Celsius: Restructuring or Bankruptcy?

On June 12, 2022, cryptocurrency lender Celsius Network froze customer withdrawals, claiming it was due to "extreme market conditions." One month later, the company filed for Chapter 11 bankruptcy in the Southern District Bankruptcy Court in New York, United States of America.

Is Celsius trustworthy? Will the company recover from this unfortunate circumstance? Or Celsius is simply substituting concepts by calling bankruptcy a restructuring?

In this article, we will give you the main details of the bankruptcy of Celsius and answer some pertinent questions. We will tell you what led to its fall, why it chose Chapter 11 as the way forward, and what the future of this company will most likely be.

What Did Celsius Do Wrong?

The major problem with Celsius is in the strategy it has been using to attract many customers to itself—its high-interest rate. Offering an annual percentage yield (APY) of almost 20% is an unsustainable marketing strategy, according to many expert analysts. Meanwhile, there are claims that Celsius was operating like a Ponzi scheme, robbing Peter to pay Paul.

Furthermore, Celsius invested in other platforms that, like it, provide very high returns. In that way, the company wanted to ensure that its model of doing business could generate sufficient funds to continue operations and pay debts without difficulties. For example, according to a report by The Block on May 13, 2022, Celsius had invested over $500 million in Anchor Protocol, another crypto-lending platform that offers up to 19.5% in interest. Unfortunately, this service belongs to a stablecoin project called TerraUSD (UST), which collapsed recently. Nonetheless, Celsius was able to pull out half a billion US dollars from Anchor amidst the crash.

According to Nik Bhatia, an adjunct professor of Business Economics and Finance at the University of Southern California who is also the founder of The Bitcoin Layer, companies like Celsius and Anchor always have to source for high rewards, and that makes them move their assets to instruments that are risky and impossible to safeguard. He also added, "When the assets go down in price... the liability remains... poor risk models."

Therefore, a high-interest rate does not always mean a safe investment opportunity.

Breakdown of Celsius’ Bad Debt

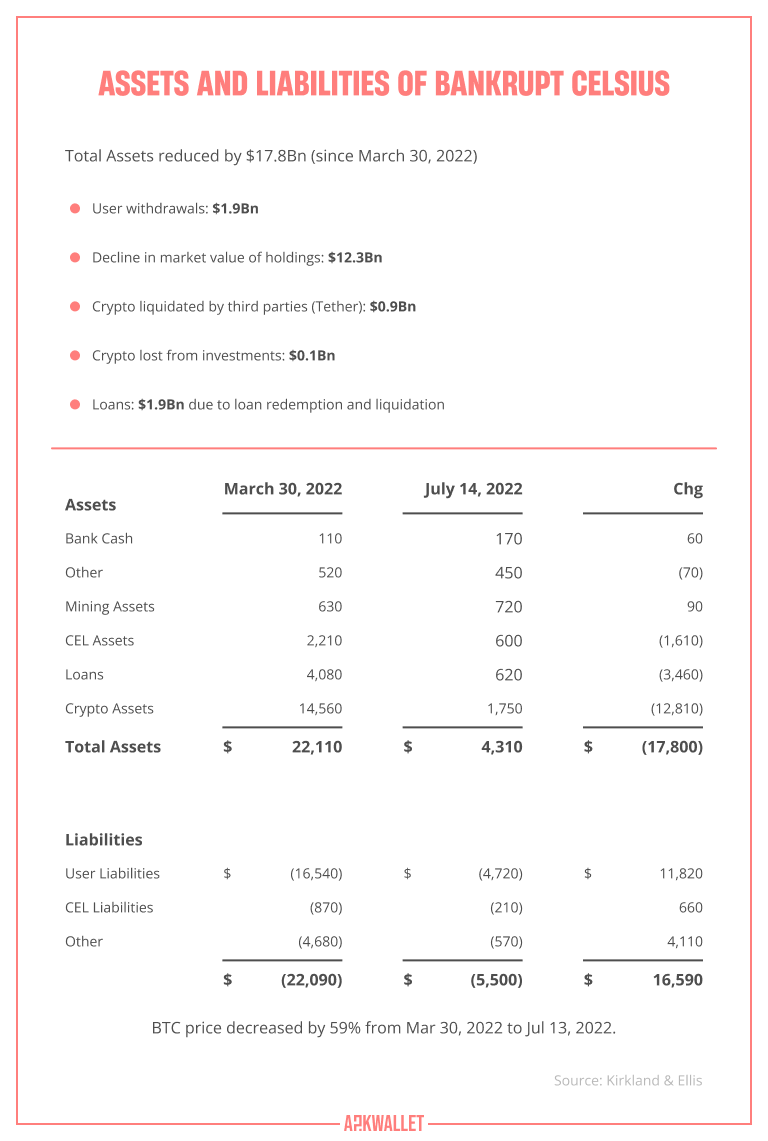

Is Celsius insolvent? Yes! Based on the set of documents that the company’s law firm, Kirkland and Ellis, filed with the United States Bankruptcy Court for the Southern District of New York, Celsius is now deeply bankrupt. The company claimed that the collapse in cryptocurrency prices, which reduced their assets by $12.3 billion, was mostly to blame for the fall. It described the present market conditions as “extreme.”

