Best Cards for Weddings and Honeymoons

Weddings and honeymoons can be joyous occasions, but they can also be expensive. However, finding the appropriate credit card might help you accumulate points and rewards that will make it easier to prepare for your big day.

Besides, it makes no difference whether you are planning a simple wedding at home or a lavish honeymoon abroad; there is a credit card that can help you with the costs. There are cards with various rewards and perks, including many that offer generous bonuses and those with 0% introductory APR.

Continue reading for the latest information about choosing and using the best credit cards for weddings and honeymoons.

Tips for Choosing a Credit Card for Weddings and Honeymoons

Consider a card that includes several rewards and perks while planning the purchases you need to make before or during your wedding and honeymoon.

So, here are our tips for choosing a credit card that will perfectly serve both purposes:

- Ensure that it offers an attractive welcome bonus that can ease your cost of purchases.

- Go for a card that can give you cashback on the amount you spend shopping.

- Look for the one that comes with travel insurance so that there will be no need to buy an additional insurance policy.

- If possible, try to get a credit card that offers airport lounge access, air miles, and many other travel rewards to give you and your spouse a fabulous honeymoon experience.

How to Use Travel Rewards for a Cheaper Honeymoon

There are a few things to keep in mind if you intend to use a travel credit card to pay for your honeymoon, redeem miles or earn points to offset your expenses. They are as follows:

Plan your honeymoon early

You should have some time to prepare for your honeymoon unless you choose to be married all of a sudden. Otherwise, before booking your tickets, figure out how many miles or points you will need.

Look at your available options to choose which card will get you the closest to your goal before the big day arrives. It could be possible to close the deficit by applying for a credit card that offers bonus miles of up to 50,000.

Compare the options for redemption

Redeeming certain cards is simple. In such cases, you effortlessly use your miles as a statement credit. As easy as this sounds, you may profit more from transferring your miles or points into your preferred hotel rewards or frequent flyer programme. In that case, you need to search for a card that allows you to make the transfer. Just be sure that transferring the points will not reduce their worth.

Know the blackout dates

See if your travel credit card has any restrictions on when you can use your points. If you cannot use your mileage when you need them, then do not accumulate thousands of kilometres.

The same rule applies when you are using the travel programme of an airline or hotel. By doing so, you will be sure of boarding when the time comes.

Watch the fees

It costs money to obtain premium rewards for a wedding or honeymoon trip. In order to avoid paying the fee the first year, seek credit cards with a low annual fee or grace periods.

A credit card with a high annual fee would not be worth getting if you intended to use it to pay for just your honeymoon vacation.

Check for additional benefits

A travel rewards card can have other benefits than earning points or miles. In that case, you may be able to save extra money on your honeymoon. For instance, some cards provide savings on things like entertainment and recreational activities or the option to upgrade your hotel at no additional cost. Some cards offer travel accident insurance or lost luggage insurance should something go wrong during your journey. Keep an eye out for them.

Best Credit Cards for Weddings and Honeymoons

You can have your wedding or honeymoon at your present location or go to a faraway destination where you may have to book hotel accommodation. Irrespective of your choice, here are our best picks of credit cards for financing small to large expenses.

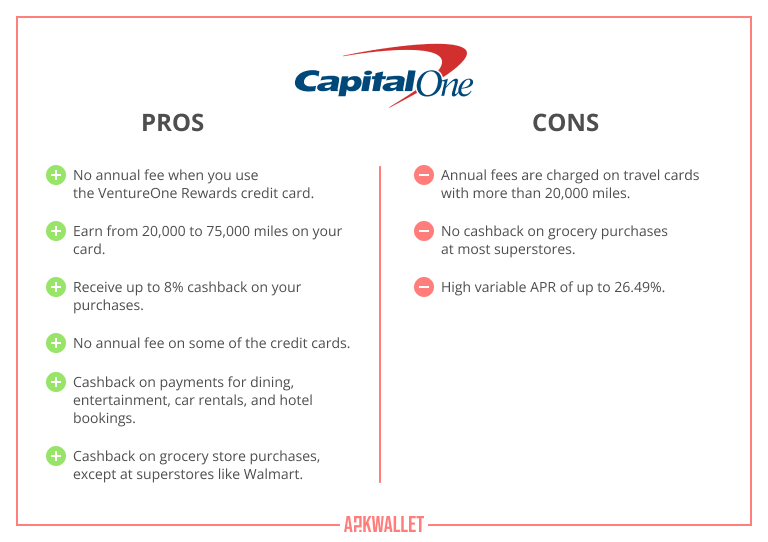

Capital One

Card Summary

Capital One offers unlimited credit card rewards that you can take advantage of for your wedding and honeymoon. They include earning as much as 75,000 miles and about 5% cashback on every purchase when you use any of the Venture series or Quicksilver credit cards, respectively. When you are ready to redeem them, you can spend your Capital One rewards on almost anything, including dining and entertainment. Simply log in to your account using its mobile banking app or website.

