Mobile-Only Banks vs Traditional Banks: Which is better for you?

For a long time, customers accepted traditional banks' lack of technology. However, with the development of mobile banks, traditional banks are trying to stay up and provide clients with the innovation they desire. The question is whether it will be mobile banking vs traditional banks. Or will they be able to work together to create the financial services that modern customers require?

Introduction

In our day and age, a large number of people do most of their banking online. This is definitely a radical change as just 5 years ago we all still had to stand in line to get any banking operation done. Now people have banking on their mobile phones, tablets, computers and can get transactions made in a matter of seconds.

Online banking has always been around however thanks to the boom in the fintech industry the number of online and mobile banking users has doubled since 2012, according to recent data. The impact of the industry is so large that many traditional banks also created mobile and online versions for their users.

However, mobile and online banking was the first to provide their consumers with many online features such as same-day transfers, low fees on international transfers and many more! Traditional banks were very slow in adopting the online and mobile format of banking that seemed to be taking over the financial system.

Early fintech companies such as Paypal have established themselves as not only a good way for individual transactions but also a viable way for small, medium, and large businesses to receive payments for their goods and services.

Though traditional banks also provide their versions of online and mobile banking, Still, there are some big differences between traditional brick-and-mortar banks that offer online banking options and banks that are entirely web-based. Before we get into the differences between online banking and traditional banking. We have to explain some of the terminology: What is online banking? What is Mobile banking? Are they the same or two different things? Read on to get it all explained.

What is Online Banking?

Online banking means managing your bank accounts with a computer or mobile device. This includes transferring funds, depositing checks, and paying bills electronically.

Traditional banks and credit unions with branches typically let customers access their accounts via the internet, too. But online banks and providers offer primarily mobile access. You won’t meet a banker face to face, but with a mobile device or computer, you can reach your account anytime. Here's a closer look at online banks.

How Online Banking Works

Online banking is designed to be convenient, saving you time and letting you do banking on your own schedule rather than only during the hours your local bank branch is open. Almost anything you can do at a traditional bank or credit union location you can accomplish online, starting with opening an account.

Opening Accounts

You can open checking, savings, and other types of accounts online, often without the hassle of printing or physically signing anything. With electronic signature capability, the entire process might now take less than 10 minutes.

If you're a customer of a financial institution that offers online banking, you can register for online access through that institution's website. At a minimum, you'll usually need the following items to get started online.

Quick Verification

Personal information, such as your birth date, is used to authenticate your identity.

To create an account with an online-only bank or credit union with which you do not already have a relationship, you will need the same information, except for the bank account number. Additional ID verification, such as a driver's license, may be required.

Registration entails creating a login (often your email address) and password. After completing registration, you will be able to log in to your account and begin banking online using simply your internet-enabled device.

Paying Bills

Instead of writing checks to pay bills, your bank can print and mail them for you monthly. However, for more convenience, you can send money to a payee online, even if the amount you owe varies every month.

Transferring Funds

If you need to transfer funds from your checking account to your savings account, you can do it online. You may even link your accounts at various banks or send money to friends and family virtually quickly using your bank's person-to-person services.

Applying for Loans

Obtaining a loan is typically a time-consuming and paper-intensive procedure, but it does not have to be. Filling out your application online expedites the credit-check process, allowing your bank or credit union to react more promptly. Some financial institutions with online loan applications make cash available the same day you are accepted for a loan. Other lenders that operate solely online can make lending judgments in less than a second.

Depositing Checks

When someone pays you with a check, it's easy to deposit the check from home if you have a smartphone. Using a mobile check deposit, you snap a photo of the check through the mobile app of your bank and submit it for payment. There’s no need to mail the check.

Viewing Current and Past Transactions

Most credit unions and banks make it simple to check your available balance, confirm that your most recent transactions were successful, and examine prior monthly statements online. You should be able to search for transactions based on their time range and kind, such as a bank card payment.

Staying Informed

Another significant advantage of internet banking is the option to set up notifications. When your bank detects potentially fraudulent activity or your balance falls below a specific threshold, you can be notified by text or email. You can be alerted when deposited funds become accessible or when a check clears.

