What is an IBAN Number?

International Bank Account Numbers, or IBAN, is an internationally accepted system that allows international money transactions to be conducted using a foreign bank account. IBAN allows for secure and quick bank transfers both locally and internationally. IBAN accounts are made available to everyone from around the world thanks to fintech companies like N26 and others. In this Askwallet post we will look at some of the best EMIs proving IBAN accounts, how IBAN accounts work and what they have to offer.

What is an IBAN number?

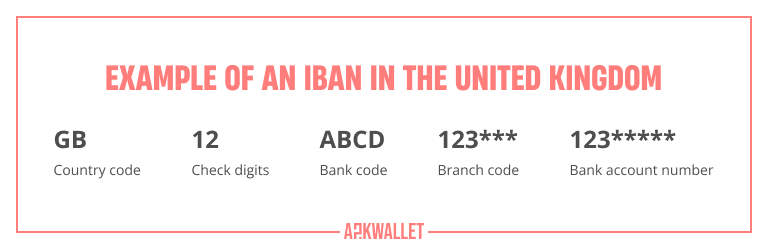

IBAN, which stands for International Bank Account Numbers, is an internationally recognized protocol that enables global money transactions to be made using an international bank account. IBAN enables safe and rapid local and international financial transfers. An IBAN number is a string of 36 symbols that includes a 2 different country code preceded with 34 numbers and letters that are unique to you and allow the bank to identify the sender, their location, their bank, and their bank account.

Your IBAN number provides a safe platform for moving money between the EU and EEA nations with unrivaled speed. There are a few online money transfer providers in the fintech industry that provide customers with their own personal IBAN account and number. N26, Revolut, and a slew of others are among the most popular.

Whenever it pertains to transnational financing, an IBAN number is quite significant. The IBAN number provides a variety of important purposes, including the ability for consumers to make and collect regional and global payments.

Which Countries Use IBAN?

IBAN is a standard format for identifying bank account numbers that are used by banks in most European countries, as well as a few other countries around the world. The United States doesn't use IBAN. The number consists of up to 34 alphanumeric characters which are divided into four sections: country code, bank code, branch code, and account number. Each country's international banking system has its own set of rules about how these codes are assigned but they all have the same basic pattern: 2 letters represent the country; 3 digits represent the banking institution; 2 digits indicate the branch location; 4 digits represent the customer's account number starting with 001-999.

How to Find an IBAN Code

Finding the right IBAN code is critical. Incorrect codes could result in delayed payments or mistakes made when sending funds- luckily, it’s not too difficult to find one! To find your IBAN code, log into your online banking portal or check the bank statement from within your app.

If you have a bank account in a European country, your bank will provide you with an IBAN. You can also find your IBAN on your bank statements. If you don't have a European bank account, you can still use an IBAN. All you need is to find a provider that offers IBAN services, such as Revolut. When you sign up for an account, they'll generate an IBAN for you.

If you're still unsure and don't see anything there, reach out to customer service and they'll help you out; if you're about to send funds abroad, talk with the person receiving them- chances are they have access to their own IBAN and can just supply what you need. Alternatively, if that's not possible for whatever reason - there are plenty of free online calculators which will generate an account number based on a bank's code. Just plug in your own info from within the form provided by these services... then let the calculations begin!

Features of an IBAN account

Some of the functions of an IBAN account include:

- Thanks to IBAN, banking institutions can quickly and easily verify the country from which a transaction is being sent.

- Using an IBAN, you can determine the exact account number in a country (International Bank Account Number). A successful international fund transfer becomes a nightmare at best, and a near-impossibility at worst, if any of these factors is missing.

- It also provides financial institutions with a simple and effective method for double-checking the accuracy of account information prior to executing a transfer.

So where can you find IBAN accounts? You can check out our list of some of the best 5 EMI with IBAN accounts down below. However, if you are looking for more options make sure to check out our full list of IBAN account providers.

FAQ

Yes, using an IBAN number to transfer funds is considered safe by European Union finance regulators, and it is routinely used to make payments across borders.

To transfer money using IBAN, you need to first check the code with the recipient. The length of an IBAN number varies depending on which country opened the bank account and the string of numbers representing this individual's international banking access number must consist of the same amount of characters for it to work properly.