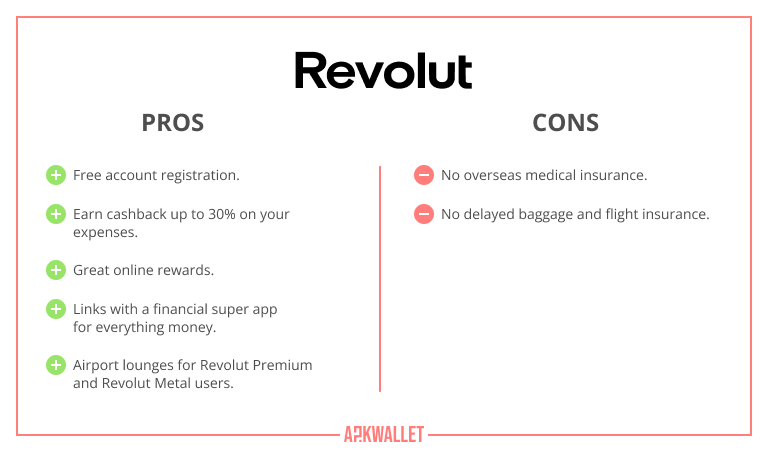

Revolut

Card Summary

Revolut offers credit cards that you can use to make purchases. You will receive discounts and up to 30% cashback offers from your favourite companies when you spend on your Revolut Reward card. The cashback reward package can cover expenses on weddings, honeymoons, holidays, taxis, groceries, coffee, and pizza.

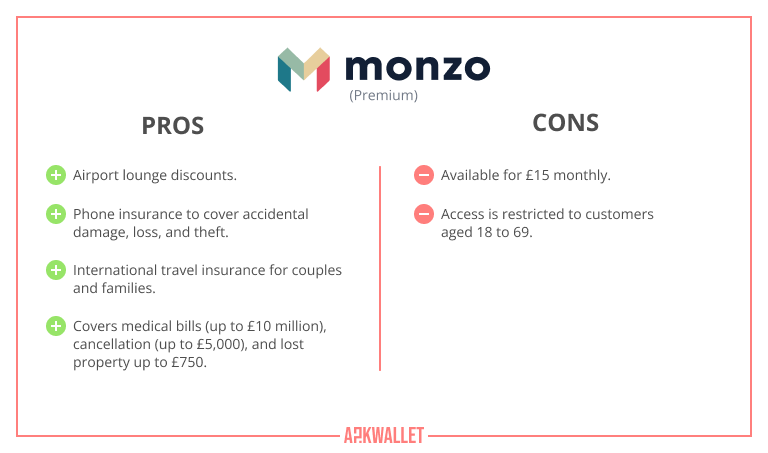

Monzo (Premium)

Card Summary

With their Premium credit cards, Monzo grabs attention while providing a host of reassuring features. They range from cashback to airport lounge access. You can use the cards in more than 200 countries where Mastercard cards are accepted. Monzo Premium is a reliable option for financing weddings and honeymoons.