The company's holdings of digital assets dropped from $14.6 billion at the end of March to just $1.7 billion as of July 14, 2022. The filings also reveal that Celsius owes its customers $4.7 billion, or nearly three times as much as the company has in digital assets.

The remaining assets of Celsius are restricted to mining equipment ($720 million), unpaid debts ($620 million), and other assets ($450 million), plus approximately $170 million in bank cash. The records also apparently account for CEL tokens valued at $600 million, which is much more than the coin's overall market valuation.

Up until June 12, when the firm stopped allowing withdrawals, users withdrew $1.9 billion from their accounts, making up a significant part of the remaining losses. The firm's assets were further decreased by $1.9 billion by loan redemptions and liquidations.

The company suffered an extra $900 million in losses when Tether liquidated the loan it had made to Celsius. Tether is the creator of the biggest stablecoin on the market, USDT, and an investor in Celsius.

Additionally, the company lost $100 million on investments.

Can Celsius Mining Help?

There are indications that a significant portion of Celsius' strategy to recover its losses relies on the anticipated future earnings of its fully owned but uncompleted mining subsidiary, Celsius Mining. It was during the court hearing on Monday, which was July 18, 2022, that the company gave this hint. But Celsius Mining is another debtor. Should the parent company now depend on it?

So, on Monday, Celsius' attorneys requested that the court authorise spending of more than $5 million to complete the building of the Texas mining centre (which they estimated would take about two more months) and to pay tariffs on mining rigs that are "currently hanging with the customs officials."

Although the request was given interim approval by Judge Martin Glenn of the U.S. Bankruptcy Court for the Southern District of New York, the final decision will be made by the U.S. Trustee, which is a division of the Department of Justice that is in charge of managing bankruptcy cases.

Shara Cornell, an attorney with the U.S. Trustee Program, expressed her worries over the feasibility of Celsius' Mining at the hearing on Monday. She told the judge that, in her opinion, the mining company is not ready for use at present but has cost the debtor a sizable sum of money. In her opinion, construction might not be a good option for now. She suggested liquidating it.

In response, Celsius' lawyers asserted that their client already operated more than 43,000 mining rigs and that it planned to increase that number to 112,000 "sometime in Q2 of 2023." According to Pat Nash, the lead lawyer for Celsius, the mining subsidiary was anticipated to mine 10,100 bitcoins in 2022 and was now mining 14.2 bitcoins per day.

Chapter 11: Is it Important for Celsius Bankruptcy?

Is the Chapter Celsius Chose to File for Bankruptcy Important?

Companies frequently file for Chapter 7 or Chapter 11 bankruptcy in the United States. These chapters are taken from the US Bankruptcy Code. However, in this case, Celsius found reasons to file for bankruptcy under Chapter 11 rather than Chapter 7.

Another name for Chapter 7 bankruptcy is "liquidation" bankruptcy. This means that when a company declares bankruptcy under Chapter 7, they have long since passed the "reorganisation" stage, and its only option for paying off debts and other obligations is to sell its assets to raise cash. It effectively indicates that the company is no longer a going concern, and as a result, the bankruptcy court will name a trustee to ensure that the creditors are paid off in order of absolute priority when the money from selling assets is gathered. In this kind of bankruptcy filing, secured debt has a higher priority than unsecured debt.

Chapter 11 bankruptcy, which is typically more involved and expensive, is also known as "rehabilitation bankruptcy" in other places. It provides the business owner(s) with a second chance to settle their debts and relaunch the company. This process entails the business owner and creditors coming to an agreement that has been approved by the court to resume operations, restructure the debt, renegotiate fees, implement proactive cost-cutting measures, and take other required steps to stabilise the business condition.

In addition, when a firm files for bankruptcy under Chapter 11, the debt is structured differently instead of being entirely absolved. Therefore, a plan must be developed to repay it with earnings in the future.

Also, in both Chapter 7 and Chapter 11 bankruptcy, the company is required to appoint a trustee. However, while the trustee is expected to work towards selling the assets of the company and returning cash to the creditors based on absolute priority, Chapter 11 requires the trustee to supervise affairs in a way that permits the company to remain in existence.

Why Did Celsius File Chapter 11?

Celsius recently made loan repayments to some companies, including a Swiss-based technology company called AAVE, MakerDAO, and Compound. The total amount paid is over $900 million. Moreover, the company has almost $170 million in cash and short-term investments. Hence, if it can create a good plan for restructuring using what it has left, the company has a chance to become successful again. That was why Celsius filed for Chapter 11 bankruptcy because it offers a second chance to do business, unlike Chapter 7, which does not.

Will Celsius’ Retail Customers Suffer?

During the court session, Pat Nash said that Celsius has nearly half a million depositors, including 300,000 that own crypto worth over $100 each in their accounts. What is the hope of these customers in this situation?

