Stripe: Financial infrastructure platform your business needs

What is Stripe?

Stripe helps small, medium and big online businesses to have reliable online payment infrastructures. Its wide range of products power payments for online and in-person retail stores, subscription businesses, software platforms and marketplaces, and all that is in-between. Stripe helps companies to manage business expenditures, issue virtual and physical cards, send invoices, get financing, prevent fraud, and a lot more. It provides all that you need to securely accept payments and reliably send payouts worldwide. Business owners can create a full payment page without knowing the code in just a few clicks. The link can be shared with their customers immediately. Amazon, Google, Zoom, Shopify, Slack, and Salesforce are some of the companies that use Stripe’s software and APIs to accept, send, and manage their online payments. Stripe was founded in 2010 in California, United States. Nowadays it operates in more than 45 countries being managed from two global headquarters in Dublin and San Francisco. Stripe supports over 135 currencies and many payment methods.

It is better to use software developers when you want to build a custom payment platform for your business. When setting up Stripe, developers use relatively simple instructions to apply building blocks (that is, APIs) on the websites or in the apps of small to large business establishments.

However, most small business owners, who do not want to build a custom payment system, avoid paying for the service of a developer by using “Stripe Checkout”. This is achieved by integrating Stripe into their online store or through the use of third-party invoicing software. A simple way to use Stripe to activate a basic checkout on your website is to copy and paste the necessary line of code into it.