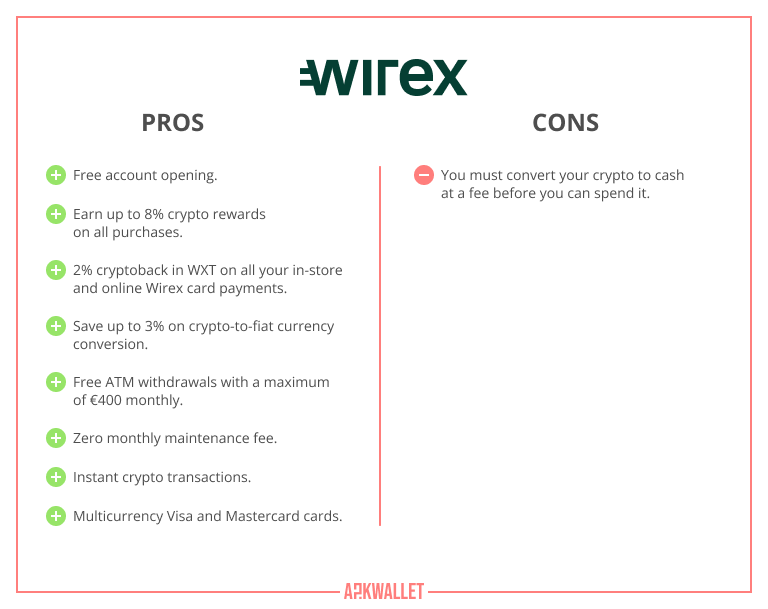

Wirex

Card Summary

Do you have a cryptocurrency account with an exchange or crypto-friendly bank? One of the best digital payment platforms for spending digital tokens like WXT is Wirex. It offers a multicurrency card that comes with 8% cryptocurrency rewards (cryptoback) on all your expenses. Create a Wirex account today and enjoy all it has to offer couples who are seeking ways to fund their weddings and honeymoons.

W1TTY

Card Summary

Couples who are planning their weddings and honeymoons can earn more on their purchases with the help of W1TTY's tools. How? W1TTY combines customised finance with a spending tracker, personalised Visa cards, cashback, and frequent incentives.

Monese (Avios)

Card Summary

The Avios product line from Monese is good for lovers who want to have memorable and pleasant weddings and honeymoons. If you are a participant in the British Airways Executive Club or the Vueling Club, then create a Monese account today to receive attractive rewards on your travels. By doing so, you can link Avios to your Monese app to keep track of the points you earn when shopping at selected stores.

Four Alternative Ways to Finance Your Weddings and Honeymoons

Not everyone likes to use credit cards for reasons ranging from overspending to fraud risks. So, aside from using a credit card and getting rewards like travel miles, we offer four other ways you can fund your wedding and honeymoon.

Personal loan

A personal loan, as opposed to a credit card, would have a number of benefits for you, such as providing the whole amount you require upfront and requiring you to repay the entire amount by the term's conclusion. So, with personal loans, you can pay upfront for your wedding expenses and repay the bill in six to sixty months.

Family and friends

Instead of getting a loan, you can ask your family and friends to financially support your wedding and send them your bank account details. Depending on their financial status and willingness to help you, the amount you might get from them may be enough to cover more than half your planned expenses. You can then complete the rest from your savings or any other fundraising option available to you.

Crowdfunding

There are several crowdfunding payment gateways that you can use to raise money for your wedding or honeymoon. They allow you to ask a large number of people for support. You might even raise an amount that your family and friends may not have been able to provide. Examples of powerful and simple platforms for funding your wedding and honeymoon are Honeyfund and GoFundMe. Expect to pay a small fee for using such payment services.

Personal savings

Many couples have sponsored their weddings and honeymoons through their personal savings. You can do likewise. It is arguably the best way to go since you would not have to owe anyone any debt or fees. All it requires is that you open a savings account and deposit funds every month for anticipated expenses.

So, if your wedding is at least a year away, you may split the entire cost by the number of months you have left and commit to a monthly savings plan. You may also want to consider using personal budgeting apps alongside.

FAQ

Yes, you can. There are credit cards that reward users with cashback, travel insurance, and miles on their purchases. You can use them to your advantage when making payments in view of your wedding.

Newlyweds like to spend quality time together somewhere far away from home. Therefore, the best credit card for newlyweds is one that comes with travel benefits and cashback on purchases. The best options include Capital One, Revolut, and Monzo.

Having your spouse as an authorised user on your credit card comes with some pros and cons.

On the one hand, you will enjoy several benefits that include sharing a bill, splitting the fees, and earning more rewards from more spending.

On the other hand, you will have to cope with several disadvantages, which include: paying for charges you did not make yourself; occasional disagreements over payments made on the card and the spending habits of your spouse; and difficulty in managing the card after a breakup or divorce.

It may be better for you to use alternative sources of funds, such as personal loans, crowdfunding platforms, and cash gifts from family and friends, instead of opening a credit card. In that way, you will avoid credit card interest and debt.

However, you may feel at ease using a credit card to pay for some wedding expenses if you have a strategy for paying it off. Be sure that you have the money to manage it.

Yes, you can. The most important thing is to have saved up enough to pay off your balance before the interest sets in. Otherwise, this will not be a good idea.

Conclusion

It might be costly to organise a wedding. So, get the most out of every purchase you make by charging it to a credit card that offers rewards points and other attractive benefits. After that, use your cashback experience, points and miles to organise a beautiful honeymoon.

Above all, remember that the benefits of using credit cards depend on your ability to make monthly payments in full. If you are not making your bill payments on time, the interest can quickly exceed whatever benefits you could get.

If you find it challenging to use a credit card without making mistakes, try any of the alternative options mentioned in this article.