These notifications are useful for information, but they can also help you immediately halt illegal activity. For example, if you are alerted of a password change and you did not make that change, you may call your bank immediately and urge them to block the culprit from emptying your account.

What is Traditional Banking?

A traditional bank is a financial institution that provides banking and other financial services to individuals, businesses, and governments. Traditional banks are usually brick-and-mortar establishments located in a city or town. They are heavily regulated by the government, which imposes stringent requirements on how they operate their business. For example, traditional banks must meet minimum capitalization requirements as mandated by law to offer banking services to their customers. Banks are also required to file quarterly reports disclosing their assets and liabilities, as well as any transactions involving insiders (e.g., board members).

The pros of traditional banking

- In-person Visits

Face-to-face banking is still very popular around the world and is used to make important transactions such as cashing checks. Additionally, many customers are not comfortable giving out their financial information online and would rather do it in person with a teller.

- Security Concerns

With traditional banking, your money is safe even if a disaster happens at the bank. You can also be sure that hackers and fraudsters won't steal your identity or access your funds so long as you take the right precautions.

- Access to Loans

One of the major pros of traditional banking is that you're able to apply for loans through banks. They offer options like mortgages and personal loans that may be more convenient than going through private lenders. If you're looking to buy a house, this may be a great option since getting approved by a mortgage company requires less documentation than buying one privately. If you want to borrow money quickly or don't have enough equity in your home, however, private lending may work better.

- More financial products to choose from

Traditional banks usually carry more products than just credit cards and checking accounts. For example, some people enjoy investing in stocks and bonds but don't trust themselves to invest in the market because of how volatile it can be. Others prefer not to invest but simply enjoy earning interest on savings accounts. Banks provide plenty of ways for people to earn income from their hard-earned money

The Disadvantages of traditional banking

- Fees

If you're using a brick-and-mortar bank, the fees are going to be higher than if you use a mobile app. With a brick-and-mortar bank, they charge fees for withdrawals, overdrafts, and monthly service charges. Some banks will waive these fees if you have an account with them.

- Account opening may take a long time at traditional banks

Depending on how busy your branch is, it might take weeks for you to open up an account.

- You might have issues getting help at traditional banks

It can be hard to get help from customer service when things go wrong with a brick-and-mortar bank because customer service is only available during office hours and by phone.

- Access is limited (KYC/AML requirements are stricter)

When you want to make a withdrawal or deposit at a physical branch, you need to provide an ID before accessing any funds. For example, if I wanted to deposit money into my checking account in person but forgot my driver's license, I would not be able to access my funds without showing proper identification first.

- Opening an account requires additional documentation

When opening up an account in person with a traditional bank, often requires additional documentation such as photocopies of your passport and driver's license which might not always be easy or convenient.

Best Mobile banks

Understanding Mobile Banking

Mobile banking is very convenient in today’s digital age with many banks offering impressive apps. The ability to deposit a check, pay for merchandise, transfer money to a friend, or find an ATM instantly are reasons why people choose to use mobile banking. However, establishing a secure connection before logging into a mobile banking app is important, or else a client might risk personal information being compromised.

Mobile banking allows consumers to be able to access banking services from anywhere. Businesses and business owners are now able to save time by making use of mobile applications to process their payments or even receive funds from clients directly to their phone numbers. It is particularly popular among small to medium-sized enterprises (SMEs).

With mobile technology, banks are able to cut down on operational costs while still maintaining client satisfaction. The fact that any client of a bank can make use of their app to request a service, such as opening an account or even the ability to schedule debit orders or other payments from an application, allows for larger transactional volumes, eventually driving business growth.

Types of Mobile Banking Services

Mobile banking services can be categorized into the following

Account information access

Account information access allows clients to view their account balances and statements by requesting a mini account statement, review transactional and account history, keep track of their term deposits, review and view loan or card statements, access investment statements (equity or mutual funds), and for some institutions, management of insurance policies.Transactions

Transactional services enable clients to transfer funds to accounts at the same institution or other institutions, perform self-account transfers, pay third parties (such as bill payments), and make purchases in collaboration with other applications or prepaid service providers.Investments

Investment management services enable clients to manage their portfolios or get a real-time view of their investment portfolios (term deposits, etc.)Support services

Support services enable clients to check on the status of their requests for loan or credit facilities, follow up on their card requests and locate ATMs.