Celsius’ retail customers will almost likely be the last to receive money back when the company starts to pay off its $5.5 billion in liabilities. Recall that $4.7 billion of this amount represents consumer holdings. There may not even be any money left by that point.

Moreover, the accuracy of Celsius's promise that it will mine 10,100 bitcoins this year is difficult to verify. Even if the company succeeds, it can only earn about $225 million at current market prices. This amount will not be enough to make Celsius solvent.

Who Will Get Their Money Back?

According to the bankruptcy petition, Celsius has more than 100,000 creditors, some of which provided unsecured loans to the platform. Alameda Research, the trading firm of Sam Bankman-Fried, and a Cayman Islands-based investment firm are among the list of the top 50 lenders that gave cash to Celsius without collateral. So, if there is anything to be taken, those creditors will probably be first in line to receive their money, leaving others to suffer.

Bankruptcy Can be a Complex Process

In May, when the TerraUSD (UST) stablecoin and associated Luna token crashed, Celsius hurried to remove its money from Terra's Anchor Protocol, which gave 20 percent interest on UST deposits. Recently, it suffered because another significant holding, ETH or stETH (linked to Ether's market value), became generally illiquid and much more widely undervalued than Ether.

What and how much will be recovered by Celsius' customers remains an uncertainty. The status of its users’ digital assets in the event of insolvency is "unsettled" and "not guaranteed." The company clearly stated this in its terms of service.

Besides, bankruptcy processes can be time-consuming. For example, the creditors of Mt. Gox are yet to be reimbursed their money in full after it went into insolvency, lost its status as the world's largest Bitcoin exchange, and shut down in 2014.

In another example, the founders of 3AC, which is a recently bankrupt crypto hedge fund, have gone missing. In other words, the whereabouts of Zhu Su and Kyle Davies could not be ascertained as of the time of filing the case on July 12, 2022. Meanwhile, the founders had allegedly not yet started meaningful work on the liquidation process.

Nevertheless, there are some good examples of successful bankruptcy recoveries in the FinTech industry and other globally influential sectors. We are referring to some companies that have gone through the same Chapter 11 bankruptcy filed by Celsius and come back stronger. A few examples are Delta, American Airlines, and General Motors.

In the case of Delta Airlines, the company filed for Chapter 11 in September 2005. It made the request after it was forced into bankruptcy due to a $19 billion debt and losses worth $7.5 billion since 2001. Upon getting official approval to proceed, the company cut down its labour costs by approximately $1 billion and slashed its capacity in the tough domestic US market. Furthermore, in line with its $3 billion plan for a turnaround, the company boosted its services to markets in the Middle East and Latin America. Through this strategy, Delta successfully came out of bankruptcy within two years.

Next Steps for Celsius

On August 10, a remote hearing for the second chapter of Celsius' bankruptcy case would take place. In the meantime, the U.S. Trustee is forming and appointing a committee of creditors. These committees, which are normally composed of the debtor's top seven unsecured creditors, will assist the court in creating a debt restructuring strategy by monitoring the bankruptcy proceedings, looking into the debtor's behaviour and business practices, and overseeing the bankruptcy process.

The Bottom Line

Today, we cannot tell what the final ruling on Celsius’ bankruptcy will be. But the company is hopeful that it can restructure and return fully to its business if granted Chapter 11 bankruptcy.

Besides, following a PWC report, there was a 35% compound annual growth rate (CAGR) of new fintech unicorns from 2016 to 2021, when the number increased from 36 to 159. Assuming business managers are to work with historical patterns, an industrial crisis is usually followed by a boom. Hence, even though many companies like Celsius, TerraUSD, and 3AC are collapsing today, some experts are optimistic that the fintech industry will thrive again when this "extreme" season is over.

FAQ

Yes! On Wednesday, July 13, 2022, the Southern District Court of New York received a Chapter 11 bankruptcy filing from the cash-strapped cryptocurrency lender Celsius Network. This happened some weeks after it stopped accepting customer withdrawals due to what it described as "extreme market conditions."

Before the company’s bankruptcy, Celsius was a licensed and fully regulated financial institution. This implies that the company must have been adhering to the highest standards of security and compliance.

Celsius is a company that lends cryptocurrencies. It is a SEC-compliant lending platform that allows customers to get interest on crypto deposits or take out loans with crypto assets as collateral.

Alex Mashinsky and S. Daniel Leon co-founded Celsius. According to the company website, the duo came up with the concept for Celsius in the summer of 2017. Less than a year later, in March 2018, they announced the company's initial coin offering of their CEL cryptocurrency.

Hopefully, yes! Celsius has plans for its recovery. That was why the company filed for Chapter 11 of the US Bankruptcy Code, which gives a second chance for a company to reorganise its affairs when it goes insolvent.

Yes, Celsius files tax returns with the IRS. The IRS always receives a duplicate of any Form 1099 you get from Celsius.

The cryptocurrency company Celsius makes money through lending coins to institutional investors, hedge funds, and exchanges, as well as by making asset-backed loans with an average interest rate of 9%.