How Digital Wallets in Europe are Reshaping Payments

Digital wallets, also known as mobile wallets have revolutionized how consumers pay for goods and services in Europe. Thanks to the rise of contactless cards, consumers are no longer tied to cash as their only means of payment and can now pay digitally from their mobile devices. In this article, we examine how digital wallets in Europe have redefined consumer spending behaviors and the growth projections of digital wallets across the region.

Digital wallets have grown tremendously in Europe, contributing to the adoption of innovative technologies and changing the way people think about payments. In fact, new research suggests that digital wallets are reshaping the way Europeans make purchases and manage money every day. Here’s how digital wallets are shaping the European payments landscape—and why they may be poised to shape it even more in the years ahead.

Market Context

We’re seeing a major change in consumer behavior. The rise of digital wallets is forcing banks to re-evaluate their value proposition, and consumers are voting with their wallets, opting for digital payment methods that offer lower fees and greater convenience. This move is especially prevalent among millennials (ages 18–35), who use mobile banking more than older generations.

Based on Accenture’s proprietary Global Payments Revenue forecasts, The Asian-Pacific has been the leader when it comes to e-payments. Furthermore, they are bound to see more growth in the coming years because of market leaders such as Alipay a subsidiary of the conglomerate Alibaba and WeChat.

Europe is also bound to see growth in the cashless payment sphere by about 2.9% in comparison with the last year. We have seen a lot of neobanks, e-wallets, and fintech startups out of Europe. Even the traditional banks are feeling the heat and started to offer their users online banking with the same features as neobanks. However, e-wallets are still providing users with some of the lowest transfer fees, quick sign-ups, and seamless connectivity to social media accounts.

In Europe, we can see that stable fintechs such as Paypal have outperformed traditional banking in recent years. More and more people are migrating from traditional banking to online banks. However, does this mean that the future of payments is definitely going to be online banks? This is a very difficult question to answer because we will need to predict the future.

Another important question to consider is that in order for online banks to completely take over, will the traditional banks have to be completely derailed? Or is it a situation where they would have to work hand in hand to provide users with the best cashless payment experience?

One more thing to consider is the increasing popularity of cryptocurrencies. Will this currency replace the role of payment intermediaries? How are merchant accounts going to be affected by this shift? These are all the questions that we will try to answer in this comprehensive article.

So, what do we know about the current wave of fintech? We are aware that there are legacy online banks that have been around for a while and have seen tremendous growth. However, new online banks such as digital currency exchange platforms and online credit card providers are the new wave of fintech that is taking Europe and the world by storm.

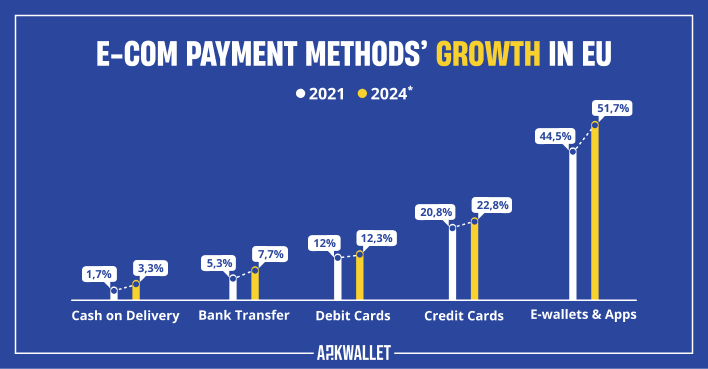

Due to the COVID 19 pandemic, many people have resorted to using online banks and online money transfer services to send and receive money online. Credit card and electronic wallets are clear winners in an e-commerce sector that, according to Statista, is expected to increase at a 6% annual rate between 2021 and 2025, reaching $4.2 trillion at the conclusion of the decade. We can see based on recent market numbers that e-wallets are here to stay. However, we would pump the brakes on saying that it will completely wipe out the traditional banks. This is because there are still many speculations about the newer fintech companies, especially in the digital currency space, or more precisely, in the field of cryptocurrency.

History of e-payments and e-wallets

Electronic payments have developed from a technological curiosity to one of the primary payment choices now accessible, as the emergence of the internet promoted online shopping and other sorts of eCommerce. The technology necessary to enable the huge amount of electronic payments that presently take place is comprised of a diversified payments infrastructure comprising cloud, legacy, and hybrid systems.

The growth of bank debit cards and credit card processing has both affected and been influenced by these payment methods, culminating in the current payments industry and payment systems we know today. For years and years, every single payment had to be done physically. However, the groundbreaking creation of the Western Union back in 1871 put electronic money transfers on the map. The money transfer further evolved to allow their service to be used to make purchases at businesses. All you had to do was link your account to your credit card and purchase the items you want.