Advantages of mobile banking

Ask anyone, and they'll tell you how much they despise going to the bank to do something as simple as sending money to someone. Going to the bank isn't the issue here; it's the fact that it takes time to get there, and then you have to wait in line.

Busy schedules and a hectic lifestyle may not always allow for this. And the last thing you want to do amid a COVID-19 epidemic is stand in line. As a result, more and more individuals are realizing the benefits of mobile banking.

Here are some of the greatest benefits of mobile banking you should know:

- Easy to use

- Accessibility i.e., the ability to access your account on a mobile device whenever you want/need

- Saves time

- Convenient

- Cost-effective

- Higher security

Downsides of Mobile Banks

Deposits Can Be a Hassle

Adding money to your account without a physical location might be difficult. Depending on the bank, you may be able to mail deposits, wire transfers, or make deposits using your card. It appears straightforward enough, but if you prefer to deposit your check in person, internet banking may not be the ideal option.

Technological Challenges

Online banks build their websites to make navigating as simple as possible for their clients, but if you're not used to virtual banking, it may take some time to acclimate. If your bank decides to change or revamp its website, you may find yourself starting again the next time you log in.

Online banking has some distinct advantages over traditional banking, but it all boils down to your level of familiarity with the process. If you know your way around a computer and don't mind not being able to visit your local branch, it's time to make the move.

Mobile Bank vs Online Banks — What's the difference?

The use of a smartphone or tablet instead of a desktop computer to execute financial transactions, check balances, and access other services is referred to as mobile banking.

On the other hand, online banking refers to any banking transaction that may be completed via the internet. This is usually done using a desktop or laptop computer on the bank's official website under a private account.

Although they are not the same, internet and mobile banking allow you to access your account and utilize numerous services without having to visit the bank.

Another distinction between online and mobile banking is functionality. An internet connection is required to utilize online banking. Mobile banking does not necessarily necessitate an internet connection, since many banks allow customers to access certain services through text messaging.

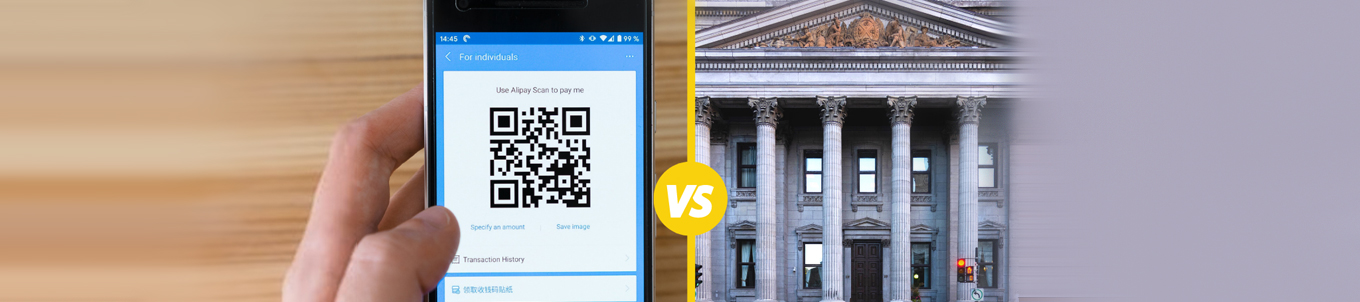

Mobile banks vs Traditional banks

In our time, we can see that many traditional banks provide a mobile app but when we say mobile banks we are talking about mobile-only banks with no physical locations. So, which is better you might ask? Well, that's a difficult question to answer as it heavily depends on what your needs are.

So with that in mind let's look at some of the differences between mobile banks and traditional banks. If you are looking for a one-stop shop for the best mobile banks and their reviews check AskWallet.io

Convenience

One of the biggest arguments for choosing a mobile bank over a traditional one is convenience. Take N26 for example, which has become a popular mobile bank for EU residents and citizens of the EEA. N26 provides its users with all the functions of a traditional bank all at the tip of their fingers and skips the hassle of waiting in line at a bank. With mobile banks like N26, users can get a virtual or physical card, there are no monthly fees and mid-market currency exchange rates.

