 15% to 35% for overdrafts and flexible interest rates for business loans. Its business loans are available from £25,001 to £250,000 and are unsecured.

Capital One

Capital One is a neobank, or full-service online bank, that offers credit cards that you can use to build your credit score, get cash back, receive dining and entertainment perks, and earn travel rewards. Its featured cards include the Platinum Mastercard, QuicksilverOne Rewards, and Venture Rewards, with benefits that range from no annual fee to 75,000 bonus miles on your purchases. Register an account with Capital One to explore the full range of products and benefits available to you.

Bnext

Bnext is a Spanish neobank that offers innovative ways to be in control of your money without hidden fees. It has a “Marketplace” where it offers several products with great features and benefits for you. They span across savings and investments, trips, energy, insurance, and mortgages. Bnext offers travel insurance to make your travel experience free of complications. You can also get a mortgage for up to 100% of your new home.

FAQ

Taxes, medical bills, rent, mortgage, college tuition, money orders, wire transfers, and risky investments should not be paid with a credit card. They will consume a large share of your credit and leave you with high interest to pay. Poor management of these expenses on your credit card can also hurt your credit score.

You should use your credit card for small expenses, which include:

- the repair of electronics and appliances;

- event tickets, especially those for events supported by your card issuer;

- inexpensive travel and hotel stays;

- car rentals;

- local and overseas purchases at grocery stores and supermarkets;

- online purchases at eCommerce stores;

- small utility bills.

You should not use your credit card for:

- taxes;

- rent;

- mortgage;

- impulse shopping;

- wire transfers;

- cash advances;

- medical bills;

- college fees;

- other high-cost expenses.

The expenses you can put on a credit card are generally small payments like repairs of electronics and appliances, event tickets, inexpensive travel and hotel stays, car rentals, local and overseas purchases at grocery stores and supermarkets, online purchases at eCommerce stores, and small utility bills.

Yes, you should pay your phone bill with your credit card if the service provider allows it. However, make sure to pay off the full balance on your credit card every month to avoid high-interest payments.

Yes, you should as long as the store accepts it. Besides, there are credit cards that offer cashback and other rewards for grocery purchases, such as Capital One (SavorOne Rewards Credit Card). But ensure that you are using your credit card for only things you can afford to repay in order to avoid running into debt and accumulating interest.

The most serious credit mistakes you should avoid include opening too many credit cards, late bill payments, keeping a high balance, taking out a cash advance, and not understanding your credit score. You can find more information about this here.

Credit card companies earn high interest when you pile up the debt. That is why you should limit your spending to an amount you can comfortably repay in full as every month passes.

Yes, you can, but that depends on whether the lender and merchant will accept it. Most lenders restrict their clients from making car loan payments with their credit cards. Those who occasionally accept this payment method charge a fee. Hence, they increase the total cost of the debt payments.

Conclusion

Not all purchases are suitable for a credit card, despite the fact that they offer a quick and safe way to manage transactions. Certain transactions that involve cash are subject to higher fees and interest rates when you charge them on your credit card. Additionally, if a personal loan offers you a clear payback time frame and a cheaper rate, use it instead of your credit card. Things that will take you many months or years to pay off should be better financed via alternatives to credit cards, as we have shown you in this article. Follow our guide and do your best to build a good credit score.