No, your IBAN number cannot be used to directly access your bank account or to make any sort of financial transaction. However, because it is associated with your bank account, it could potentially be used by someone trying to commit fraud or identity theft. If you believe your IBAN number has been compromised, you should contact your bank immediately.

BAN stands for International Bank Account Number - a code used around the world to identify individual bank accounts. An account number is a unique set of numbers used to identify a specific bank account.

EMIs providing IBAN account numbers

Revolut

Revolut was originally conceived as a multi-currency bank account providing an IBAN account that reduced the numerous bank charges and commissions connected with international transactions. It was a success in the EEA region, generating several million euros, and now aims to be a legitimate online bank. Today, Revolut has grown outside the United Kingdom and now offers its services in a variety of European nations, as well as the United States, Canada, and Singapore, among others.

IbanDirect

Ibandirect is a mobile internet bank whose goal is to make banking more convenient for its clients. The platform was developed by Cardbit OU, an Estonian startup. The banking platform has a lot to offer its clients, and it charges reasonable commissions and transaction costs.

Users of the site can establish an IBAN account as well as a VISA prepaid card for SEPA transactions in EUR and BTC with ease. The platform's VISA prepaid card is offered by the Electronic Money Institution Waletto UAB.

Monzo

Monzo is a banking app founded in the United Kingdom with almost five million users. The majority of the service's functionalities are available to UK customers, but others, such as the Monzo debit card and IBAN account, are available to users in other countries.

Monzo allows you to make payments, sign up for joint accounts and split expenditures, sign up even if you are a teenager, spend money overseas, and so on. Monzo is also accessible for business customers, particularly entrepreneurs who wish to precisely manage their expenditures.

FirstDirect

FirstDirect has long been associated with financial sector innovation. In the years 2000 and 2006, the banking service introduced online and mobile apps. First Direct offers its customers a card, the option to conduct SEPA and SWIFT transactions, and insurance. The financial service has been in operation for many years, and expertise results in a superior offering.

N26

N26 is a sophisticated financial service that provides some of the same services as a traditional bank but in a fully digital format. They have a lot to offer, from cash withdrawals at ATMs to international money transfers at low exchange rates. N26 consumers may open several sorts of bank accounts, as can business users, who can also create accounts for their activities.

N26, as a German bank, provides bank accounts with German IBANs.

Why were IBAN numbers created?

Prior to the introduction of IBAN numbers, it was difficult for consumers to distinguish between national standards for bank account identification in different countries. Due to the misunderstanding, much crucial information was overlooked, resulting in payment rerouting.

Prior to the implementation of the IBAN number system, forwarding details were known by many different names such as BIC (Business Identifier Code), SWIFT code, and SWIFT-BIC, and did not involve any special provisions for the transaction of funds, leaving proof of identity solely on the existing agreement of the sender and the intended recipient.

The IBAN identification system was designed to make international money transfers easier. IBAN accounts, on the other hand, are a highly common method for making domestic transactions throughout the EU. In addition to your bank details and sort code, IBAN numbers hold information on the account owner's bank, the country in which the bank is situated, and a range of other account features.

As a direct consequence, processing errors denied transactions, and cross-border payment inefficiencies are decreased. IBANs are required for transferring funds and payments; they couldn't be used for other financial operations, including withdrawing cash.

How Does an IBAN Differ From a SWIFT Code?

The primary distinction between an IBAN and a SWIFT code is what they are used to identify. A SWIFT code, unlike an IBAN number, solely specifies a bank. An IBAN number identifies a bank as well as an individual account at that financial institution. Therefore, an IBAN specifies the unique international account to which a payment is being directed, whereas a SWIFT number indicates the banking institution that owns the accounts.

Prior to the worldwide unification of IBAN and SWIFT codes, transactions among nations and regions regularly ended up in the incorrect place, disrupting almost everyone's life. Transactions that were made erroneously or got into the wrong places would usually necessitate additional funds to address these errors. It was clear that something had to be done.

The huge quantity of information that the SWIFT system readily transmits across banking institutions is one of its key advantages. A SWIFT code includes details such as an individual's personal debit and credit balances, the status of an account, and particular details about the individual's money transfer.