Pros

- No monthly fees

- Highly customizable payment gateway

- Transparent pricing and flat rates

- Offers P2P exchange with a crypto wallet

- Supports 135+ currencies and many countries

- Supports many payment methods

- Offers exceptional tools for managing subscriptions and billing

- 24/7 customer support

- Fast and easy set-up

Cons

- Occasional issues with account stability

- Software development expertise is required to use its Open APIs

Pricing

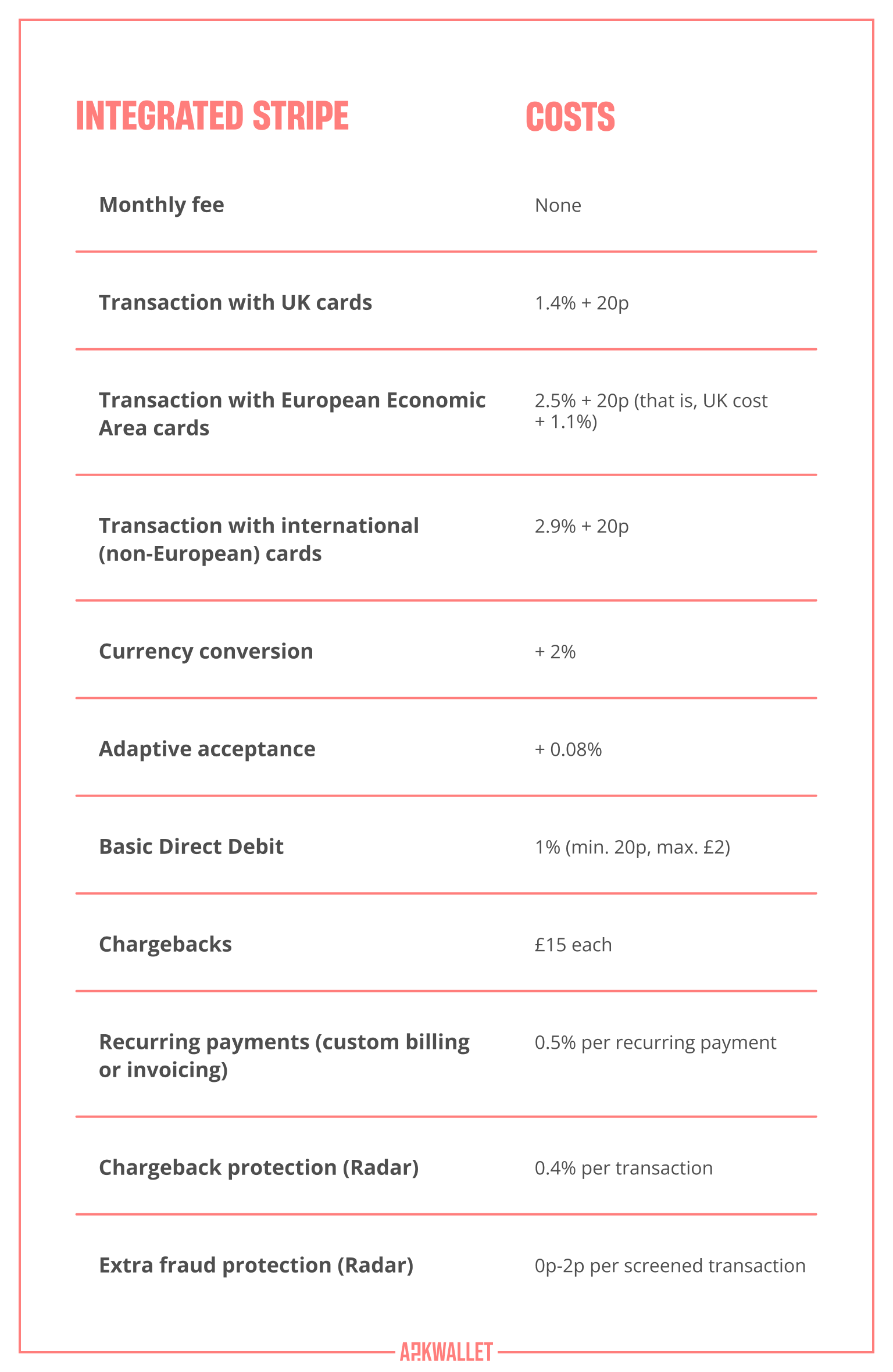

When it comes to service price, Stripe has two options for you: Customised Stripe and Integrated Stripe. The former is ideal for businesses that have a large volume of payments, high-value transactions, or a unique business model, while the latter is a good option for any type of business (including E-commerce, subscription, SaaS platforms, or marketplaces) that needs a complete payments platform and want to get started to manage payments in minutes.

There are no monthly fees, setup fees, or contractual commitment charges for the integrated price offer. Only the following pay-as-you-go charges, which are based on the payments you process, apply to this plan:

The transaction rates above apply to all Mastercard, Visa, Maestro, American Express, Apple Pay, and Google Pay payments.

Note: For Customised Stripe, which can allow you to design a personalised package for your business with a large volume of payments, contact Stripe’ssales team.

Features

Stripe features refer to its products and services. They include Stripe Payments, Stripe Corporate Card, Stripe Billing, Stripe Radar, Stipe Sigma, Stripe Connect, Stripe Climate, Stripe Tax, Stripe Atlas, Stripe Revenue Recognition, and several others. These are various tools through which Stripe helps businesses to

- accept payments via credit cards, secure vaults, e-wallets, mobile apps, and in-person checkouts, as well as make currency conversions and send money worldwide (Stripe Payments);

- manage subscriptions, invoicing and end-to-end billing (Stripe Billing and Stripe Invoicing);

- develop carbon removal technologies (Stripe Climate);

- avoid numerous fees, lengthy paperwork, and legal complexity in the process of launching their start-ups (Stripe Atlas) – a service provided at a one-off cost of $500;

- set up advanced fraud prevention systems using artificial intelligence and machine learning (Stripe Radar);

- and analyse complex data (Stripe Sigma), to mention a few.

In terms of speed, when you begin processing real payments from your clients with Stripe, you will often not get your first reimbursement until 7–14 days following your first successful payment. The initial payout may take longer than expected due to a variety of factors, which could include your country of residence or being in a high-risk business. But once you're setting it up, payouts can arrive in your bank account on a 2-day rolling basis. Or you can opt to receive payouts weekly or monthly.

Setting up

If you intend to use Stripe to create your custom payment solution, be ready to use the vast programming documentation available online. These guidelines cover various APIs and infrastructures. So, it will be helpful for your developer to set up Stripe on your online platform.

Nonetheless, there are other ways to set up Stripe. For instance, through e-commerce platforms such as Wix, BigCommerce, and Squarespace, you can create an account with Stripe and link it with your online store easily.

Another option is to use Shopify, which does not require having a separate Stripe account because Stripe powers it. The Shopify Payments system helps you to accept card payments online and create convenient checkouts. It saves you the stress of setting up Stripe or any other third-party payment service provider. However, this option is not available for users in the UK.

Reviews & support

There are only two ways to contact the customer support team of Stripe – via phone or chat and email, which are available 24/7. Most issues will take very little time to resolve, but some may require the intervention of specialists or individual departments.