Being able to have your bank in your pocket at any time is definitely a luxury that we have all come to expect from mobile banks. Another thing that makes mobile banks convenient is their person-2-person transactions. Imagine you are at a bar or dinner with friends, the bill comes and you all have to get each other's details to pay each other back. With mobile banks, this process is made easier and quicker with services like cash apps, PayPal, and Venmo.

Regulation

Every financial institution is regulated in some way or another to make it safe for people to use. But fintech is generally more lenient and flexible and banks are stricter.

Mobile Banks

Mobile banks don’t have one particular regulator. This is one reason why so many fintech startups have appeared. Without strict regulation, these companies can make changes to their business and do what they want without strict guidelines. While this makes it easier for fintech startups to work faster and adapt to their users’ needs, some consider it a risky industry. Depending on the country, authorities do regulate fintech businesses. And some companies choose to be more regulated or compliant, so their customers feel safer.

Traditional banks

Banks are regulated by national or central banks in their country of origin. The regulating bodies require banks to adhere to legal requirements, restrictions, and guidelines that are put in place to safeguard their people’s money. Banking regulations are used to ensure transparency between financial institutions and their customers.

Setting up an account

To open an account with one of the major high-street banks, you may need to schedule an appointment. You may also apply online by filling out a form. You will also need to supply verification, such as proof of address and your passport.

To open an account with a mobile-only bank, you'll nearly always need to download the company's smartphone app. You will usually be asked to prove your identification, which will entail producing your passport or driving license, as well as evidence of address. This makes opening an account with mobile banks a quicker and more streamlined process. You can apply from anywhere in the world as long as you have a mobile connection. However, with some mobile banks, the verification process might take a while, but usually, it takes 1-2 business days.

International Transfers

Our world is more connected than it has ever been. Many of us have family and friends scattered all around the world. Sending money abroad should be a headache when the only option was traditional banking options. With traditional banking, you would have to wait in line, pay exuberant fees, and do not forget about the exchange rates.

However, with mobile banks making international transfers have been made accessible to anyone. With a quick transfer, low fees, and mid-market exchange rates, users can send money to any corner of the world. Many mobile banks support international transfers to many countries however some countries do not have support. There are not a lot of countries that are not supported by mobile banks. But in such a case, traditional banks might be the only way you can get money to those countries.

Fees

One of the biggest downsides of traditional banking is all the different types of ways the banks charge you. At traditional banks, there is a fee for almost every transaction and they are significantly high. However, mobile banks provide the lowest fees you can find at any financial institution. Whether it is international transfers, monthly service fees, or card fees, mobile banks either have no fees or very low fees. That's one of the reasons why mobile banks and the fintech industry have gained popularity in recent years.

Interest Rates

One of the most significant benefits of internet banking is a small increase in interest rates on both checking and savings accounts. While most traditional banks now provide rates ranging from 0.10 per cent to 0.50 per cent, you may discover online checking and savings accounts with somewhat higher rates ranging from 0.9 percent to 1%. While it may not appear to be much, the rates provided by some of the best savings accounts may add up over time, especially if you have a large amount of money in your account.

Risk

While fintech is riskier, the rewards far exceed the dangers. The industry is regarded as risky because of the flexible nature of fintech laws. However, people continue to use it because it provides a quicker, less costly, more inventive, and user-friendly experience. As well as other services not available at regular banks.

Stricter restrictions, of course, result in a lesser risk, making conventional banks the safer alternative. However, leveraging financial technology is critical if you want to stay competitive, reach more people, and deliver a better customer experience. Just make sure you're utilizing a well-known and, if required, compatible software or service. For example, to guarantee that both merchant and customer data is securely handled in credit card transactions, our payment gateway must be PCI DSS certified.

24/7 banking

Banking online is easier than ever at an age when nearly everyone has access to the Internet, even when on the go. You may now access your account at any time, making money management a breeze, which is especially useful if you own a business.

The new generation of fintech businesses has made it simpler to connect and manage your financial life on additional platforms, such as mobile devices and custom-built applications, allowing you to communicate with clients around the clock. Nowadays, internet banking is more than just monitoring your balance and paying bills; you may also receive payments from clients. And, thanks to Open Banking, you can do it all while maintaining your regular bank account.