Then came the age of debit credit cards where people could buy whatever they wanted with this little card with a magnetic strip. The evolution of electronic payment methods proceeded much further with the introduction of the Internet. This period saw the initiation of eCommerce as a speedier and more efficient form of card-not-present transactions, which had previously existed in the form of mail orders, phone orders, and other similar sorts of transactions.

This followed the implementation of electronic verification systems, which swiftly checked and authorized digital payments sent through a number of channels. Soon after, mobile devices became popular payment options, allowing users to make mobile payments using mobile wallets like PayPal.

Europe's future: digital wallets for every citizen

All payments systems go through a transition period in which they shift from cash to electronic payments. Some European countries have made real progress, but there is still a lot of work to be done. The old-fashioned leather wallet with banknotes, credit cards, and loyalty cards will soon be history for all Europeans – along with paper coupons and special membership cards.

The many different digital wallets under development today on both sides of the Atlantic can trace their origins back to Paypal, launched 20 years ago by Peter Thiel and Max Levchin. They were followed by Google Wallet and Apple Pay a few years later. Each of these digital wallets has had its problems, but none of them have been sufficient enough for consumers to see it as a viable alternative to traditional payment methods like cash or credit cards.

Since then, mobile phone companies have come up with other solutions that will allow us to pay for things from our smartphones – either via applications downloaded onto our phones or through apps created by our banks. Mobile technology has given rise to many fintech start-ups that believe that people should no longer need a wallet at all: virtual currencies exist and offer users additional security (but also greater freedom).

According to reports, the new ideas are part of a review of the EU's current electronic identity and trust services (eIDAS) regulatory framework. So yet, this approach has not been widely adopted across the union (19 out of 27), and those that have are incompatible with one another. This indicates that Europe is on the verge of developing a unified electronic wallet for all people, regardless of where they live. What factors affect individual choices? And what lessons can we learn from looking at existing models? What types of innovations should we expect over the next five years? We’ll see how digital wallets evolve and how they will change our lives in many different ways.

According to reports, the new ideas are part of a review of the EU's current electronic identity and trust services (eIDAS) regulatory framework. So yet, this approach has not been widely adopted across the union (19 out of 27), and those that have are incompatible with one another. This indicates that Europe is on the verge of developing a unified electronic wallet for all people, regardless of where they live.

Intending to achieve payment autonomy, we need a system that provides sufficient safety without reducing convenience or adding unnecessary bureaucracy. How do banks reconcile their need for security with consumers’ desire for simplicity? This digital transformation is expected to generate economic growth and improve people’s quality of life by enabling them to use new services more easily, particularly in countries where there has been little innovation until now – like Poland, Hungary, or Romania – but also across borders.

How digital wallets are used in Europe?

One of every three European citizens currently owns a smartphone, and one out of every two has purchased a mobile device within the last year. In many major cities across Europe – including Paris, London, Berlin, and Stockholm – using your phone for payment is now easier than using cash or a credit card.

And what’s more, it will soon be even easier to use a digital wallet than to get money from an ATM. The age of mobile payments is upon us: people can pay for anything with their smartphones, whether they’re sitting on a subway train or walking down the street. It’s fast, convenient, and safe; most importantly it reduces our need to carry around cash. Each month more new apps are developed that make paying with your phone safer and easier (such as Wise).

By 2023, analysts predict that Europe will see almost half a billion transactions via digital wallets per month. Our smartphones truly have become our go-to device for shopping online and making purchases at retail stores. The future of payments lies here, not in outdated swipe-and-sign technologies like magnetic stripe cards used by banks today.

However, not only consumers have seen the benefits of digital wallets. Businesses small and large also have a lot to benefit from digital wallets. From competitive pricing for merchant accounts especially for high-risk businesses such as online gambling to helping businesses process payments from multiple channels.

Also, there are services such as PayPal’s Pay In 4, and ClearPay that are taking the pay now pay later payment model online. Allowing users to buy things online but pay in 4 small payments as suppose to buying the product at full price. This is not a new concept it has existed for a while, there have been services such as layaway. However, these services allow you to skip all the paperwork and it is directly integrated with some of the biggest eCommerce sites such as ASOS.

What is a Digital Wallet?

The history of paper money dates back to Ancient China, circa 1100 BC. Today, modern-day society is changing that paradigm again by moving away from stuff and embracing cashless payments.

Digital wallets are online payment methods that typically take the shape of an app. To make payments, you don't need to enter your card data or carry a real card because the wallet securely saves virtual copies of debit and credit cards. You may also keep digital tickets and e-vouchers there, ensuring that you always have the necessary documentation on hand.