The following are some of the popular user feedback or reviews you can find about Stripe online:

Recommendations:

- Stripe is a brilliant platform with a fantastic app.

- Good service and documentation.

- An amazing system with the best services.

- Comprehensive guides for developers.

Complaints:

- Stripe payouts are slow.

- Matching payouts with customer payments can be problematic.

- Stripe closes accounts suddenly and withholds the funds.

- Sends so many worthless and irritating text messages.

How Stripe stacks up

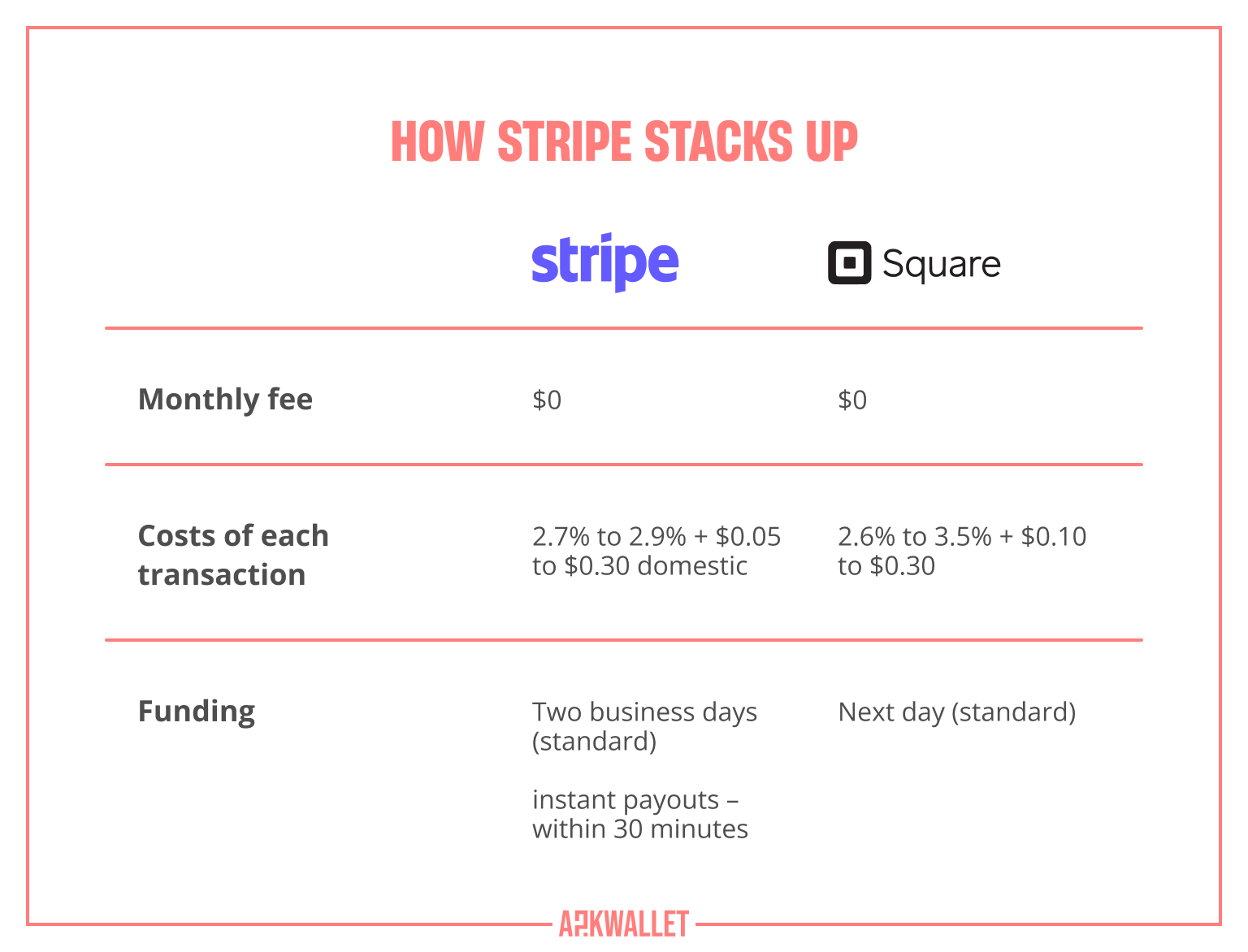

Stripe is not the only provider of payment gateway services today, but it claims to be the most powerful because of its rich features. Since there are other competitors, we would advise you to make a comparison of the leading options available to you before making a choice. To show you an example of how to compare them, in the United States, let us see how Stripe stacks up with Square and Payment Depot, which are also leaders in the industry.