FAQ

- People who don’t want to go into a bank or ATM to do their banking: If you’re busy, on the go, or just not that comfortable with traditional banks and ATMs, mobile-only banks might be your best option. The biggest drawback is that you won’t have any access to tellers and branch locations—so if you have questions about your account, you won't be able to talk with an actual person face-to-face.

- People who don’t use banks often: If you only need checking and savings accounts occasionally—for example, for paying bills online—mobile-only banks can save you money on monthly fees because they charge lower rates than traditional banks for people with low balances.

- People who want to save money on fees: If you don’t need access to a branch or teller, mobile-only banks can be less expensive than traditional banks—especially if you have a low balance and don’t use your account often.

- People who are comfortable with technology: If you're comfortable using online banking and other digital tools, mobile-only banks might be a good fit for you because they're designed around those tools and make it easy to do everything from managing your accounts to paying bills online.

- People who want more control over their finances: If you like to track your spending, mobile-only banks can be a good option because they make it easy to see and manage your accounts online or through a mobile app.

- Young people with limited income or credit history who can’t get approved for traditional accounts: If you don't have a lot of money to deposit in an account, and you don't have a long credit history, mobile-only banks are a good option because they often don't require any minimum balance or credit check.

- Travellers with temporary visas that don’t allow them to open traditional bank accounts in other countries (especially useful if you travel often): If you're on a visa and can't get a traditional bank account, mobile-only banks are an option for managing your money while travelling.

- For those who want to advantage of checking and savings accounts that are free, along with unlimited check writing

If you’re more concerned with convenience than cost, stick with what you know. And if there’s any chance that your account may get into serious debt (because there are high fees associated with overdrafts), traditional banks are much more forgiving than mobile-only ones they might even save your finances from ruin. Additionally, if you tend to keep large balances in checking and require debit cards for regular purchases and ATM withdrawals, then choose a traditional bank. That way, you can avoid monthly maintenance fees.

- For those who need a little hand-holding:

If you’re not ready to navigate your account, stick with what you know—with a traditional bank. A mobile-only bank may work for digitally savvy young people, but it can be a difficult transition for older generations, especially those who haven’t done much online banking. For example, it's rare that a mobile-only bank provides free personal checks or cashier's checks (which banks issue as proof of payment) because they don't offer physical branches to make them for you. In fact, most mobile-only banks don't have any physical locations at all and tend to not allow personal bankers to give face-to-face advice on their accounts.

- For Those who need to bank for large businesses:

If you run a large business, then choose a traditional bank—not a mobile-only one. Mobile-only banks aren’t meant for companies that have multiple locations or employees and typically don’t offer products like business checking accounts or merchant services. Additionally, if you have any tax liabilities from your business, traditional banks are much better equipped to handle them than their mobile counterparts. This is because most traditional banks offer online banking and bill pay, which makes it easy to manage your personal and business finances together—especially when it comes time to file taxes at year's end.

Online and brick-and-mortar bank accounts have the same guarantees; they are both insured by FDIC insurance. Both also use cryptography to safeguard users' personal information, but there are other differences you may want to consider before deciding which type of account best fits your needs.

There are a number of different reasons that customers switch to mobile banking, but the most common is the ability to access their funds on their own time. With traditional banks, customers have to wait for hours or days for transactions to go through, which can cause serious problems when you need money fast. This is why many people prefer mobile banking because it allows them to get their money as soon as they need it.

Online banks know that people are always looking for ways to save money where they can, so they offer much higher interest rates than most traditional brick-and-mortar banks in order to attract new customers. But because online-only banks don't have the high cost of maintaining physical branches--which means they also don't need any employees there--they're able to offer their services at a lower price than what you'll find at many regular bank locations.

Online banking has a number of risks associated with it. The first and foremost risk is that hackers can steal your identity and access your account. This can lead to all sorts of problems, such as fraudulently taking out loans in your name or being issued an incorrect tax return. The second risk is that cyber-criminals can gain access to your computer or smartphone, which could lead to confidential information like social security numbers being stolen.