This shift toward cashless payments is evident with leading mobile payment apps like Apple Pay and Android Pay, along with digital wallets like PayPal or Wise. A recent study shows that 60% of consumers favor digital payment methods over cash. As well as evolving consumer behavior, European countries have also made progress when it comes to going cashless.

What are the best mobile wallets for cross-border payments in Europe?

There are numerous cross-border payment companies in Europe, but they all differ in terms of cost, speed, usability, and security. To find the best mobile wallet provider that’s right for you, you need to carefully consider how much you spend overseas, how fast you want your payments to arrive, and the level of security you want in a place to protect your money. So before you start shopping around, here’s a quick guide to the different types of mobile wallets in Europe:

TransferGo

This is one of Europe’s most popular digital money transfer services, offering no fees on transactions. The company also offers specific rates on over 60 currencies with nearly 700 online destinations—which makes it ideal for those who regularly send money abroad. What’s more, customers can be assured that TransferGo works hard to ensure its network runs smoothly and provides timely updates on any delays (or fees) that occur. It also has a dedicated staff who is always ready to help via email or social media channels.

Wise

One of the biggest names in online money transfers, Wise allows you to make international transactions that can save a ton of money on fees. It uses mid-market rates and has no hidden fees, so you get a great deal on your transaction.

XE

It’s free to send money with XE, and transfers arrive within 24 hours. With no fees on transactions or currency exchange and a lower spread than bank rates, it’s one of Europe’s cheapest ways to move money. What's more, its multilingual interface makes it easy to transfer between multiple currencies. (For specific euro conversions, you'll have to go through their conversion calculator).

PaySend

PaySend aims to be a multi-currency version of PayPal. It works with Euro, USD, and GBP so can be used as an alternative to more well-known options for transferring money between countries. If you’re looking for a solution that will make it easy to send money from any country, PaySend is a viable option worth exploring.

How to Accept Digital Wallet Payments in Europe

You can accept digital wallet payments directly or through a digital payment provider. Either way, it’s just as easy to set up. You’ll need to go through an assessment process and be approved by your bank. Then you’ll choose which types of payment you want to offer, and these can change over time.

The user experience is largely similar between digital wallets, but how you access them will vary depending on your device. If your customers pay using a digital wallet app on their smartphone, they may not even see what payments processor you’re using! Be sure to double-check with any service providers about minimum amounts for deposits and withdrawal times for funds into your bank account so that you know exactly what is involved before selecting the one that's right for you.

We have selected some of the best digital payment providers in Europe to make the choice easier for you. Here is our list:

ConnectPay

ConnectPay is an Electronic Money Institution (EMI) that provides the following services to companies and institutional clients: bank and card payments, euro and cross-border payments, multicurrency accounts, corporate cards, merchant accounts, and BaaS.

Paysera

Paysera offers online banking, money transfers, card processing, currency exchange, point-of-sale payment systems, and mobile micropayments. It mostly targets e-commerce, gaming or entertainment portals, restaurants, and mobile POS. All foreign payments in the system are performed at local rates due to a global network of partners.

Monzo

Monzo is a digital banking app-only solution for consumers and companies. It allows you to manage your money, make spending budgets, examine account summaries, receive quick alerts. Highly recommended for businesses and customers from the UK.

Stripe

All types of companies can take advantage of Stripe. That fintech company builds financial infrastructures on the internet making collecting credit cards online immediately easy for businesses. No merchant account or payment gateway is required.

Start accepting digital wallets and other locally preferred payment methods worldwide

If you’re serious about global e-commerce, then it’s time to start accepting digital wallets. Companies that have been operating outside of Europe have heard their consumers asking for PayPal and other popular payment methods, but have not been able to offer these methods because they weren’t approved by local financial institutions.

Now, however, nearly all companies can accept digital wallets since they are regulated and authorized locally. The ability to access digital wallets has given a boost to European e-commerce as consumers can now easily purchase goods and services using their favorite digital wallets. Many businesses realize that customers prefer paying with their favorite methods, such as prepaid cards, money transfers, or e-wallets allowing for a better customer experience.

Conclusion

With consumers already comfortable with digital wallets and their ability to offer a convenient and hassle-free alternative to traditional plastic payment methods, wallet adoption will become even more widespread over time. For example, a survey conducted by The Boston Consulting Group found that 37 percent of respondents were using mobile payments at least once per week.

In addition, about 65 percent were using wallets for making purchases online. The survey also found that women were slightly more likely than men to use digital wallets (48 percent versus 40 percent). While these payments may not rival those of credit cards or other types of payment options, new avenues for purchasing goods are opening up as technology continues to advance and consumers become increasingly accustomed to using digital alternatives over plastic ones.