So, on the one hand, the pricing of Stripe and Square are a bit similar, although Square is more expensive with some transactions. Still, Square has a competitive edge over Stripe in that it offers standard next-day funding for all accounts.

Payment Depot, on the other hand, offers a very different price structure than Stripe, with low per-transaction expenses and high monthly fees. Square is therefore more beneficial for a business that conducts a large volume of transactions.

Is Stripe right for your business?

You may consider Stripe to build a powerful payment gateway for your online business. This is because as of 2022, Stripe supports over 135 currencies, thereby making it easy for you to let millions of customers pay for your products and services in their domestic currencies. Besides, it is currently available in 47 countries, including many in Europe, Asia, and America. If you are not in these parts of the world, with Stripe Atlas service, you can incorporate a company easily in the United States, set up a US bank account, and start using Stripe from your location.

But Stripe goes beyond payments processing and offers business management features, like Radar to mitigate fraud as well as Stripe Invoicing and Billing.

Who should use Stripe payments?

Ideally, you should use Stripe for your business if you:

- Make most of your sales online.

- Want to accept payments from customers around the world.

- Want your customers to be able to use many payment methods, including digital wallets, bank transfers, cards, checks, SEPA direct debit, and several others.

Countries

Stripe is available in 47 countries, including the United Kingdom, Germany, Romania, France, Switzerland, Australia, Latvia, Belgium, Lithuania, Bulgaria, Brazil, Malaysia, Canada, the United States, India, Japan, Italy, United Arab Emirates, and many others. You can find the complete and up-to-date list of countries here.

Stripe developer & software tools

Although Stripe can be used without coding, most of its users were probably attracted to it because of its incredible APIs with which developers can easily connect to e-commerce platforms. Software developers can use Python, Java, Ruby, Node, PHP, and several other supported languages to integrate the Stripe payment platform into other sites.

Some of the software tools that Stripe has for developers are:

- Connect: Stripe Connect gives you a suite of tools for platforms and marketplaces such as Kickstarter or Uber. Stripe Connect lets you develop and scale end-to-end payment experiences, including global payouts.

- Relay: Stripe Relay enables you to accept payments in mobile apps, thereby turning your app into a digital store. Relay builds in-app “Buy Buttons'' and sends all sales data to the seller so that the transaction may be fulfilled.

- Radar: As we mentioned earlier, software developers can use Stripe Radar to build smarter systems for fraud protection. It can create frictionless 3D Secure authentication as well as synchronise existing blocklists and allow lists of users.

- Sigma: Stripe Sigma allows you to produce really customised reports using SQL (structured query language), whereas a conventional, tech-driven payment processing tool could let you make custom reports using a set of prebuilt criteria and call it sophisticated. Sigma can provide you with data if you can construct a SQL query.

- Terminal: Software developers can use Stripe Terminal to accept payments through point-of-sale (POS) terminals. It offers a viable option for most online businesses to facilitate in-person sales by accepting payments through point-of-sale (POS) hardware systems. Moreover, Stripe’s credit card scanners are relatively affordable, and you will get reasonable pricing for in-person transactions as well.

Payment types & currencies supported

Through Stripe Invoicing, the Stripe payment processing service supports more than 15 payment methods, including Alipay, credit transfer, bank transfer, SEPA direct debit, and many others. The latest list of payment methods can be found in this online document.

In addition, Stripe supports over 135 currencies. They include USD, EUR, and GBP, with various minimum charges per settlement currency. Find the complete and current list of Stripe supported currencies here.

Conclusion

Even though Stripe is a very powerful payment processor with fantastic tools that are ideal for software developers, anyone can use already-integrated Stripe checkouts in some online businesses. In that way, they can enjoy invoicing with built-in payments, secure payment processing, sales reporting, and fraud prevention.

Stripe also offers Instant Payouts, so businesses can instantly send funds to a supported debit card. That is true for Canada, Singapore, and the US. Instant Payouts are also available in the UK, but in this case, you will have to use a banking account.

Some customers complain that payouts may take a lot of time, but typically the first payout for every new Stripe account takes up to one week. It also depends on many factors such as the industry and country they are operating in.